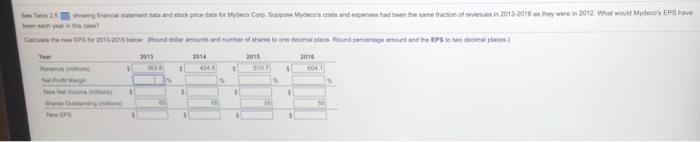

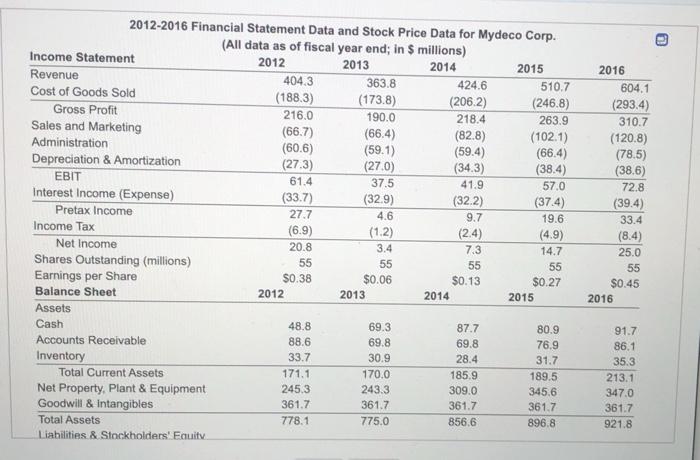

www to Cup Score years old beroof 2013-2016 were in 2012. What would des Eve the Power of room and promotes will 2011 2011 1 1 . 5 3 2012-2016 Financial Statement Data and Stock Price Data for Mydeco Corp. (All data as of fiscal year end; in $ millions) Income Statement 2012 2013 2014 2015 Revenue 404.3 363.8 424.6 510.7 Cost of Goods Sold (188.3) (173.8) (206.2) (246.8) Gross Profit 216.0 190.0 218.4 263.9 Sales and Marketing (66.7) (66.4) (82.8) (102.1) Administration (60.6) (59.1) (59.4) (66.4) Depreciation & Amortization (273) (27.0) (34.3) (38.4) EBIT 61.4 37.5 41.9 57.0 Interest Income (Expense) (337) (32.9) (32.2) (374) Pretax Income 27.7 4.6 9.7 19.6 Income Tax 1.9) (1.2) (2.4) (4.9) Net Income 20.8 3.4 14.7 Shares Outstanding (millions) 55 55 55 Earnings per Share $0.38 $0.06 $0.13 $0.27 Balance Sheet 2012 2013 2014 2015 Assets Cash 48.8 69.3 87.7 80.9 Accounts Receivable 88.6 69.8 69.8 76.9 Inventory 33.7 30.9 28.4 31.7 Total Current Assets 171.1 170.0 185.9 189.5 Net Property, Plant & Equipment 245.3 243.3 309.0 345.6 Goodwill & Intangibles 361.7 361.7 361.7 361.7 Total Assets 778.1 775.0 856.6 896.8 Liabilities & Stockholders' Equity 2016 604.1 (293.4) 310.7 (120.8) (78.5) (38.6) 72.8 (39.4) 33.4 (8.4) 25.0 55 $0.45 2016 7.3 55 91.7 86.1 35.3 213.1 347.0 361.7 921.8 www to Cup Score years old beroof 2013-2016 were in 2012. What would des Eve the Power of room and promotes will 2011 2011 1 1 . 5 3 2012-2016 Financial Statement Data and Stock Price Data for Mydeco Corp. (All data as of fiscal year end; in $ millions) Income Statement 2012 2013 2014 2015 Revenue 404.3 363.8 424.6 510.7 Cost of Goods Sold (188.3) (173.8) (206.2) (246.8) Gross Profit 216.0 190.0 218.4 263.9 Sales and Marketing (66.7) (66.4) (82.8) (102.1) Administration (60.6) (59.1) (59.4) (66.4) Depreciation & Amortization (273) (27.0) (34.3) (38.4) EBIT 61.4 37.5 41.9 57.0 Interest Income (Expense) (337) (32.9) (32.2) (374) Pretax Income 27.7 4.6 9.7 19.6 Income Tax 1.9) (1.2) (2.4) (4.9) Net Income 20.8 3.4 14.7 Shares Outstanding (millions) 55 55 55 Earnings per Share $0.38 $0.06 $0.13 $0.27 Balance Sheet 2012 2013 2014 2015 Assets Cash 48.8 69.3 87.7 80.9 Accounts Receivable 88.6 69.8 69.8 76.9 Inventory 33.7 30.9 28.4 31.7 Total Current Assets 171.1 170.0 185.9 189.5 Net Property, Plant & Equipment 245.3 243.3 309.0 345.6 Goodwill & Intangibles 361.7 361.7 361.7 361.7 Total Assets 778.1 775.0 856.6 896.8 Liabilities & Stockholders' Equity 2016 604.1 (293.4) 310.7 (120.8) (78.5) (38.6) 72.8 (39.4) 33.4 (8.4) 25.0 55 $0.45 2016 7.3 55 91.7 86.1 35.3 213.1 347.0 361.7 921.8