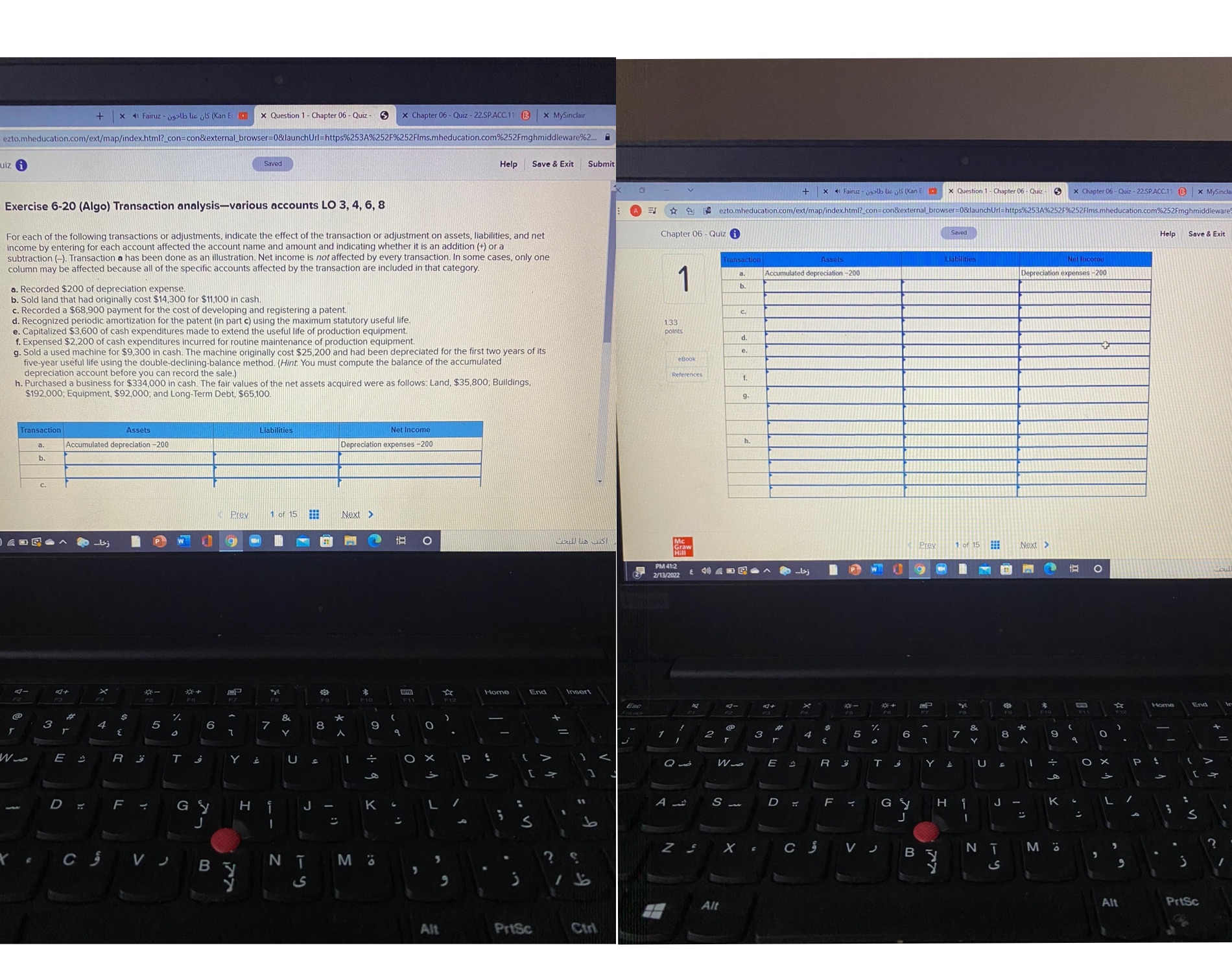

+ X 41 Fairuz - 0galb lic jlS (Kan E ( x Question 1 - Chapter 06 - Quiz - x Chapter 06 - Quiz - 22.SP.ACC.11 B x MySinclair ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252FIms.mheducation.com%252Fmghmiddleware%2.. Saved Help Save & Exit Submit + | * * Fairuz - usall lic gis (Kan E ID X Question - Chapter 06 - Quiz . | Chapter 06- Quiz - 22SPACC.1 B | x MySinch Exercise 6-20 (Algo) Transaction analysis-various accounts LO 3, 4, 6, 8 A = 1 5 ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=08launchUrl=https96253A96252F%252Fims.mheducation.com252Fmghmiddleware For each of the following transactions or adjustments, indicate the effect of the transaction or adjustment on assets, liabilities, and net Chapter 06 - Quiz i Saved Help Save & Exit income by entering for each account affected the account name and amount and indicating whether it is an addition (+) or a subtraction (-). Transaction a has been done as an illustration. Net income is not affected by every transaction. In some cases, only one column may be affected because all of the specific accounts affected by the transaction are included in that category. expenses -200 a. Recorded $200 of depreciation expense. b. Sold land that had originally cost $14,300 for $11,100 in cash. c. Recorded a $68,900 payment for the cost of developing and registering a patent. d. Recognized periodic amortization for the patent (in part c) using the maximum statutory useful life. 1.33 . Capitalized $3,600 of cash exp of cash expenditures made to extend the useful life of production equipment. points f. Expensed $2,200 of cash expenditures incurred for routine maintenance of production equipment. g. Sold a used machine for $9,300 in cash. The machine originally cost $25,200 and had been depreciated for the first two years of its five-year useful life using the double-declining-balance method. (Hint. You must compute the balance of the accumulated eBook depreciation account before you can record the sale.) References h. Purchased a business for $334,000 in cash. The fair values of the net assets acquired were as follows: Land, $35,800; Buildings. $192,000; Equipment, $92,000; and Long-Term Debt, $65,100. Transaction Assets Liabilities Net Income a. Accumulated depreciation -200 Depreciation expenses -200 Prev 1 of 15 1 Next > Prey 10 15 : Next > 3 2/13/202 40 5 - 20 45; Home End Insert Esc 4 - *+ 2 D C IN INA All Alt PrtSc Alt Prise Ctri