Question

X Company currently buys a part from a supplier for $13.29 per unit but is considering making the part itself next year. This year, they

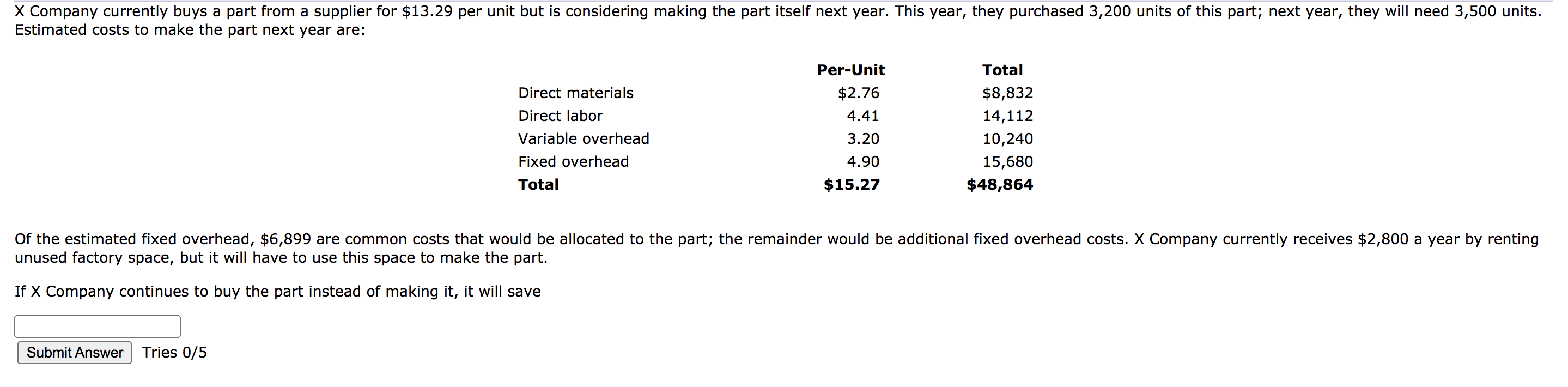

X Company currently buys a part from a supplier for $13.29 per unit but is considering making the part itself next year. This year, they purchased 3,200 units of this part; next year, they will need 3,500 units. Estimated costs to make the part next year are:

X Company currently buys a part from a supplier for $13.29 per unit but is considering making the part itself next year. This year, they purchased 3,200 units of this part; next year, they will need 3,500 units. Estimated costs to make the part next year are:

Of the estimated fixed overhead, $6,899 are common costs that would be allocated to the part; the remainder would be additional fixed overhead costs. X Company currently receives $2,800 a year by renting unused factory space, but it will have to use this space to make the part.

| Per-Unit | Total | ||

| Direct materials | $2.76 | $8,832 | |

| Direct labor | 4.41 | 14,112 | |

| Variable overhead | 3.20 | 10,240 | |

| Fixed overhead | 4.90 | 15,680 | |

| Total | $15.27 | $48,864 | |

If X Company continues to buy the part instead of making it, it will save

X Company currently buys a part from a supplier for $13.29 per unit but is considering making the part itself next year. This year, they purchased 3,200 units of this part; next year, they will need 3,500 units. Estimated costs to make the part next year are: Direct materials Direct labor Variable overhead Fixed overhead Total Per-Unit $2.76 4.41 3.20 4.90 $15.27 Total $8,832 14,112 10,240 15,680 $48,864 Of the estimated fixed overhead, $6,899 are common costs that would be allocated to the part; the remainder would be additional fixed overhead costs. X Company currently receives $2,800 a year by renting unused factory space, but it will have to use this space to make the part. If X Company continues to buy the part instead of making it, it will save Submit Answer Tries 0/5Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started