Answered step by step

Verified Expert Solution

Question

1 Approved Answer

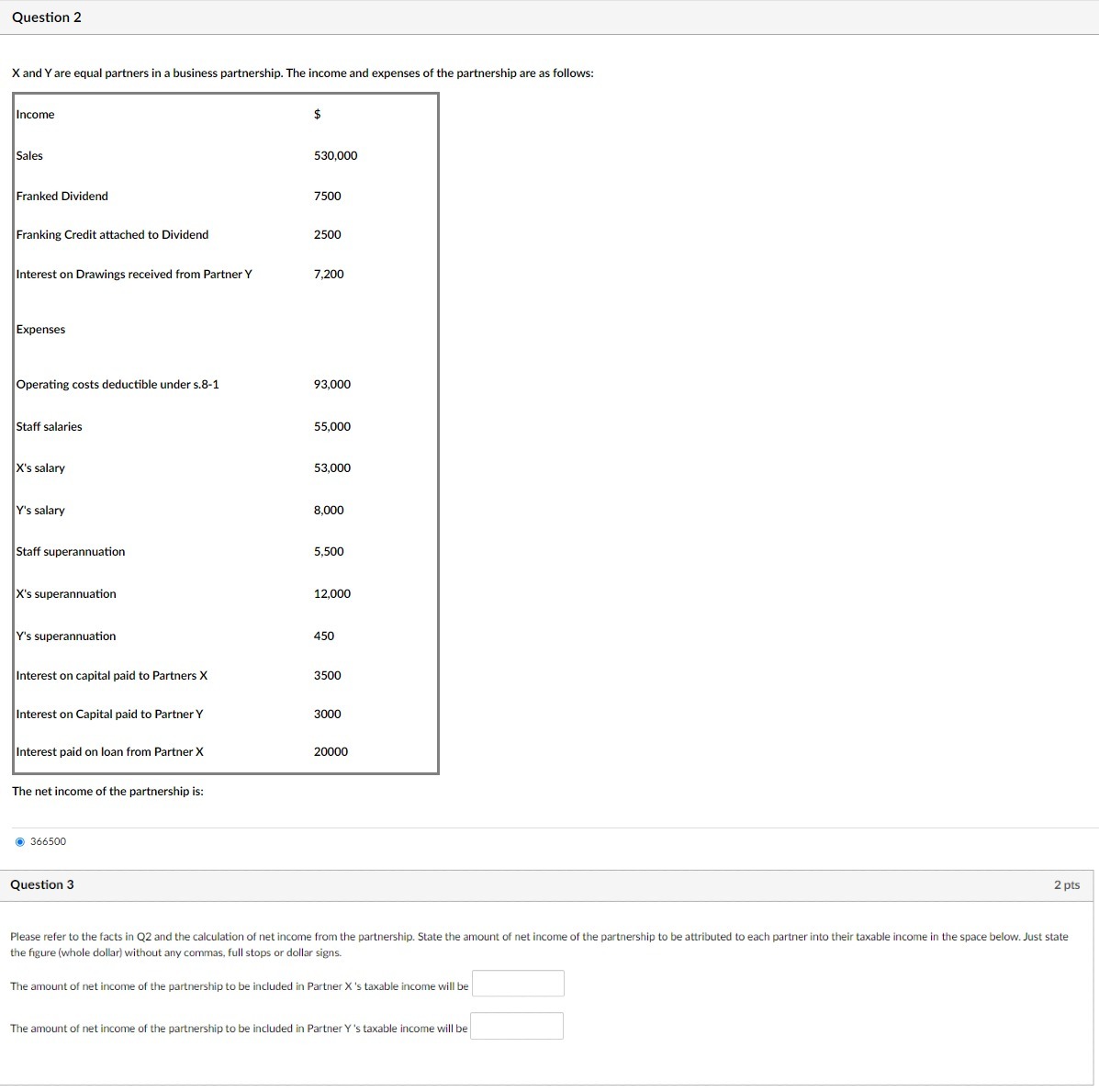

X and Y are equal partners in a business partnership. The income and expenses of the partnership are as follows: The net income of the

X and Y are equal partners in a business partnership. The income and expenses of the partnership are as follows:

The net income of the partnership is:

Question

Please refer to the facts in Q and the calculation of net income from the partnership. State the amount of net income of the partnership to be attributed to each partner into their taxable income in the space below. Just state

the figure whole dollar without any commas, full stops or dollar signs.

The amount of net income of the partnership to be included in Partner s taxable income will be

The amount of net income of the partnership to be included in Partner s taxable income will be

here is the question for incometax framework

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started