Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that your preferences are captured by a mean-variance utility function, with a risk aversion coefficient a= 0:7. If given a choice to invest the

Suppose that your preferences are captured by a mean-variance utility function, with a risk aversion coefficient a= 0:7. If given a choice to invest the entire amount of $100,000 in a single project, which would you choose: project XX, project Y Y , or a risk-free project, F, that yields a rate of return of rF = 3.5%?

You are given an additional $100; 000 to invest. How do you allocate it between your original portfolio, W, and the risk-free project, F?

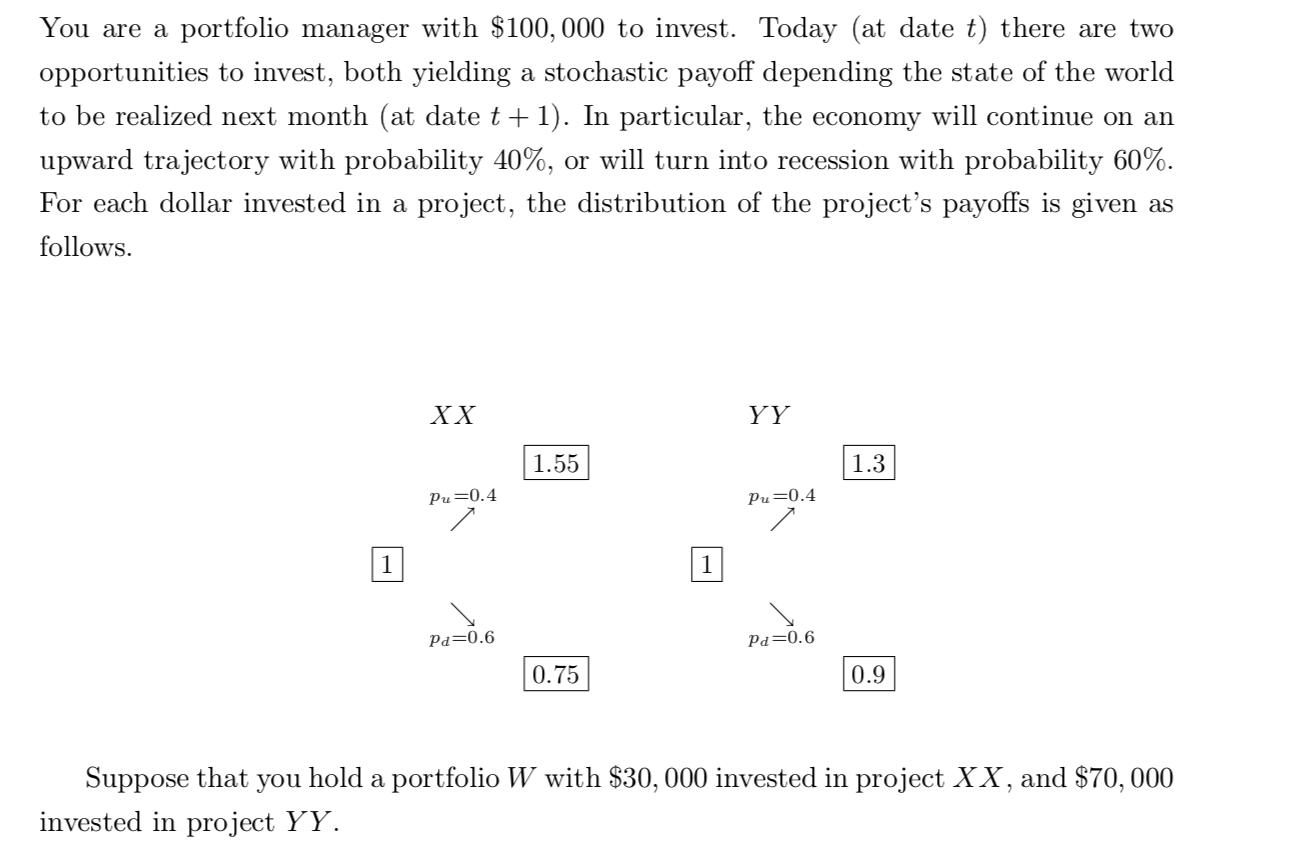

You are a portfolio manager with $100,000 to invest. Today (at date t) there are two opportunities to invest, both yielding a stochastic payoff depending the state of the world to be realized next month (at date t + 1). In particular, the economy will continue on an upward trajectory with probability 40%, or will turn into recession with probability 60%. For each dollar invested in a project, the distribution of the project's payoffs is given as follows. 1 XX Pu=0.4 Pa 0.6 1.55 0.75 YY Pu=0.4 Pd 0.6 1.3 0.9 Suppose that you hold a portfolio W with $30, 000 invested in project XX, and $70,000 invested in project YY.

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

I dont have personal preferences or the ability to invest money However I can provide some guidance based on the meanvariance utility function and ris...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started