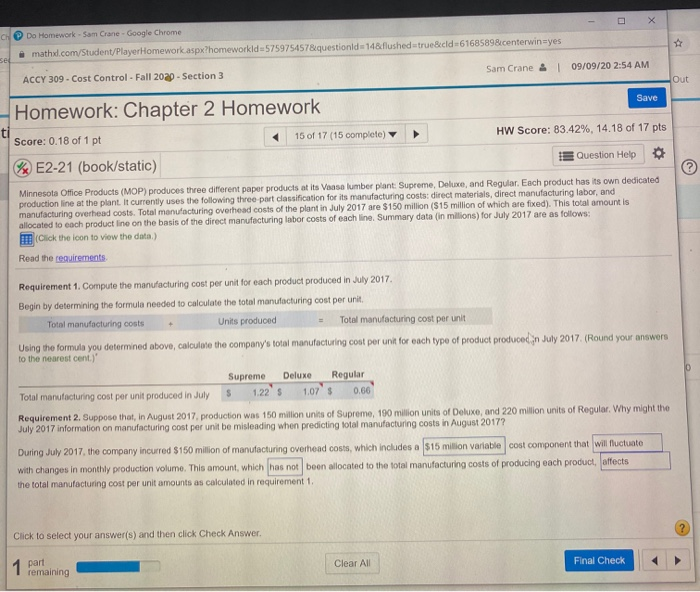

X CH Do Homework - Sam Crane - Google Chrome .math.com/Student/PlayerHomework aspx?homework d=575975457&questionid=14&flushed=true&cid=61685898.centerwin-yes sel Sam Crane 09/09/20 2:54 AM ACCY 309 - Cost Control - Fall 2020 - Section 3 Out Save Homework: Chapter 2 Homework Score: 0.18 of 1 pt 15 of 17 (15 complete) HW Score: 83.42%, 14.18 of 17 pts %E2-21 (book/static) Question Help Minnesota Office Products (MOP) produces three different paper products at its Vase lumber plant Supreme, Deluxe, and Regular. Each product has its own dedicated production line at the plant. It currently uses the following three part classification for its manufacturing costs: direct materials, direct manufacturing labor, and manufacturing overhead costs. Total manufacturing overhead costs of the plant in July 2017 are $150 million (S15 million of which are fixed). This total amount is allocated to each product line on the basis of the direct manufacturing labor costs of each line. Summary data (in millions) for July 2017 are as follows: Click the loon to view the data) Read the requirements Requirement 1. Compute the manufacturing cost per unit for each product produced in July 2017 Begin by determining the formule needed to calculate the total manufacturing cost per unit Total manufacturing costs Units produced Total manufacturing cost per unit Using the formula you determined above, calculate the company's total manufacturing cost per unit for each type of product produced in July 2017 (Round your answers to the nearest cent.) Supreme Deluxe Regular Total manufacturing cost per unit produced in July S 1.22's 1.07 0.66 Requirement 2. Suppose that, in August 2017. production was 150 million units of Supreme, 190 milion units of Deluxe, and 220 million units of Regular. Why might the July 2017 information on manufacturing cost per unit be misleading when predicting total manufacturing costs in August 2017? During July 2017, the company incurred $150 million of manufacturing overhead costs, which includes a $15 milion variable cost component that will fluctuato with changes in monthly production volume. This amount, which has not been allocated to the total manufacturing costs of producing each product, affects the total manufacturing cost per unit amounts as calculated in requirement 1. Click to select your answer(s) and then click Check Answer 1 Final Check part remaining Clear All X CH Do Homework - Sam Crane - Google Chrome .math.com/Student/PlayerHomework aspx?homework d=575975457&questionid=14&flushed=true&cid=61685898.centerwin-yes sel Sam Crane 09/09/20 2:54 AM ACCY 309 - Cost Control - Fall 2020 - Section 3 Out Save Homework: Chapter 2 Homework Score: 0.18 of 1 pt 15 of 17 (15 complete) HW Score: 83.42%, 14.18 of 17 pts %E2-21 (book/static) Question Help Minnesota Office Products (MOP) produces three different paper products at its Vase lumber plant Supreme, Deluxe, and Regular. Each product has its own dedicated production line at the plant. It currently uses the following three part classification for its manufacturing costs: direct materials, direct manufacturing labor, and manufacturing overhead costs. Total manufacturing overhead costs of the plant in July 2017 are $150 million (S15 million of which are fixed). This total amount is allocated to each product line on the basis of the direct manufacturing labor costs of each line. Summary data (in millions) for July 2017 are as follows: Click the loon to view the data) Read the requirements Requirement 1. Compute the manufacturing cost per unit for each product produced in July 2017 Begin by determining the formule needed to calculate the total manufacturing cost per unit Total manufacturing costs Units produced Total manufacturing cost per unit Using the formula you determined above, calculate the company's total manufacturing cost per unit for each type of product produced in July 2017 (Round your answers to the nearest cent.) Supreme Deluxe Regular Total manufacturing cost per unit produced in July S 1.22's 1.07 0.66 Requirement 2. Suppose that, in August 2017. production was 150 million units of Supreme, 190 milion units of Deluxe, and 220 million units of Regular. Why might the July 2017 information on manufacturing cost per unit be misleading when predicting total manufacturing costs in August 2017? During July 2017, the company incurred $150 million of manufacturing overhead costs, which includes a $15 milion variable cost component that will fluctuato with changes in monthly production volume. This amount, which has not been allocated to the total manufacturing costs of producing each product, affects the total manufacturing cost per unit amounts as calculated in requirement 1. Click to select your answer(s) and then click Check Answer 1 Final Check part remaining Clear All