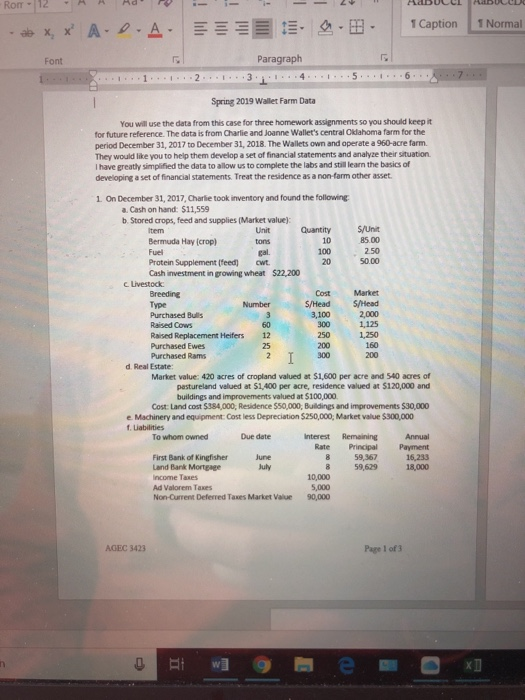

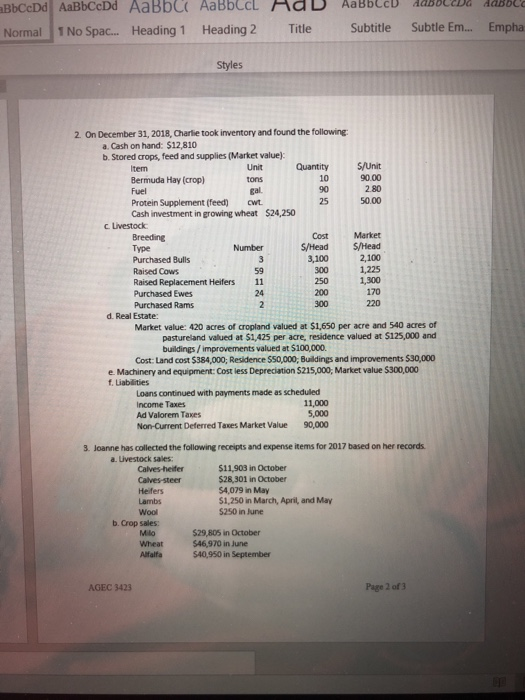

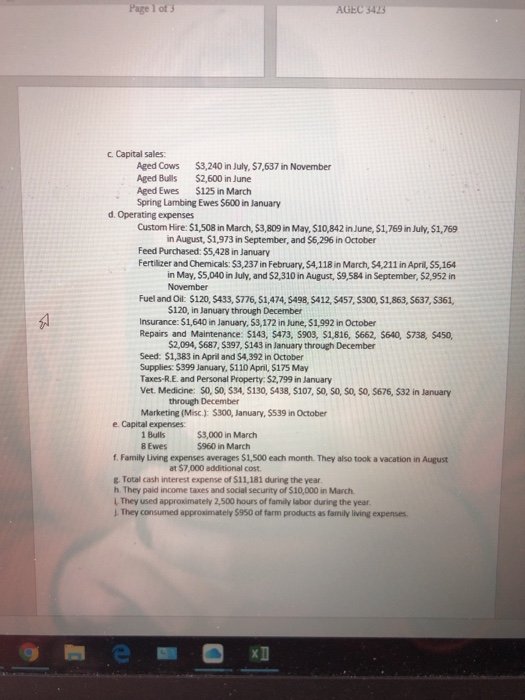

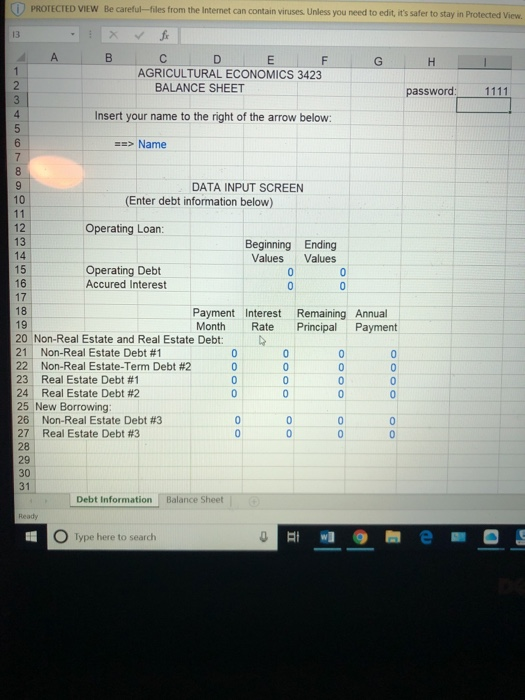

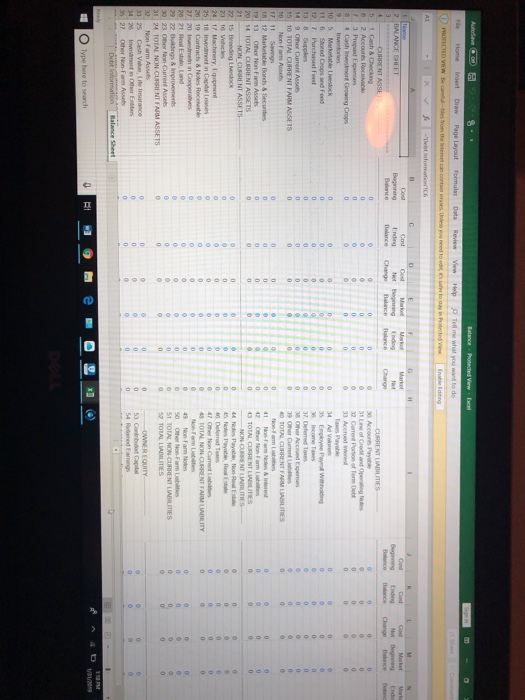

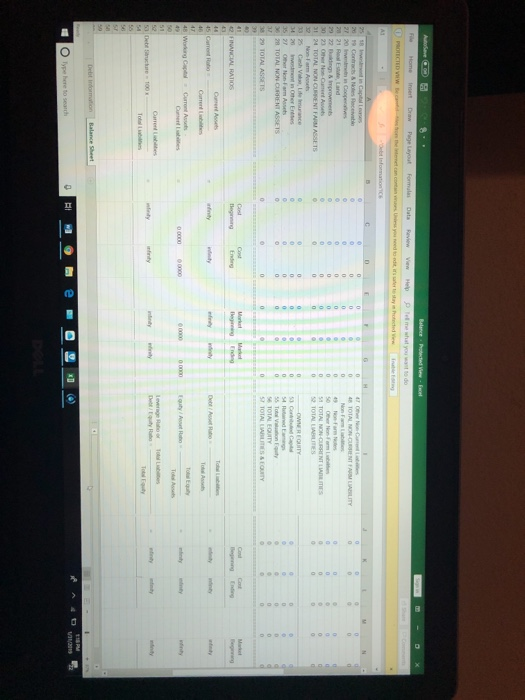

x' A-2. . B- 1 caption L Normal x, Font Paragraph 15H6 Spring 2019 Wallet Farm Data You will use the data from this case for three homework assignments so you should keep it for future reference. The data is from Charlie and Joanne Wallet's central Ckdahoma farm for the period December 31, 2017 to December 31, 2018. The Wallets own and operate a 960-acre farm. They would like you to help them develop a set of financial statements and analyze their situation I have greatly simplified the data to allow us to complete the labs and still learn the basics of developing a set of financial statements. Treat the residence as a non-farm other asset. 1 On December 31, 2017, Charlie took inventory and found the following a Cash on hand: $11,559 b. Stored crops, feed and supplies (Market value): Unit s/unit Item Bermuda Hay (crop) Fuel Protein Supplement [feed cwt Cash investment in growing wheat $22,200 Quantity 10 100 20 2.50 50.00 c Livestock Cost Market Type Purchased Bulls Raised Cows Raised Replacement Heifers 12 S/Head S/Head 300 2000 160 Purchased Ewes Purchased Rams 200 1250 300 d. Real Estate Market value: 420 acres of cropland valued at $1,600 per acre and 540 acres of pastureland velued at $1,400 per acre, residence valued at $120,000 and buildings and improvements valued at $100,000 Cost Land cost $384,000, Residence $50,000, Buildings and improvements $30,000 e Machinery and equipment Cost less Depreciation $250,000, Market value $300,000 f. Liabilities To whom owned e date Interest Remaining Annual First Bank of Kingfisher une Land Bank Morteage income Taxes Ad Valorem Taxes Non-Current Deferred Taxes Market Value 90,000 Rate PrincipalPayment 10,000 59629 16,233 18,000 8 59,367 July 5,000 AGEC 3423 Page 1 of 3 Normal 1 No Spac... . Heading 1 Heading 2 Title Subtitle Subtle Em.... Empha Styles 2. On December 31, 2018, Charlie took inventory and found the following a. Cash on hand: $12,810 b. Stored crops, feed and supplies (Market value): Item Unit Quantity S/Unit 10 90 25 90.00 2.80 50.00 tons Fuel Protein Supplement (feed) wt Cash investment in growing wheat $24,250 c. Livestock CostMarket Type Purchased Bulls Raised Cows Raised Replacement Heifers Purchased Ewes Purchased Rams S/Head S/Head 1,225 170 3,100 250 300 11 24 200 1,300 d. Real Estate: Market value: 420 acres of cropland valued at $1,650 per acre and 540 acres of pastureland valued at $1,425 per acre, residence valued at $125,000 and buildings / improvements valued at $100,000. Cost Land cost $384,000; Residence $50,000, Buildings and improvements $30,000 e. Machinery and equipment: Cost less Depreciation $215,000, Market value $300,000 f. Liabilities Loans continued with payments made as scheduled Income Taxes Ad Valorem Taxes Non-Current Deferred Taxes Market Value 90,000 11,000 5,000 3. Joanne has collected the following receipts and expense items for 2017 based on her records a. Livestock sales 511,903 in October $28,301 in October $4,079 in May $1,250 in March, April, and May 5250 in June Heifers b. Crop sales 529,805 in October $46,970 in June 540,950 in September AGEC 3423 Page 2 of 3 Page 1 ot 5 AGEC 3423 C. Capital sales Aged Cows $3,240 in July, $7,637 in November Aged Bulls $2,600 in June Aged Ewes $125 in March Spring Lambing Ewes $600 in January d. Operating expenses Custom Hire: $1,508 in March, $3,809 in May, $10,842 in June, $1,769 in July, $1,769 in August, $1,973 in September, and $6,296 in October Feed Purchased: $5,428 in January Fertilizer and Chemicals: $3,237 in February, S4,118 in March, $4,211 in April, S5,164 in May, $5,040 in July, and $2,310 in August, $9,584 in September, $2,952 in November S120, in January through December $2,094, $687, 5397, $143 in January through December Fuel and Oil: $120, $433, S776, $1,474, $498, $412, S457, S300, $1,863, 5637, S361, Insurance: S1,640 in January, $3,172 in June, $1,992 in October Repairs and Maintenance: $143, SA73, 5903, $1,816, $662, $640, $738, $450, Seed: $1,383 in April and $4,392 in October Supplies: $399 January, $110 April, $175 May Taxes-R.E. and Personal Property: $2,799 in January Vet. Medicine: $0, S0, 534, 5130, S438, S107, so, so, so, so, $676, $32 in Januany through December Marketing (Misc.J: $300, January, $539 in October e. Capital expenses 1 Bulls 8 Ewes $3,000 in March $960 in March f. Family Living expenses averages $1,500 each month. They also took a vacation in August at $7,000 additional cost E Total cash interest expense of $11,181 during the year h. They paid income taxes and social security of $10,000 in March L They used approximately 2,500 hours of family labor during the year They consumed approximately $950 of farm products as family living expenses PROTECTED VIEW Be careful-files from the Internet can contain viruses Unless you need to edit, it's safer to stay in Protected View. AGRICULTURAL ECONOMICS 3423 BALANCE SHEET password: 1111 Insert your name to the right of the arrow below: Name DATA INPUT SCREEN 10 (Enter debt information below) Operating Loan 12 13 14 15 Beginning Ending Values Values Operating Debt Accured Interest Payment Interest Remaining Annual Month Rate Principal Payment 18 19 20 Non-Real Estate and Real Estate Debt: 21 | Non-Real Estate Debt #1 22 Non-Real Estate-Term Debt #2 23 Real Estate Debt #1 24 Real Estate Debt #2 25 New Borrowing 26 Non-Real Estate Debt #3 27 | Real Estate Debt #3 28 29 30 31 Debt Information Balance Sheet O Type here to search x' A-2. . B- 1 caption L Normal x, Font Paragraph 15H6 Spring 2019 Wallet Farm Data You will use the data from this case for three homework assignments so you should keep it for future reference. The data is from Charlie and Joanne Wallet's central Ckdahoma farm for the period December 31, 2017 to December 31, 2018. The Wallets own and operate a 960-acre farm. They would like you to help them develop a set of financial statements and analyze their situation I have greatly simplified the data to allow us to complete the labs and still learn the basics of developing a set of financial statements. Treat the residence as a non-farm other asset. 1 On December 31, 2017, Charlie took inventory and found the following a Cash on hand: $11,559 b. Stored crops, feed and supplies (Market value): Unit s/unit Item Bermuda Hay (crop) Fuel Protein Supplement [feed cwt Cash investment in growing wheat $22,200 Quantity 10 100 20 2.50 50.00 c Livestock Cost Market Type Purchased Bulls Raised Cows Raised Replacement Heifers 12 S/Head S/Head 300 2000 160 Purchased Ewes Purchased Rams 200 1250 300 d. Real Estate Market value: 420 acres of cropland valued at $1,600 per acre and 540 acres of pastureland velued at $1,400 per acre, residence valued at $120,000 and buildings and improvements valued at $100,000 Cost Land cost $384,000, Residence $50,000, Buildings and improvements $30,000 e Machinery and equipment Cost less Depreciation $250,000, Market value $300,000 f. Liabilities To whom owned e date Interest Remaining Annual First Bank of Kingfisher une Land Bank Morteage income Taxes Ad Valorem Taxes Non-Current Deferred Taxes Market Value 90,000 Rate PrincipalPayment 10,000 59629 16,233 18,000 8 59,367 July 5,000 AGEC 3423 Page 1 of 3 Normal 1 No Spac... . Heading 1 Heading 2 Title Subtitle Subtle Em.... Empha Styles 2. On December 31, 2018, Charlie took inventory and found the following a. Cash on hand: $12,810 b. Stored crops, feed and supplies (Market value): Item Unit Quantity S/Unit 10 90 25 90.00 2.80 50.00 tons Fuel Protein Supplement (feed) wt Cash investment in growing wheat $24,250 c. Livestock CostMarket Type Purchased Bulls Raised Cows Raised Replacement Heifers Purchased Ewes Purchased Rams S/Head S/Head 1,225 170 3,100 250 300 11 24 200 1,300 d. Real Estate: Market value: 420 acres of cropland valued at $1,650 per acre and 540 acres of pastureland valued at $1,425 per acre, residence valued at $125,000 and buildings / improvements valued at $100,000. Cost Land cost $384,000; Residence $50,000, Buildings and improvements $30,000 e. Machinery and equipment: Cost less Depreciation $215,000, Market value $300,000 f. Liabilities Loans continued with payments made as scheduled Income Taxes Ad Valorem Taxes Non-Current Deferred Taxes Market Value 90,000 11,000 5,000 3. Joanne has collected the following receipts and expense items for 2017 based on her records a. Livestock sales 511,903 in October $28,301 in October $4,079 in May $1,250 in March, April, and May 5250 in June Heifers b. Crop sales 529,805 in October $46,970 in June 540,950 in September AGEC 3423 Page 2 of 3 Page 1 ot 5 AGEC 3423 C. Capital sales Aged Cows $3,240 in July, $7,637 in November Aged Bulls $2,600 in June Aged Ewes $125 in March Spring Lambing Ewes $600 in January d. Operating expenses Custom Hire: $1,508 in March, $3,809 in May, $10,842 in June, $1,769 in July, $1,769 in August, $1,973 in September, and $6,296 in October Feed Purchased: $5,428 in January Fertilizer and Chemicals: $3,237 in February, S4,118 in March, $4,211 in April, S5,164 in May, $5,040 in July, and $2,310 in August, $9,584 in September, $2,952 in November S120, in January through December $2,094, $687, 5397, $143 in January through December Fuel and Oil: $120, $433, S776, $1,474, $498, $412, S457, S300, $1,863, 5637, S361, Insurance: S1,640 in January, $3,172 in June, $1,992 in October Repairs and Maintenance: $143, SA73, 5903, $1,816, $662, $640, $738, $450, Seed: $1,383 in April and $4,392 in October Supplies: $399 January, $110 April, $175 May Taxes-R.E. and Personal Property: $2,799 in January Vet. Medicine: $0, S0, 534, 5130, S438, S107, so, so, so, so, $676, $32 in Januany through December Marketing (Misc.J: $300, January, $539 in October e. Capital expenses 1 Bulls 8 Ewes $3,000 in March $960 in March f. Family Living expenses averages $1,500 each month. They also took a vacation in August at $7,000 additional cost E Total cash interest expense of $11,181 during the year h. They paid income taxes and social security of $10,000 in March L They used approximately 2,500 hours of family labor during the year They consumed approximately $950 of farm products as family living expenses PROTECTED VIEW Be careful-files from the Internet can contain viruses Unless you need to edit, it's safer to stay in Protected View. AGRICULTURAL ECONOMICS 3423 BALANCE SHEET password: 1111 Insert your name to the right of the arrow below: Name DATA INPUT SCREEN 10 (Enter debt information below) Operating Loan 12 13 14 15 Beginning Ending Values Values Operating Debt Accured Interest Payment Interest Remaining Annual Month Rate Principal Payment 18 19 20 Non-Real Estate and Real Estate Debt: 21 | Non-Real Estate Debt #1 22 Non-Real Estate-Term Debt #2 23 Real Estate Debt #1 24 Real Estate Debt #2 25 New Borrowing 26 Non-Real Estate Debt #3 27 | Real Estate Debt #3 28 29 30 31 Debt Information Balance Sheet O Type here to search