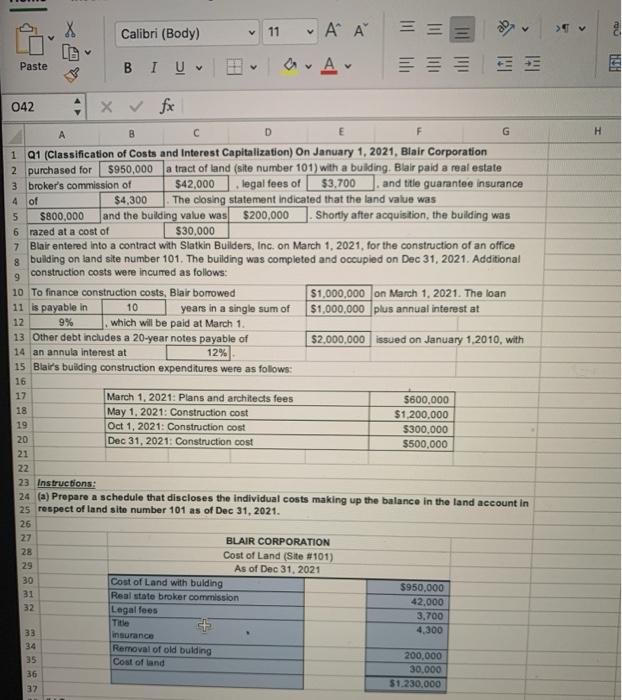

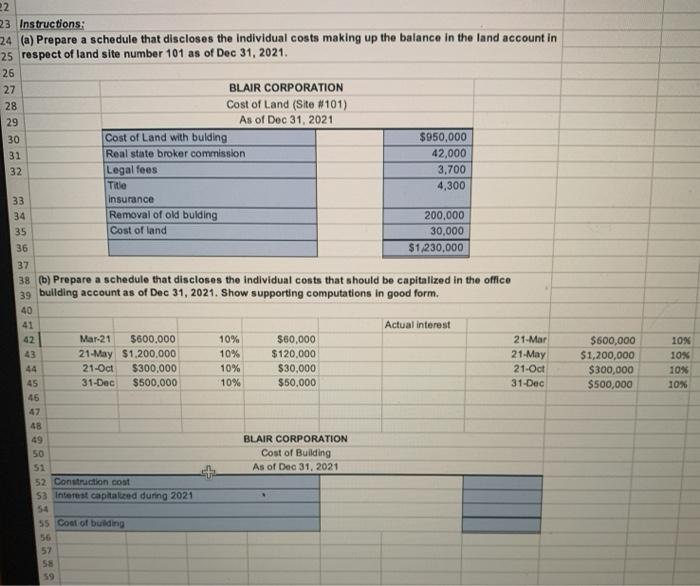

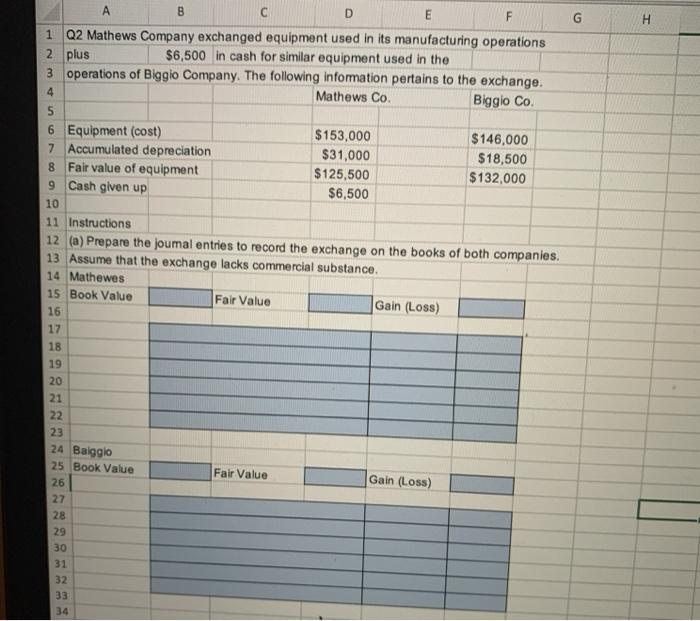

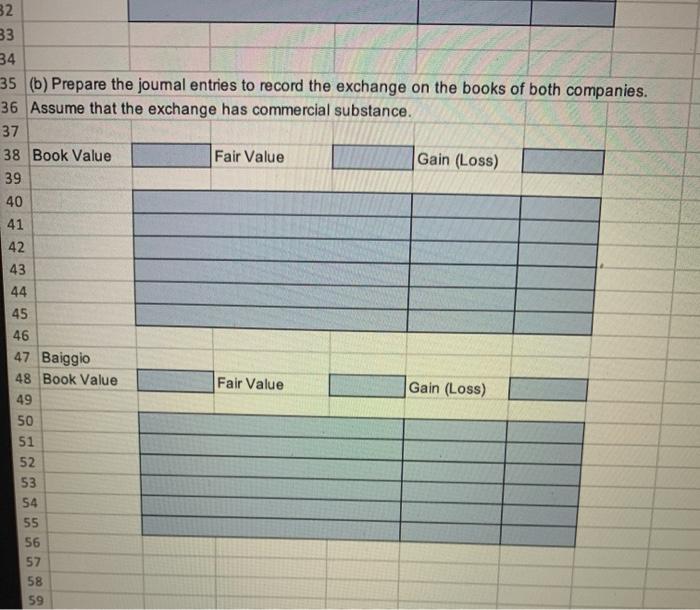

X Calibri (Body) v 11 ' ' OD C Paste BIU v a. Av 042 H B D G 1 Q1 (Classification of Costs and Interest Capitalization) On January 1, 2021, Blair Corporation 2 purchased for $950,000 atract of land (site number 101) with a building. Blair paid a real estate 3 broker's commission of $42.000 legal fees of $3.700 and title guarantee insurance 4 of $4,300 The closing statement indicated that the land value was 5 $800,000 and the building value was $200,000 Shortly after acquisition, the building was 6 razed at a cost of $30,000 7 Blair entered into a contract with Slatkin Builders, Inc. on March 1, 2021, for the construction of an office 8 building on land site number 101. The building was completed and occupied on Dec 31, 2021. Additional 9 construction costs were incumed as follows: 10 To finance construction costs, Blair borrowed $1,000,000 on March 1, 2021. The loan 11 is payable in 10 years in a single sum of $1,000,000 plus annual interest at 12 9% which will be paid at March 1. 13 Other debt includes a 20-year notes payable of $2.000.000 issued on January 1,2010, with 14 an annula interest at 12% 15 Blair's building construction expenditures were as follows: 16 17 March 1, 2021: Plans and architects fees $600,000 18 May 1, 2021: Construction cost $1.200.000 19 Oct 1, 2021: Construction cost $300.000 20 Dec 31, 2021: Construction cost $500,000 21 22 23 Instructions: 24 (a) Prepare a schedule that discloses the individual costs making up the balance in the land account in 25 respect of land site number 101 as of Dec 31, 2021. 26 27 BLAIR CORPORATION 28 Cost of Land (Site #101) 29 As of Dec 31, 2021 30 Cost of Land with bulding $950,000 31 Real state broker commission 42,000 32 Legal fees 3,700 Title 33 4,300 insurance 34 Removal of old bulding 35 200,000 Cost of land 30,000 36 $1.230.000 37 22 23 Instructions: 24 (a) Prepare a schedule that discloses the Individual costs making up the balance in the land account in 25 respect of land site number 101 as of Dec 31, 2021. 26 27 BLAIR CORPORATION 28 Cost of Land (Site #101) 29 As of Dec 31, 2021 30 Cost of Land with bulding $950,000 31 Real state broker commission 42,000 32 Legal fees 3,700 Title 4,300 33 insurance 34 Removal of old bulding 200,000 35 Cost of land 30,000 36 $1,230,000 37 38 (6) Prepare a schedule that discloses the individual costs that should be capitalized in the office 39 bullding account as of Dec 31, 2021. Show supporting computations in good form. 40 41 Actual interest 42 Mar-21 $600,000 10% $60,000 21-Mar 21-May $1.200.000 10% $120,000 21-May 44 21-Oct $300,000 10% $30,000 21-Oct 45 31-Dec $500.000 10% $50,000 31-Dec 46 47 $600,000 $1,200,000 $300,000 $500,000 10% 10% 10% 10% 50 51 BLAIR CORPORATION Cost of Building As of Dec 31, 2021 52 Construction cost 53 Interest capitakzed during 2021 55 Coot of building 56 57 58 G H A B D E F 1 Q2 Mathews Company exchanged equipment used in its manufacturing operations 2 plus $6,500 in cash for similar equipment used in the 3 operations of Biggio Company. The following information pertains to the exchange. 4 Mathews Co. Biggio Co. 5 6 Equipment (cost) $153,000 $146,000 7 Accumulated depreciation $31,000 $18,500 8 Fair value of equipment $125,500 $132,000 9 Cash given up $6,500 10 11 Instructions 12 (a) Prepare the joumal entries to record the exchange on the books of both companies. 13 Assume that the exchange lacks commercial substance. 14 Mathewes 15 Book Value Fair Value Gain (LOSS) 16 17 18 19 20 21 22 23 24 Baiggio 25 Book Value Fair Value 26 27 28 29 30 31 32 33 34 Gain (Loss) 32 33 34 35 (b) Prepare the joumal entries to record the exchange on the books of both companies. 36 Assume that the exchange has commercial substance. 37 38 Book Value Fair Value Gain (Loss) 39 40 41 42 43 44 45 46 47 Baiggio 48 Book Value Fair Value Gain (Loss) 49 50 51 52 53 54 55 56 57 58 59 X Calibri (Body) v 11 ' ' OD C Paste BIU v a. Av 042 H B D G 1 Q1 (Classification of Costs and Interest Capitalization) On January 1, 2021, Blair Corporation 2 purchased for $950,000 atract of land (site number 101) with a building. Blair paid a real estate 3 broker's commission of $42.000 legal fees of $3.700 and title guarantee insurance 4 of $4,300 The closing statement indicated that the land value was 5 $800,000 and the building value was $200,000 Shortly after acquisition, the building was 6 razed at a cost of $30,000 7 Blair entered into a contract with Slatkin Builders, Inc. on March 1, 2021, for the construction of an office 8 building on land site number 101. The building was completed and occupied on Dec 31, 2021. Additional 9 construction costs were incumed as follows: 10 To finance construction costs, Blair borrowed $1,000,000 on March 1, 2021. The loan 11 is payable in 10 years in a single sum of $1,000,000 plus annual interest at 12 9% which will be paid at March 1. 13 Other debt includes a 20-year notes payable of $2.000.000 issued on January 1,2010, with 14 an annula interest at 12% 15 Blair's building construction expenditures were as follows: 16 17 March 1, 2021: Plans and architects fees $600,000 18 May 1, 2021: Construction cost $1.200.000 19 Oct 1, 2021: Construction cost $300.000 20 Dec 31, 2021: Construction cost $500,000 21 22 23 Instructions: 24 (a) Prepare a schedule that discloses the individual costs making up the balance in the land account in 25 respect of land site number 101 as of Dec 31, 2021. 26 27 BLAIR CORPORATION 28 Cost of Land (Site #101) 29 As of Dec 31, 2021 30 Cost of Land with bulding $950,000 31 Real state broker commission 42,000 32 Legal fees 3,700 Title 33 4,300 insurance 34 Removal of old bulding 35 200,000 Cost of land 30,000 36 $1.230.000 37 22 23 Instructions: 24 (a) Prepare a schedule that discloses the Individual costs making up the balance in the land account in 25 respect of land site number 101 as of Dec 31, 2021. 26 27 BLAIR CORPORATION 28 Cost of Land (Site #101) 29 As of Dec 31, 2021 30 Cost of Land with bulding $950,000 31 Real state broker commission 42,000 32 Legal fees 3,700 Title 4,300 33 insurance 34 Removal of old bulding 200,000 35 Cost of land 30,000 36 $1,230,000 37 38 (6) Prepare a schedule that discloses the individual costs that should be capitalized in the office 39 bullding account as of Dec 31, 2021. Show supporting computations in good form. 40 41 Actual interest 42 Mar-21 $600,000 10% $60,000 21-Mar 21-May $1.200.000 10% $120,000 21-May 44 21-Oct $300,000 10% $30,000 21-Oct 45 31-Dec $500.000 10% $50,000 31-Dec 46 47 $600,000 $1,200,000 $300,000 $500,000 10% 10% 10% 10% 50 51 BLAIR CORPORATION Cost of Building As of Dec 31, 2021 52 Construction cost 53 Interest capitakzed during 2021 55 Coot of building 56 57 58 G H A B D E F 1 Q2 Mathews Company exchanged equipment used in its manufacturing operations 2 plus $6,500 in cash for similar equipment used in the 3 operations of Biggio Company. The following information pertains to the exchange. 4 Mathews Co. Biggio Co. 5 6 Equipment (cost) $153,000 $146,000 7 Accumulated depreciation $31,000 $18,500 8 Fair value of equipment $125,500 $132,000 9 Cash given up $6,500 10 11 Instructions 12 (a) Prepare the joumal entries to record the exchange on the books of both companies. 13 Assume that the exchange lacks commercial substance. 14 Mathewes 15 Book Value Fair Value Gain (LOSS) 16 17 18 19 20 21 22 23 24 Baiggio 25 Book Value Fair Value 26 27 28 29 30 31 32 33 34 Gain (Loss) 32 33 34 35 (b) Prepare the joumal entries to record the exchange on the books of both companies. 36 Assume that the exchange has commercial substance. 37 38 Book Value Fair Value Gain (Loss) 39 40 41 42 43 44 45 46 47 Baiggio 48 Book Value Fair Value Gain (Loss) 49 50 51 52 53 54 55 56 57 58 59