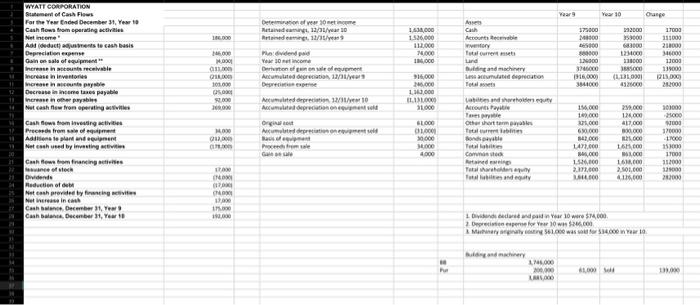

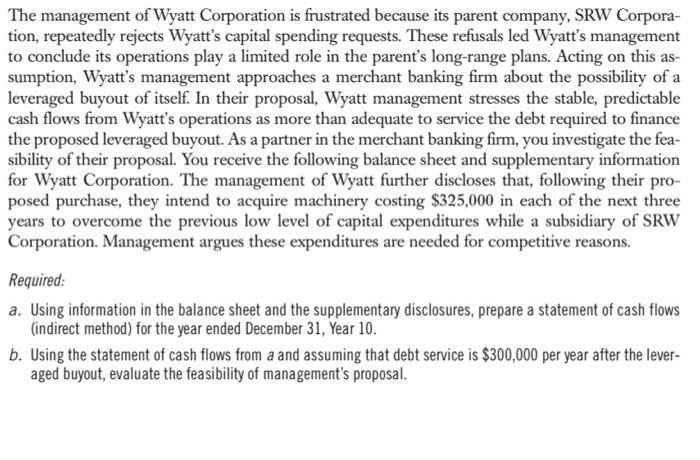

WYATI CCOTOFATICN Statement ot Cast Flews. Far the Yaw Finded December 31, Ywar to Cash nowa toom sperating wetliates Net inteme" Ady (oeduct) agquptededs to cash basis Depreciation eapense Coin os asla of equipmest on inerease in astsunta incelit. herease in atceuste puystile Decrease in incere tases payable nerrase in ofter pryabint Not cash fisw fron operaing astivities Cash fewe som twetsirg activet. Net cosh ueed by ineseting sevitiet Cash fews bom tranking setieises thrunce of blexi Pedevetien of debs Net ineriase in cach Cash bwent, December 31, Twey 3 Cash Baianta, Decenber 31, Tiaur th The management of Wyatt Corporation is frustrated because its parent company, SRW Corporation, repeatedly rejects Wyatt's capital spending requests. These refusals led Wyatt's management to conclude its operations play a limited role in the parent's long-range plans. Acting on this assumption, Wyatt's management approaches a merchant banking firm about the possibility of a leveraged buyout of itself. In their proposal, Wyatt management stresses the stable, predictable cash flows from Wyatt's operations as more than adequate to service the debt required to finance the proposed leveraged buyout. As a partner in the merchant banking firm, you investigate the feasibility of their proposal. You receive the following balance sheet and supplementary information for Wyatt Corporation. The management of Wyatt further discloses that, following their proposed purchase, they intend to acquire machinery costing $325,000 in each of the next three years to overcome the previous low level of capital expenditures while a subsidiary of SRW Corporation. Management argues these expenditures are needed for competitive reasons. Required: a. Using information in the balance sheet and the supplementary disclosures, prepare a statement of cash flows (indirect method) for the year ended December 31, Year 10. b. Using the statement of cash flows from a and assuming that debt service is $300,000 per year after the leveraged buyout, evaluate the feasibility of management's proposal. WYATI CCOTOFATICN Statement ot Cast Flews. Far the Yaw Finded December 31, Ywar to Cash nowa toom sperating wetliates Net inteme" Ady (oeduct) agquptededs to cash basis Depreciation eapense Coin os asla of equipmest on inerease in astsunta incelit. herease in atceuste puystile Decrease in incere tases payable nerrase in ofter pryabint Not cash fisw fron operaing astivities Cash fewe som twetsirg activet. Net cosh ueed by ineseting sevitiet Cash fews bom tranking setieises thrunce of blexi Pedevetien of debs Net ineriase in cach Cash bwent, December 31, Twey 3 Cash Baianta, Decenber 31, Tiaur th The management of Wyatt Corporation is frustrated because its parent company, SRW Corporation, repeatedly rejects Wyatt's capital spending requests. These refusals led Wyatt's management to conclude its operations play a limited role in the parent's long-range plans. Acting on this assumption, Wyatt's management approaches a merchant banking firm about the possibility of a leveraged buyout of itself. In their proposal, Wyatt management stresses the stable, predictable cash flows from Wyatt's operations as more than adequate to service the debt required to finance the proposed leveraged buyout. As a partner in the merchant banking firm, you investigate the feasibility of their proposal. You receive the following balance sheet and supplementary information for Wyatt Corporation. The management of Wyatt further discloses that, following their proposed purchase, they intend to acquire machinery costing $325,000 in each of the next three years to overcome the previous low level of capital expenditures while a subsidiary of SRW Corporation. Management argues these expenditures are needed for competitive reasons. Required: a. Using information in the balance sheet and the supplementary disclosures, prepare a statement of cash flows (indirect method) for the year ended December 31, Year 10. b. Using the statement of cash flows from a and assuming that debt service is $300,000 per year after the leveraged buyout, evaluate the feasibility of management's proposal