Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wylde West has recently moved to Canada to start his own record label. After a few years of apparent success, he is considering creating

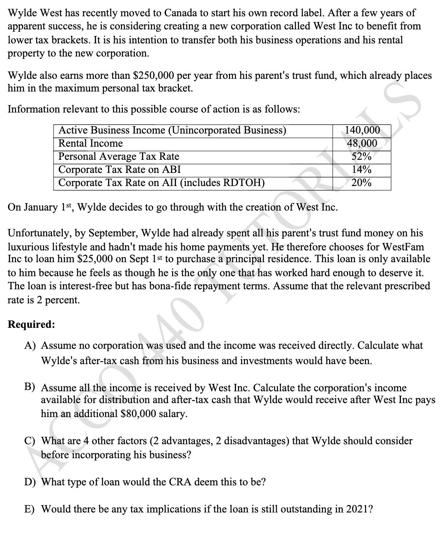

Wylde West has recently moved to Canada to start his own record label. After a few years of apparent success, he is considering creating a new corporation called West Inc to benefit from lower tax brackets. It is his intention to transfer both his business operations and his rental property to the new corporation. Wylde also earns more than $250,000 per year from his parent's trust fund, which already places him in the maximum personal tax bracket. Information relevant to this possible course of action is as follows: Active Business Income (Unincorporated Business) Rental Income Personal Average Tax Rate Corporate Tax Rate on ABI Corporate Tax Rate on All (includes RDTOH) 140,000 48,000 $2% 14% 20% 40 S On January 1, Wylde decides to go through with the creation West Inc. Unfortunately, by September, Wylde had already spent all his parent's trust fund money on his luxurious lifestyle and hadn't made his home payments yet. He therefore chooses for WestFam Inc to loan him $25,000 on Sept 1s to purchase a principal residence. This loan is only available to him because he feels as though he is the only one that has worked hard enough to deserve it. The loan is interest-free but has bona-fide repayment terms. Assume that the relevant prescribed rate is 2 percent. Required: A) Assume no corporation was used and the income was received directly. Calculate what Wylde's after-tax cash from his business and investments would have been. B) Assume all the income is received by West Inc. Calculate the corporation's income available for distribution and after-tax cash that Wylde would receive after West Inc pays him an additional $80,000 salary. C) What are 4 other factors (2 advantages, 2 disadvantages) that Wylde should consider before incorporating his business? D) What type of loan would the CRA deem this to be? E) Would there be any tax implications if the loan is still outstanding in 2021?

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

A Without incorporating Wyldes income would be subject to personal tax rates Lets calculate his aftertax cash from his business and investments Active ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started