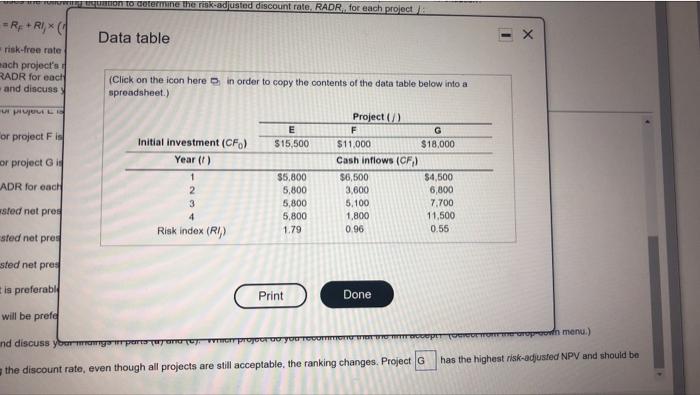

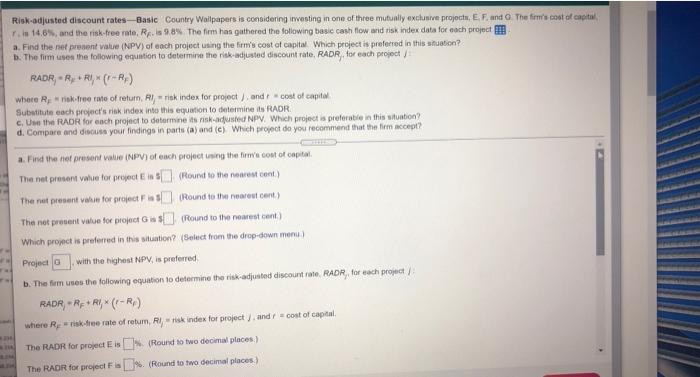

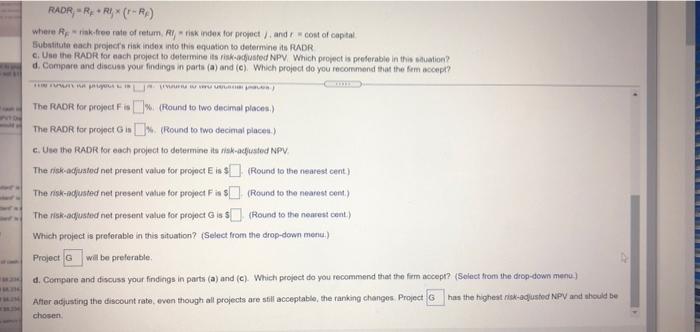

x 1 Untion to determine the risk-adjusted discount rate, RADR for each project -Rx+ RI* Data table risk-free rate mach projects RADR for each (Click on the icon here in order to copy the contents of the data table below into a and discussy spreadsheet.) UL Project (1) E F G or project Fid Initial investment (CF) $15,500 $11,000 $18,000 or project Year (1) Cash inflows (CF) 1 $5,800 $6,500 $4,500 ADR for each 2 5,800 3,600 3 5,800 5.100 7,700 ested net pret 4 5,800 1,800 11,500 Risk index (RU) 1.79 0.96 0.55 sted net pret 6,800 sted net pret is preferably Print Done will be prefe TOOS eroporn menu.) nd discuss your org pertama ya TT has the highest risk-adjusted NPV and should be the discount rate, even though all projects are still acceptable, the ranking changes. Project G Risk-adjusted discount rates - Basic Country Wallpapers is considering investing in one of three mutually exclusive projects, E F and The firm's cost of capital Tils 14.6%, and the risk free rate, R. 989 The firm has gathered the following basic cash flow and risk index data for each project a. Find the nel present value (NPV) of each project using the firm's cost of capital. Which project is preferred in this situation? b. The firm use the following equation to determine the risk-adjusted discount rate RADR for each project RADR-R* RI* (R) where Risk free rate of return, RI nisk index for project and cost of capital Substitute each project's risk index into this equation to determine ts RADR c. Use the RADR for each project to determine its risk-adusted NPV. Which project is preferable in this situation? d. Compare and discuss your findings in parts (a) and (c) Which project do you recommend that the firm accept? a. Find the represent value (NPV) of each project using the time out of capital The net present wlue for project E (Round to the newest cent) The nut present was for project Fas(Round to the west cent) The net present value for projects (Round to the nearest cent) Which project is preferred in this situation? (Select from the drop-down menu Project with the highest NPV, is preferred b. The firm uses the following equation to determine the risk-adjusted discount rate RADR, for each project RADR-RF+ RI* (-R) where Rinistre rate of retum, Risk Index for project and cost of capital The RADR for project E. (Round to two decimal places) The RADR for project F (Round to two decimal places) . RADR-RE-RI (-RA) where Risk free rate of retum. Rytisk index for project and cost of capital Substitute each project's risk index into this equation to determine its RADR c. Use the RADR for each project to determine its riskusted NPV Which project is preferable in this station? d. Compare and discuss your findings in parts (a) and (c) Which project do you recommend that the form accept? EUWAR WAR The RADR for project F(Round to two decimal places) The RADR for projecton (Round to two decimal place.) c. Use the RADR for each project to determine isikusted NPV The risk adjusted not present value for project is S. (Round to the nearest cent) The risk-adjusted net present value for project Fins (Round to the nearest cond) The risk adjusted not present value for projectes (Round to the nearest cent) Which project is preferable in this situation? (Select from the drop-down menu.) Project will be preferable d. Compare and discuss your findings in parts (a) and (c). Which project do you recommend that the firm accept? (Select from the drop-down menu) has the highest risk-aqustod NPV and should be After adjusting the discount rate, even though all projects are still acceptable, the ranking changes. Project G chosen