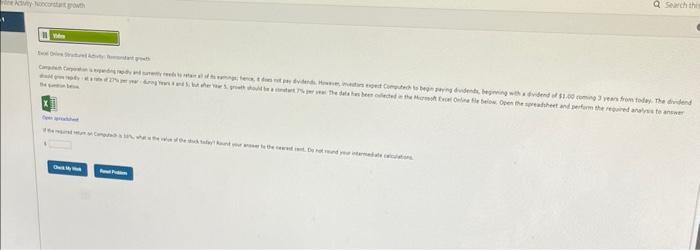

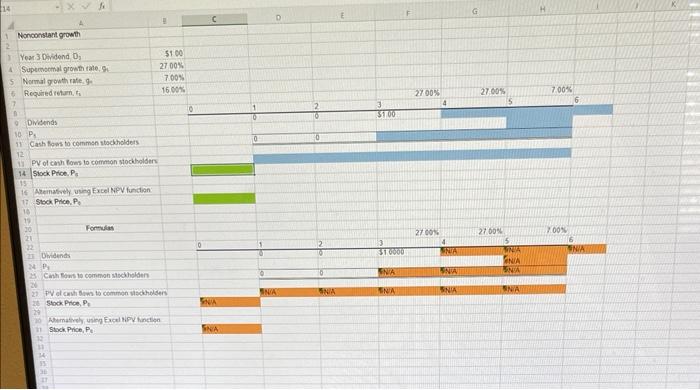

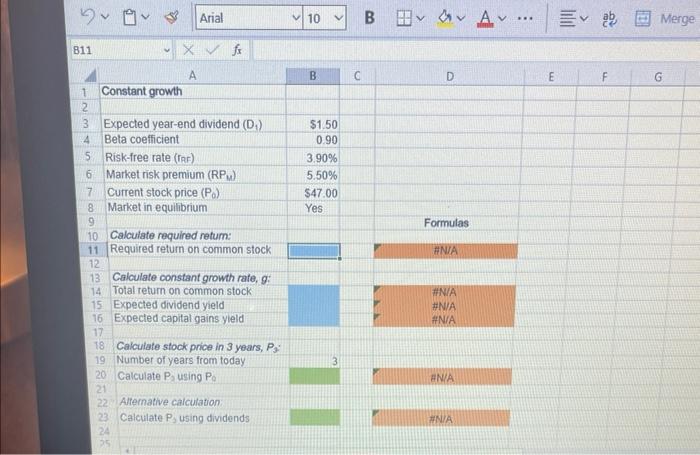

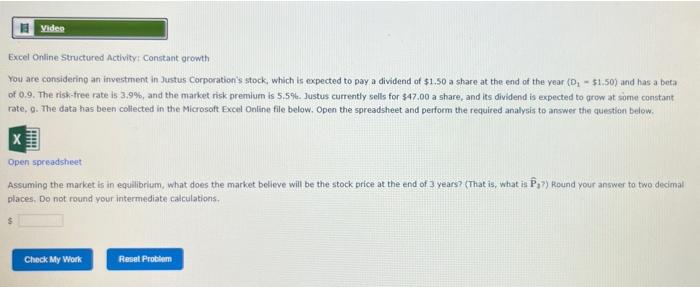

x 14 Nonconslant growth Extel Online Struct You are considering an investment in Justus Coeporation's stock, which is expected to pay a dividend of 31.50 a share at the end of the year (0131.50) and has a beta of 0.9. The riak-free rate is 3.9\%, and the market risk premiim is 5.5\%. hustus currenth scils for 147.00 a share, and ins dividend is expected to grow at some constant. rate, 6. The data has been collected in the Microseft Excel Online fle below. Open the spreadsheet and perform the required analivia to answer the question beiow. open spreatuheet Dlaces. Do not round your intermediate calculations. Excel Online Structured Activity. Constant growth You are considering an investment in Justus Corporation's stock, which is expected to pay a dividend of $1.50 a share at the end of the year ( D1=$1.50 ) and has a beta of 0.9. The risk-tree rate is 3.9%, and the market risk premiurn is 5.5%. Justus currently sells for 347.00 a share, and its dividend is expected to grow at siome constant rate. 9. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet Assuming the market is in eqailibriam, what does the market believe will be the stock price at the end of 3 years? (That is, what is P^h ) ) Round your answer to two decimal slaces, Do not round your intermediate calculations. x 14 Nonconslant growth Extel Online Struct You are considering an investment in Justus Coeporation's stock, which is expected to pay a dividend of 31.50 a share at the end of the year (0131.50) and has a beta of 0.9. The riak-free rate is 3.9\%, and the market risk premiim is 5.5\%. hustus currenth scils for 147.00 a share, and ins dividend is expected to grow at some constant. rate, 6. The data has been collected in the Microseft Excel Online fle below. Open the spreadsheet and perform the required analivia to answer the question beiow. open spreatuheet Dlaces. Do not round your intermediate calculations. Excel Online Structured Activity. Constant growth You are considering an investment in Justus Corporation's stock, which is expected to pay a dividend of $1.50 a share at the end of the year ( D1=$1.50 ) and has a beta of 0.9. The risk-tree rate is 3.9%, and the market risk premiurn is 5.5%. Justus currently sells for 347.00 a share, and its dividend is expected to grow at siome constant rate. 9. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet Assuming the market is in eqailibriam, what does the market believe will be the stock price at the end of 3 years? (That is, what is P^h ) ) Round your answer to two decimal slaces, Do not round your intermediate calculations