Answered step by step

Verified Expert Solution

Question

1 Approved Answer

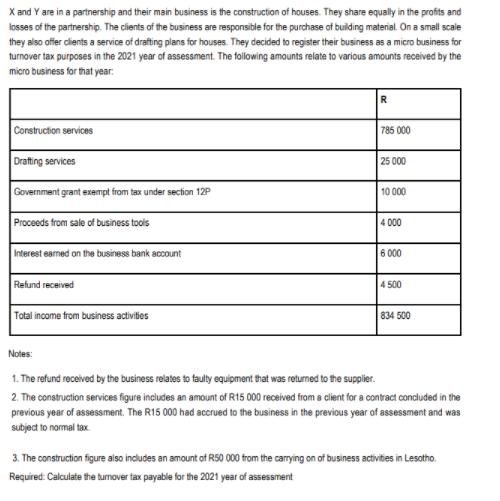

X and Y are in a partnership and their main business is the construction of houses. They share equally in the profits and losses

X and Y are in a partnership and their main business is the construction of houses. They share equally in the profits and losses of the partnership. The clients of the business are responsible for the purchase of building material. On a smll scale they also offer clients a service of drafting plans for houses. They decided to register their business as a micro business for turnover tax purposes in the 2021 year of assessment. The following amounts relate to various amounts received by the micro business for that year: R Construction services 785 000 Drafting services 25 000 Government grant exempt from tax under section 12P 10 000 Proceeds from sale of business tools 4 000 Interest eamed on the business bank account 6 000 Refund received 4 500 Total income from business actvilies 834 500 Notes: 1. The refund received by the business relates to faulty equioment that was retumed to the supplier. The construction services figure includes an amount of R15 000 received from a client for a contract condluded in the previous year of assessment. The R15 000 had accrued to the business in the previous year of assessment and was subject to normal tax. 3. The construction figure also includes an amount of R50 000 from the carrying on of business activities in Lesotho. Required: Calculate the tumover tax payable for the 2021 year of assessment

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer Services R R Construction Services 785000 LessContract concluded in previous year Considered ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started