Answered step by step

Verified Expert Solution

Question

1 Approved Answer

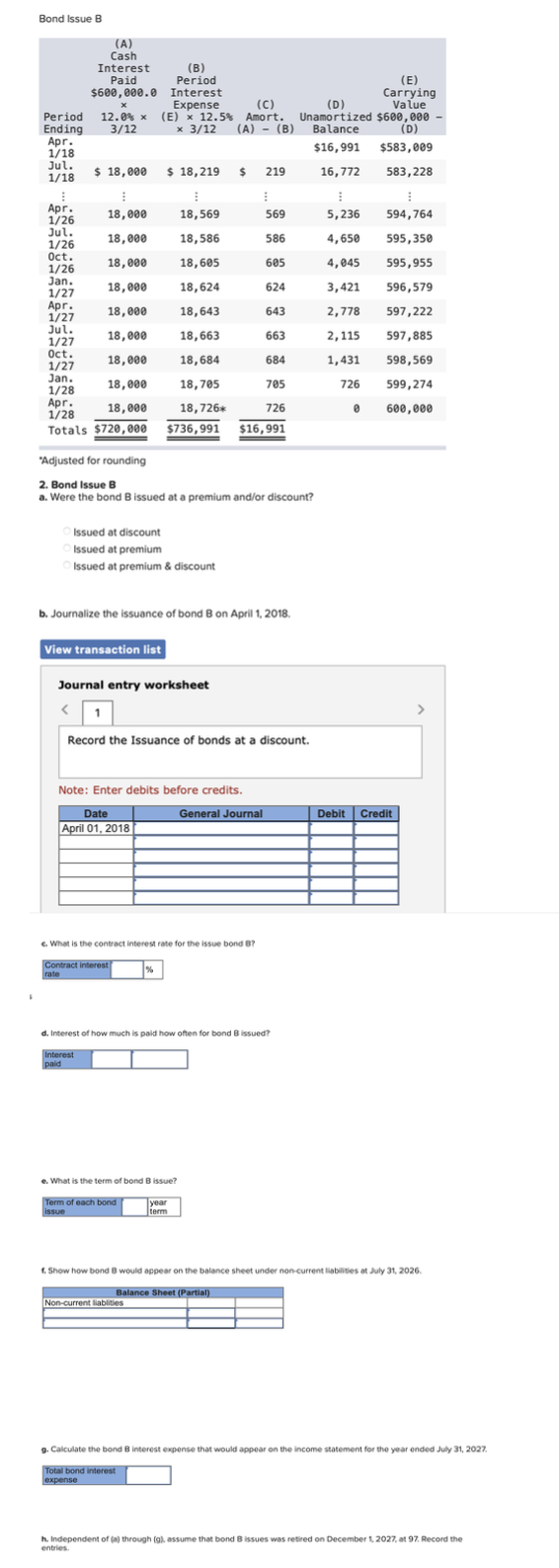

x Bond Issue B (A) Cash Interest Paid $600,000.0 (B) Period Interest Expense Period 12.0% x (E) x 12.5% Ending 3/12 x 3/12 (C)

x Bond Issue B (A) Cash Interest Paid $600,000.0 (B) Period Interest Expense Period 12.0% x (E) x 12.5% Ending 3/12 x 3/12 (C) Amort. (A) - (B) (D) (E) Carrying Value Unamortized $600,000 Balance (D) Apr. 1/18 $16,991 $583,009 Jul. $ 18,000 $18,219 $ 219 16,772 583,228 1/18 Apr. 1/26 18,000 18,569 569 5,236 594,764 Jul. 18,000 18,586 586 4,650 595,350 1/26 Oct. 18,000 18,605 605 4,045 595,955 1/26 Jan. 1/27 18,000 18,624 624 3,421 596,579 Apr. 1/27 18,000 18,643 643 2,778 597,222 Jul. 18,000 18,663 663 2,115 597,885 1/27 Oct. 1/27 18,000 18,684 684 1,431 598,569 Jan. 1/28 18,000 18,705 705 726 599,274 Apr. 18,000 18,726* 726 600,000 1/28 Totals $720,000 $736,991 $16,991 "Adjusted for rounding 2. Bond Issue B a. Were the bond B issued at a premium and/or discount? Issued at discount Issued at premium Issued at premium & discount b. Journalize the issuance of bond B on April 1, 2018. View transaction list Journal entry worksheet < Record the Issuance of bonds at a discount. Note: Enter debits before credits. Date April 01, 2018 General Journal Debit Credit c. What is the contract interest rate for the issue bond B? Contract interest rate d. Interest of how much is paid how often for bond B issued? Interest paid e. What is the term of bond B issue? Term of each bond issue year term f. Show how bond B would appear on the balance sheet under non-current liabilities at July 31, 2026. Balance Sheet (Partial) Non-current liablities g. Calculate the bond B interest expense that would appear on the income statement for the year ended July 31, 2027. Total bond interest expense h. Independent of (a) through (g), assume that bond B issues was retired on December 1, 2027, at 97. Record the entries.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started