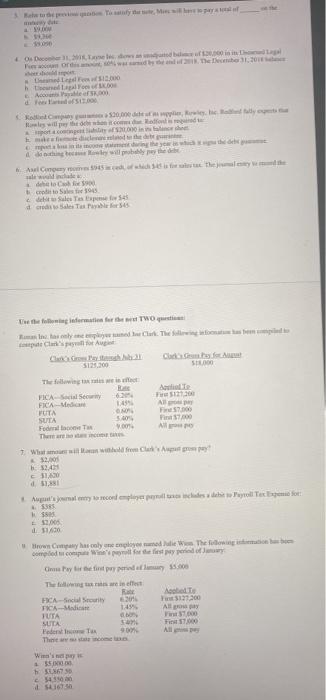

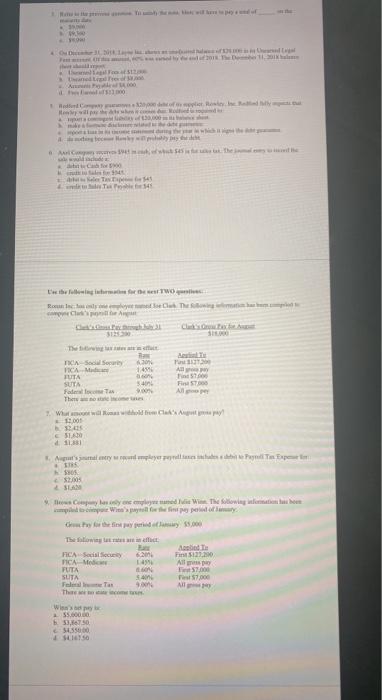

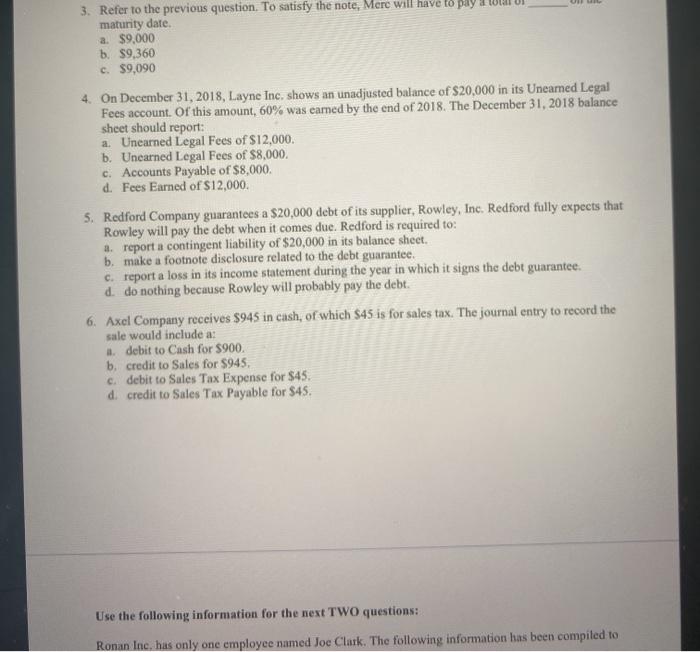

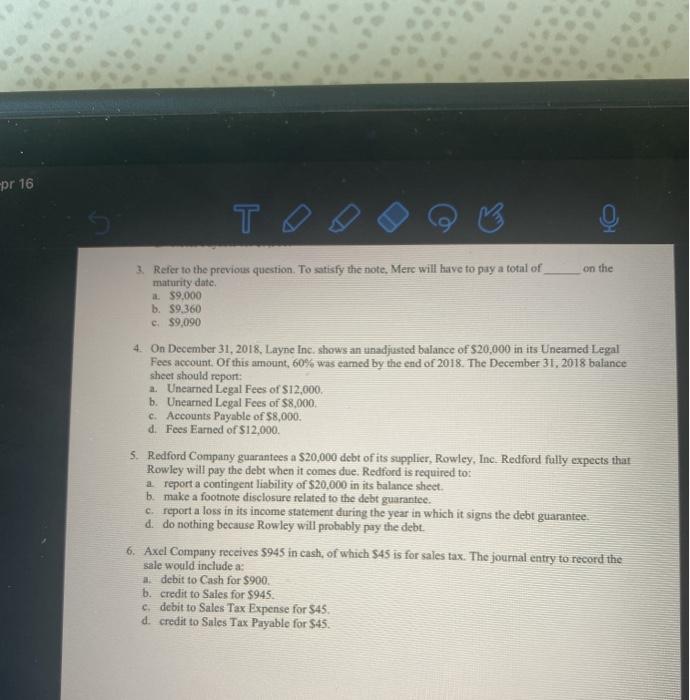

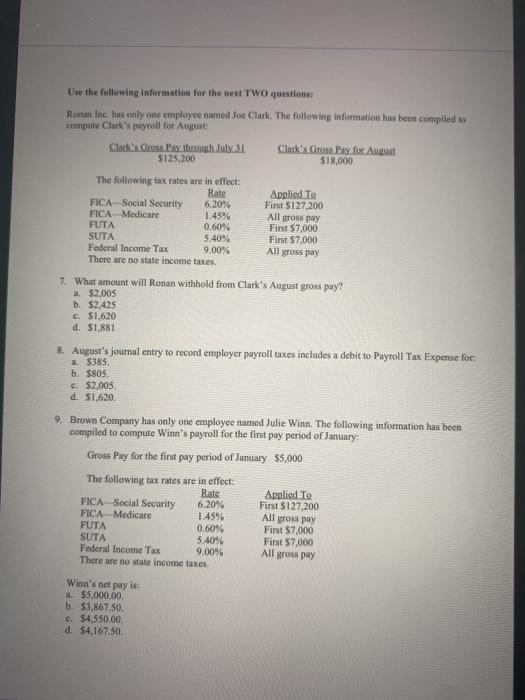

wy 13.000 hello Accorso He wille who fondi Sinisch patients with new probe Alay the dhe 90 to Sales Se Tape de este The following form for the TWO Chief SO 12.00 Al P7000 Alpe HICAS Soy FICA Medica FUTA SUTA 5 Foto 001 The 1 What will also 20 24H ingat a journal y necond ampliare per a les de Petrol Tec Expense for SR 14.30 town Company has completed the song como completo de espera Cenyed The game in effet AT FICA-Social Security 63 127300 1:49 Aly FUTA 1000 Fit 600 Font 90 Themes.com SUTA Win's 55 h 670 100 GELER 000 Here two 3.000 w dit Tex 141 145 therefore CA C. Cleaner 30 149 RE Al TICAS RICAM TUTA SUTA Fade Tan The son Ally 19.00 16 1111 ' mya Expert 00 SAN Cenedlaethol who cm Willow FICA Social TICAM Medes FUTA SUITA Fala The com 22.30 Allspy 57.000 Test 7.000 M San som Wise 55.000 53,6750 54,550.00 0 3. Refer to the previous question. To satisfy the note, Mere will have to pay maturity date. a. $9,000 b. $9,360 c. $9,090 4. On December 31, 2018, Layne Inc. shows an unadjusted balance of $20,000 in its Uneamed Legal Fees account. Of this amount, 60% was earned by the end of 2018. The December 31, 2018 balance sheet should report: a. Unearned Legal Fees of $12,000 b. Unearned Legal Fees of $8,000, c. Accounts Payable of $8,000 d. Fees Earned of $12,000. 5. Redford Company guarantees a $20,000 debt of its supplier, Rowley, Inc. Redford fully expects that Rowley will pay the debt when it comes due. Redford is required to: a. report a contingent liability of $20,000 in its balance sheet. b. make a footnote disclosure related to the debt guarantee c. report a loss in its income statement during the year in which it signs the debt guarantee. d. do nothing because Rowley will probably pay the debt. 6. Axel Company receives $945 in cash, of which $45 is for sales tax. The journal entry to record the sale would include a: debit to Cash for $900. b. credit to Sales for $945, c. debit to Sales Tax Expense for $45. d. credit to Sales Tax Payable for $45. Use the following information for the next TWO questions: Ronan Inc. has only one employee named Joe Clark. The following information has been compiled to pr 16 Too on the 3. Refer to the previous question. To satisfy the note. Merc will have to pay a total of maturity date. 39.000 b. S9,360 c. $9,090 4. On December 31, 2018. Layne Inc. shows an unadjusted balance of $20,000 in its Uneared Legal Fees account of this amount, 60% was camed by the end of 2018. The December 31, 2018 balance sheet should report: a. Uncarned Legal Fees of S12,000, b. Unearned Legal Fees of $8,000 c. Accounts Payable of $8,000. d. Fees Earned of $12,000 5. Redford Company guarantees a $20,000 debt of its supplier, Rowley, Inc. Redford fully expects that Rowley will pay the debt when it comes due. Redford is required to: a report a contingent liability of $20,000 in its balance sheet. b. make a footnote disclosure related to the debt guarantee. c. report a loss in its income statement during the year in which it signs the debt guarantee. d. do nothing because Rowley will probably pay the debt. 6. Axel Company receives $945 in cash, of which 545 is for sales tax. The journal entry to record the sale would include a: 1. debit to Cash for $900, b. credit to Sales for $945. c debit to Sales Tax Expense for $45. d. credit to Sales Tax Payable for $45. Use the following Information for the next two questions: Roman Inc. has only one employee named Joe Clark. The following information has been compiled to compote Clark's payroll for August Clark's Gross Pay through July. JI Clark Geo Pay for August $125,200 $18,000 The following tax rates are in effect: Rate Applied To FICA Social Security 6.20% First $127.200 FICA Medicare 1.45% All gross pay FUTA 0,60% First $7,000 SUTA 5.40% First $7,000 Federal Income Tax 9.00% All gross pay There are no state income taxes 7. What amount will Ronan withhold from Clark's August gross pay? a $2,005 b. $2,425 c. $1,620 d. $1.881 8. August's joumal entry to record employer payroll taxes includes a debit to Payroll Tax Expense for a $385 b. 5805 c. $2,005 d. $1.620. 9. Brown Company has only one employee named Julie Winn. The following information has been compiled to compute Winn's payroll for the first pay period of January Gross Pay for the first pay period of January $5,000 The following tax rates are in effect: Rate Applied To FICA_Social Security 6,20% First $127,200 FICA Medicare 1.45% All gross pay FUTA 0.60% First $7,000 SUTA 5.40% First $7,000 Federal Income Tax 9.00% All gross pay There are no state income taxes Winn's net pay is: a $5,000.00 b. 53.867.50 c. $4,550.00 d. $4,167.50 wy 13.000 hello Accorso He wille who fondi Sinisch patients with new probe Alay the dhe 90 to Sales Se Tape de este The following form for the TWO Chief SO 12.00 Al P7000 Alpe HICAS Soy FICA Medica FUTA SUTA 5 Foto 001 The 1 What will also 20 24H ingat a journal y necond ampliare per a les de Petrol Tec Expense for SR 14.30 town Company has completed the song como completo de espera Cenyed The game in effet AT FICA-Social Security 63 127300 1:49 Aly FUTA 1000 Fit 600 Font 90 Themes.com SUTA Win's 55 h 670 100 GELER 000 Here two 3.000 w dit Tex 141 145 therefore CA C. Cleaner 30 149 RE Al TICAS RICAM TUTA SUTA Fade Tan The son Ally 19.00 16 1111 ' mya Expert 00 SAN Cenedlaethol who cm Willow FICA Social TICAM Medes FUTA SUITA Fala The com 22.30 Allspy 57.000 Test 7.000 M San som Wise 55.000 53,6750 54,550.00 0 3. Refer to the previous question. To satisfy the note, Mere will have to pay maturity date. a. $9,000 b. $9,360 c. $9,090 4. On December 31, 2018, Layne Inc. shows an unadjusted balance of $20,000 in its Uneamed Legal Fees account. Of this amount, 60% was earned by the end of 2018. The December 31, 2018 balance sheet should report: a. Unearned Legal Fees of $12,000 b. Unearned Legal Fees of $8,000, c. Accounts Payable of $8,000 d. Fees Earned of $12,000. 5. Redford Company guarantees a $20,000 debt of its supplier, Rowley, Inc. Redford fully expects that Rowley will pay the debt when it comes due. Redford is required to: a. report a contingent liability of $20,000 in its balance sheet. b. make a footnote disclosure related to the debt guarantee c. report a loss in its income statement during the year in which it signs the debt guarantee. d. do nothing because Rowley will probably pay the debt. 6. Axel Company receives $945 in cash, of which $45 is for sales tax. The journal entry to record the sale would include a: debit to Cash for $900. b. credit to Sales for $945, c. debit to Sales Tax Expense for $45. d. credit to Sales Tax Payable for $45. Use the following information for the next TWO questions: Ronan Inc. has only one employee named Joe Clark. The following information has been compiled to pr 16 Too on the 3. Refer to the previous question. To satisfy the note. Merc will have to pay a total of maturity date. 39.000 b. S9,360 c. $9,090 4. On December 31, 2018. Layne Inc. shows an unadjusted balance of $20,000 in its Uneared Legal Fees account of this amount, 60% was camed by the end of 2018. The December 31, 2018 balance sheet should report: a. Uncarned Legal Fees of S12,000, b. Unearned Legal Fees of $8,000 c. Accounts Payable of $8,000. d. Fees Earned of $12,000 5. Redford Company guarantees a $20,000 debt of its supplier, Rowley, Inc. Redford fully expects that Rowley will pay the debt when it comes due. Redford is required to: a report a contingent liability of $20,000 in its balance sheet. b. make a footnote disclosure related to the debt guarantee. c. report a loss in its income statement during the year in which it signs the debt guarantee. d. do nothing because Rowley will probably pay the debt. 6. Axel Company receives $945 in cash, of which 545 is for sales tax. The journal entry to record the sale would include a: 1. debit to Cash for $900, b. credit to Sales for $945. c debit to Sales Tax Expense for $45. d. credit to Sales Tax Payable for $45. Use the following Information for the next two questions: Roman Inc. has only one employee named Joe Clark. The following information has been compiled to compote Clark's payroll for August Clark's Gross Pay through July. JI Clark Geo Pay for August $125,200 $18,000 The following tax rates are in effect: Rate Applied To FICA Social Security 6.20% First $127.200 FICA Medicare 1.45% All gross pay FUTA 0,60% First $7,000 SUTA 5.40% First $7,000 Federal Income Tax 9.00% All gross pay There are no state income taxes 7. What amount will Ronan withhold from Clark's August gross pay? a $2,005 b. $2,425 c. $1,620 d. $1.881 8. August's joumal entry to record employer payroll taxes includes a debit to Payroll Tax Expense for a $385 b. 5805 c. $2,005 d. $1.620. 9. Brown Company has only one employee named Julie Winn. The following information has been compiled to compute Winn's payroll for the first pay period of January Gross Pay for the first pay period of January $5,000 The following tax rates are in effect: Rate Applied To FICA_Social Security 6,20% First $127,200 FICA Medicare 1.45% All gross pay FUTA 0.60% First $7,000 SUTA 5.40% First $7,000 Federal Income Tax 9.00% All gross pay There are no state income taxes Winn's net pay is: a $5,000.00 b. 53.867.50 c. $4,550.00 d. $4,167.50