Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wyro Ltd is a company that makes wire products such as supermarket shopping trolleys and baskets. The company has an authorised share capital of 200000

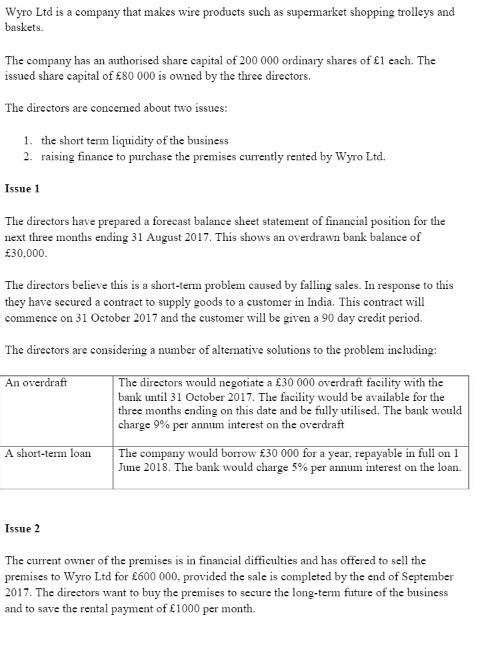

Wyro Ltd is a company that makes wire products such as supermarket shopping trolleys and baskets. The company has an authorised share capital of 200000 ordinary shares of 1 each. The issued share capital of 80000 is owned by the three directors. The directors are concerned about two issues: 1. the short term liquidity of the business 2. raising finance to purchase the premises currently rented by Wyro Ltd. Issue 1 The directors have prepared a forecast balance sheet statement of financial position for the next three months ending 31 August 2017 . This shows an overdrawn bank balance of f30.000 The directors believe this is a short-term problem caused by falling sales. In response to this they have secured a contract to supply goods to a customer in India. This contract will commence on 31 Oetober 2017 and the customer will be given a 90 day credit period. The directors are considering a number of alternative solutions to the problem including: Issue 2 The current owner of the premises is in financial difficulties and has offered to sell the premises to Wyro Ltd for $600000, provided the sale is completed by the end of September 2017. The directors want to buy the premises to secure the long-term future of the business and to save the rental payment of 1000 per month. Evaluate potential sources of finance to: (a) solve the short-term cash flow problems; (b) finance the purchase of the premises. In your answer you must advise the directors which sourees of finance you would recommend. Wyro Ltd is a company that makes wire products such as supermarket shopping trolleys and baskets. The company has an authorised share capital of 200000 ordinary shares of 1 each. The issued share capital of 80000 is owned by the three directors. The directors are concerned about two issues: 1. the short term liquidity of the business 2. raising finance to purchase the premises currently rented by Wyro Ltd. Issue 1 The directors have prepared a forecast balance sheet statement of financial position for the next three months ending 31 August 2017 . This shows an overdrawn bank balance of f30.000 The directors believe this is a short-term problem caused by falling sales. In response to this they have secured a contract to supply goods to a customer in India. This contract will commence on 31 Oetober 2017 and the customer will be given a 90 day credit period. The directors are considering a number of alternative solutions to the problem including: Issue 2 The current owner of the premises is in financial difficulties and has offered to sell the premises to Wyro Ltd for $600000, provided the sale is completed by the end of September 2017. The directors want to buy the premises to secure the long-term future of the business and to save the rental payment of 1000 per month. Evaluate potential sources of finance to: (a) solve the short-term cash flow problems; (b) finance the purchase of the premises. In your answer you must advise the directors which sourees of finance you would recommend

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started