Question

X and Y entered into Joint Venture to sell a consignment of timber sharing profits and losses equally. X provides timber from stock at

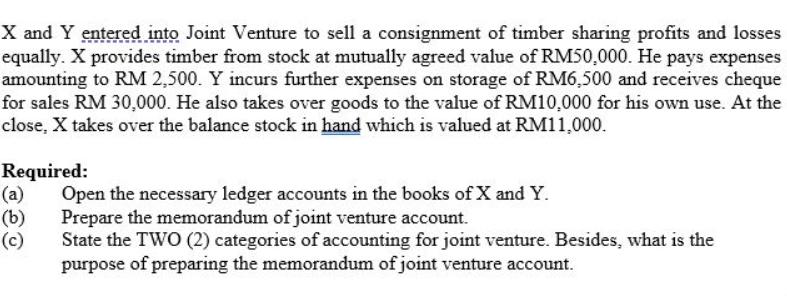

X and Y entered into Joint Venture to sell a consignment of timber sharing profits and losses equally. X provides timber from stock at mutually agreed value of RM50,000. He pays expenses amounting to RM 2,500. Y incurs further expenses on storage of RM6,500 and receives cheque for sales RM 30,000. He also takes over goods to the value of RM10,000 for his own use. At the close, X takes over the balance stock in hand which is valued at RM11,000. Required: (a) (b) Open the necessary ledger accounts in the books of X and Y. Prepare the memorandum of joint venture account. State the TWO (2) categories of accounting for joint venture. Besides, what is the purpose of preparing the memorandum of joint venture account.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a In the book of X Joint venture with Y Dr Cr Purchase 50000 Expenses 2500 Balance stock in hand 110...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Smith and Roberson Business Law

Authors: Richard A. Mann, Barry S. Roberts

15th Edition

1285141903, 1285141903, 9781285141909, 978-0538473637

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App