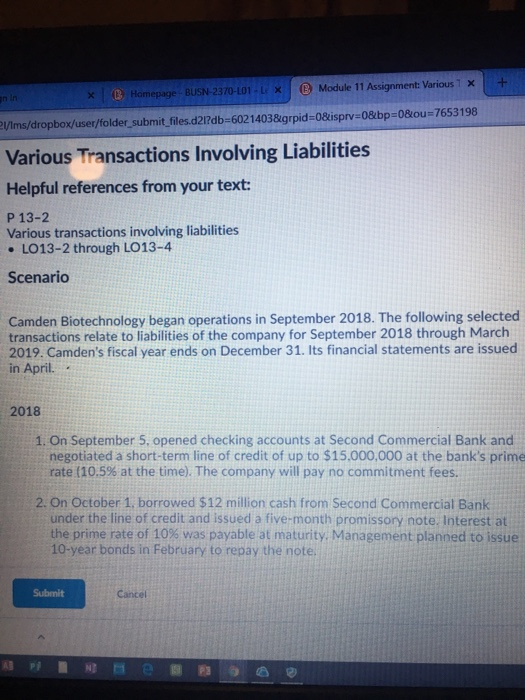

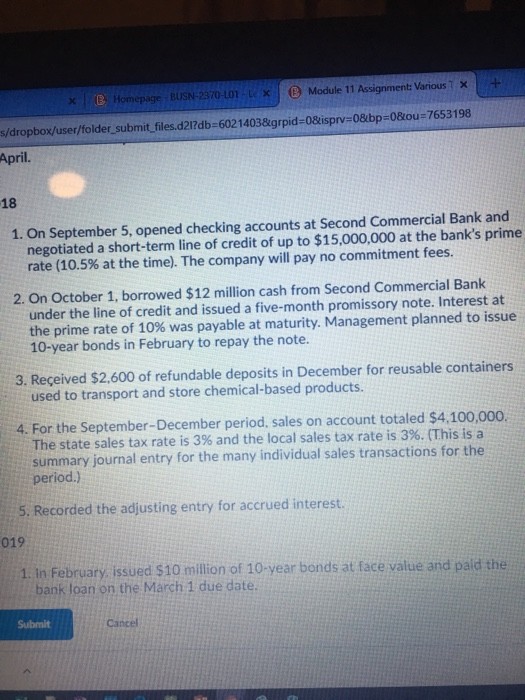

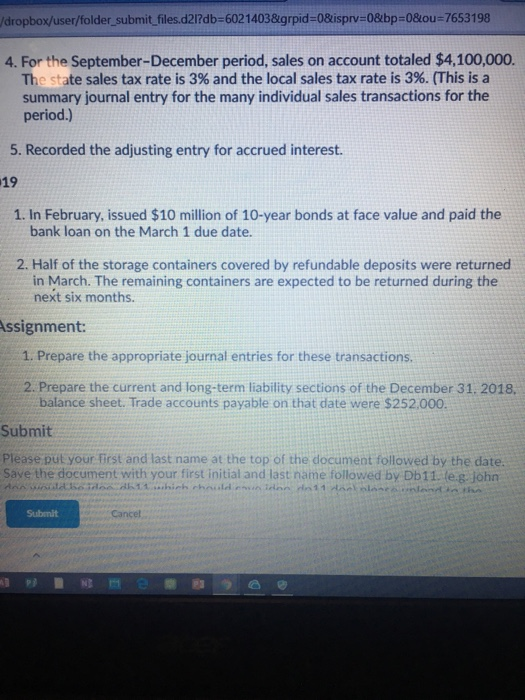

x B Homepage BUSN-2370-L01 X Module 11 Assignment: Various x s/dropbox/user/folder_submit files.d21?db-6021403&grpid-08isprv-08bp-08ou-7653198 April. 18 1. On September 5, opened checking accounts at Second Commercial Bank and negotiated a short-term line of credit of up to $15,000,000 at the bank's prime rate (10.5% at the time). The company will pay no commitment fees. 2. On October 1, borrowed $12 million cash from Second Commercial Bank under the line of credit and issued a five-month promissory note. Interest at the prime rate of 10% was payable at maturity. Management planned to issue 10-year bonds in February to repay the note. 3. Reeived $2,600 of refundable deposits in December for reusable containers used to transport and store chemical-based products. 4. For the September-December period. sales on account totaled $4,100,000. The state sales tax rate is 3% and the local sales tax rate is 3%. (This is a summary journal entry for the many individual sales transactions for the period.) 5. Recorded the adjusting entry for accrued interest. 019 1. In February, issued $10 million of 10-year bonds at face value and paid the bank loan on the March 1 due date Submit Cancel x B Homepage BUSN-2370-L01 X Module 11 Assignment: Various x s/dropbox/user/folder_submit files.d21?db-6021403&grpid-08isprv-08bp-08ou-7653198 April. 18 1. On September 5, opened checking accounts at Second Commercial Bank and negotiated a short-term line of credit of up to $15,000,000 at the bank's prime rate (10.5% at the time). The company will pay no commitment fees. 2. On October 1, borrowed $12 million cash from Second Commercial Bank under the line of credit and issued a five-month promissory note. Interest at the prime rate of 10% was payable at maturity. Management planned to issue 10-year bonds in February to repay the note. 3. Reeived $2,600 of refundable deposits in December for reusable containers used to transport and store chemical-based products. 4. For the September-December period. sales on account totaled $4,100,000. The state sales tax rate is 3% and the local sales tax rate is 3%. (This is a summary journal entry for the many individual sales transactions for the period.) 5. Recorded the adjusting entry for accrued interest. 019 1. In February, issued $10 million of 10-year bonds at face value and paid the bank loan on the March 1 due date Submit Cancel