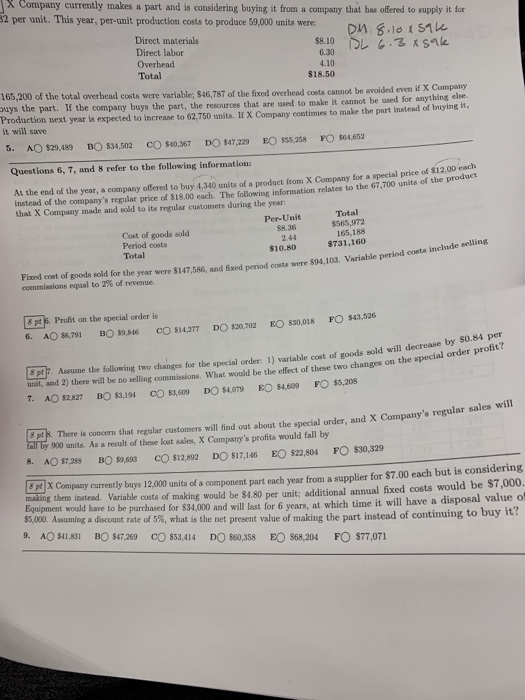

X Company currently makes a part and is considering buying it from a company that has offered to supply it for %2 per unit. This year, per-unit production costs to produce 59,00 units were D s.lo 1 Direct materials Direct labor Overbead Total 6.30 4.10 $18.50 al overbead costs were variable; $46,787 of the fixed overhead costs cannot be avoided even if X Company uys the part. If the company buys the part, the resources that are used to make it cannot be used for anything ele action next year is expected to increase to 62,750 units. If X Company contimues to make the part instead of buying it, it will save 5. AO $29,489 BO $34,502 CO s40,367 DO S47,229 EO $5.258 FO $64 652 Questions 6,7, and 8 refer to the following information: At the end of the year, a company offered to buy 4,340 units of a product from X Company for a special price of $12.00 each instead of the company's regular price of $18.00 each. The following information relates to the 67,700 units that X Company made and sold to its regular customers during the year of the product Per-Unit 88.36 Total $565,972 Cost of goods sold Period costs Total 165,188 244 $10.80 $731,160 the year were $147,586, and fixed period costs were $94,103. Variable period costs include selling commissions equal to 2% of revenue. 8 pt 6. Profit on the special order is 6. AO $6,791 BO 9,86 CO $14.277 DO $20,702 E 30,018 FO $43,326 pdr. Asume the following two chainges for the special order: 1) variable cost of goods sold wi 8 pt . Assume the unst, and 2) there will be no selling commissions. What would be the effect of these two changes on will pt. There is concern that regular customers will find oat about the special order, and X Company's regu 8. AO s7,288 BOS 9,693 $12,892 DO $17,146 EO $22,804 FO$30,329 p X Compazy currently buys 12,000 units of a component part each year from a supplier for $7.00 each but is considering 900 units. As a result of these lost sales, X Company's profits would fall by g them instead. Variable costs of making would be $4.80 per unit; additional annual fixed costs would be $7,000. to be parchased for $34,000 and will last for 6 years, at which time it will have a disposal value of $5,000 Assuming a discount rate of 5%, what is the net present value of making the part instead of continuing to buy it 9. AO $41,831 BO 47,269 CO 53,414 DO $60,358 EO $68,204 FO $77,071