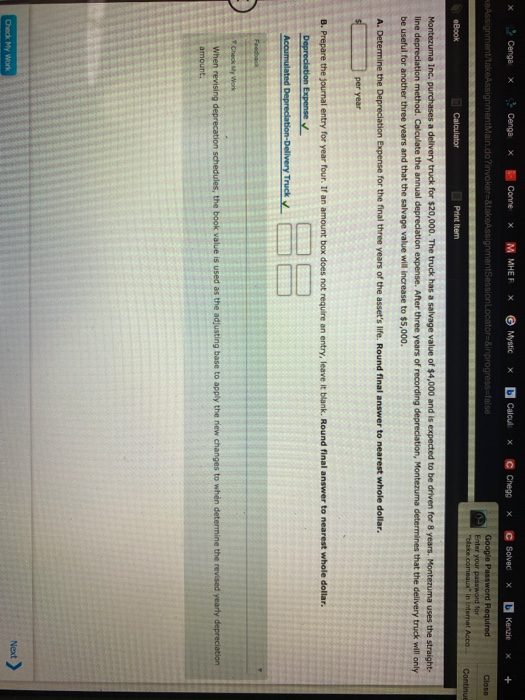

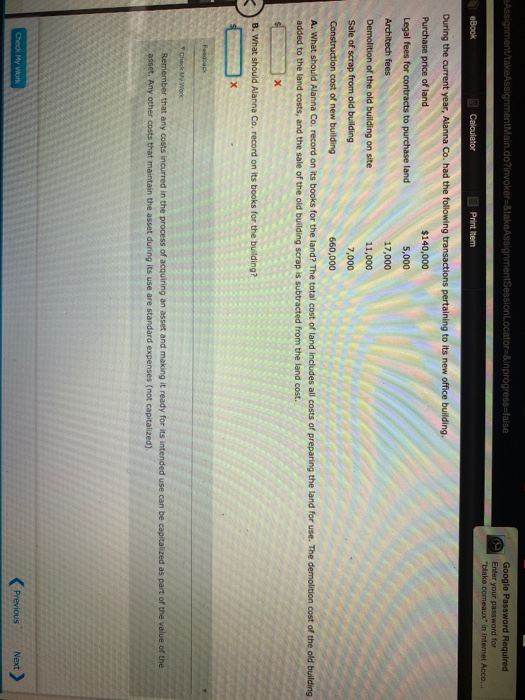

X Cange X C enga X ConneX M MHERX Mystic X Calcul Chege X C Solved Karcie X + KeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSession Locator=&inprogress=false Close Google Password Required Enter your password for blake come in Internet Acco... Continue eBook Calculator Print Item Montezuma Inc. purchases a delivery truck for $20,000. The truck has a salvage value of $4,000 and is expected to be driven for 8 years. Montezuma uses the straight- line depreciation method. Calculate the annual depreciation expense. After three years of recording depreciation, Montezuma determines that the delivery truck will only be useful for another three years and that the salvage value will increase to $5,000. A. Determine the Depreciation Expense for the final three years of the asset's life. Round final answer to nearest whole dollar. B. Prepare the journal entry for year four. If an amount box does not require an entry, leave it blank. Round final answer to nearest whole dollar. Depreciation Expense Accumulated Depreciation Delivery Truck Check My Work When revising deprecation schedules, the book value is used as the adjusting base to apply the new changes to when determine the revised yearly depreciation amount. Check My Work Next Assignment/takeAssignmentMain.do?invoker=&takeAssignmentSession Locator=&inprogress=false Google Password Required Enter your password for blake.comeaux in Internet Acco... eBook Calculator Print item During the current year, Alanna Co. had the following transactions pertaining to its new office building. Purchase price of land $140,000 Legal fees for contracts to purchase land 5,000 Architech fees 17,000 Demolition of the old building on site 11,000 Sale of scrap from old building Construction cost of new building A. What should Alanna Co. record on its books for the land? The total cost of land includes all costs of preparing the land for use. The demolition cost of the old building added to the land costs, and the sale of the old building scrap is subtracted from the land cost. SX B. What should Alanna Co. record on its books for the building? Feedback Check My Work Remember that any costs incurred in the process of acquiring an asset and making it ready for its intended use can be capitalized as part of the value of the asset. Any other costs that maintain the asset during its use are standard expenses (not capitalized). Check My Work Previous Next > X Cange X C enga X ConneX M MHERX Mystic X Calcul Chege X C Solved Karcie X + KeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSession Locator=&inprogress=false Close Google Password Required Enter your password for blake come in Internet Acco... Continue eBook Calculator Print Item Montezuma Inc. purchases a delivery truck for $20,000. The truck has a salvage value of $4,000 and is expected to be driven for 8 years. Montezuma uses the straight- line depreciation method. Calculate the annual depreciation expense. After three years of recording depreciation, Montezuma determines that the delivery truck will only be useful for another three years and that the salvage value will increase to $5,000. A. Determine the Depreciation Expense for the final three years of the asset's life. Round final answer to nearest whole dollar. B. Prepare the journal entry for year four. If an amount box does not require an entry, leave it blank. Round final answer to nearest whole dollar. Depreciation Expense Accumulated Depreciation Delivery Truck Check My Work When revising deprecation schedules, the book value is used as the adjusting base to apply the new changes to when determine the revised yearly depreciation amount. Check My Work Next Assignment/takeAssignmentMain.do?invoker=&takeAssignmentSession Locator=&inprogress=false Google Password Required Enter your password for blake.comeaux in Internet Acco... eBook Calculator Print item During the current year, Alanna Co. had the following transactions pertaining to its new office building. Purchase price of land $140,000 Legal fees for contracts to purchase land 5,000 Architech fees 17,000 Demolition of the old building on site 11,000 Sale of scrap from old building Construction cost of new building A. What should Alanna Co. record on its books for the land? The total cost of land includes all costs of preparing the land for use. The demolition cost of the old building added to the land costs, and the sale of the old building scrap is subtracted from the land cost. SX B. What should Alanna Co. record on its books for the building? Feedback Check My Work Remember that any costs incurred in the process of acquiring an asset and making it ready for its intended use can be capitalized as part of the value of the asset. Any other costs that maintain the asset during its use are standard expenses (not capitalized). Check My Work Previous Next >