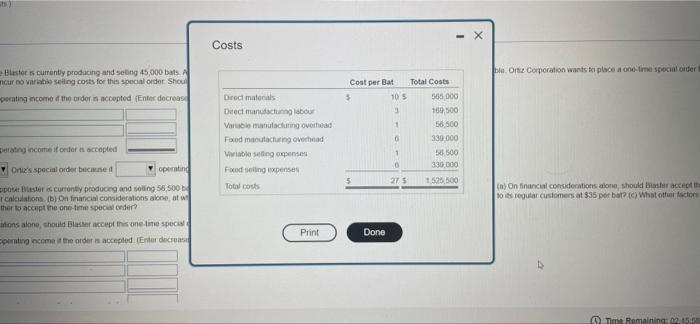

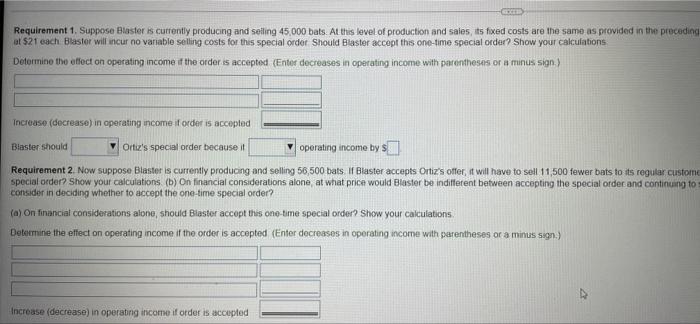

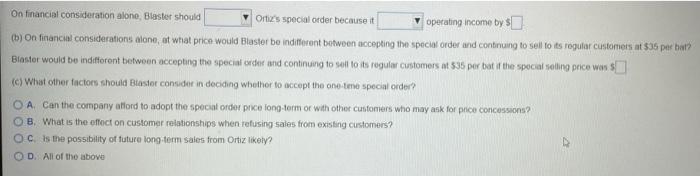

- X Costs Ort Corporation wants to place a one-time special order Bester is currently producing and selling 45,000 bats nur no variable selling costs for this special order Shou perating income of the order is accepted (Enter decrease Direct matons Dect manatacung labour Viru manufacturing overhead Faxed tacturing overhead Viable singaponses Food sing expenses Coat per Bar Total Costs 10 5 565 000 100.000 1 58.500 330.000 1 55.500 330.000 275 1.525,500 Total costs getting income order is accepted One's special order because it operatind post viester is current producing and selling 56 500 calculations by On financial considerations alone at w ther to accept the one time special order? itions alone should Blaster accept this one time special penting come the order is accepted Enter decrease (a) on financial considerations alone should be accept los rogular customers at $35 per bar) What other factors Print Done Time Remaining 0245 Requirement 1. Suppose Blaster is currently producing and selling 45,000 bats. At this level of production and sales, its fixed costs are the same as provided in the preceding at $2 each Blaster will incur no variable selling costs for this special order Should Blaster accept this one-time special order? Show your calculations Determine the effect on operating income if the order is accepted (Enter decreases in operating income with parentheses or a minus sign) Increase (decrease) in operating income if order is accepted Blaster should Ortiz's special order because it operating income by $ Requirement 2. Now suppose Blaster is currently produong and selling 56,500 bats | Blaster accepts Ortizis offer, it will have to sell 11,500 fewer bats to its regular custome special order? Show your calculations (b) On financial considerations alone, at what price would Blaster be indifferent between accepting the special order and continuing to consider in deciding whether to accept the one-time special order? (a) on financial considerations alone, should Blaster accept this one-time special order? Show your calculations Determine the effect on operating income if the order is accepted (Enter decreases in operating income with parentheses or a minus sign.) Increase (decreaso) in operating income if order is accepted On financial consideration alone, Blaster should Ortiz's special order because it operating income by $ (6) on financial considerations alone, at what price would Blaster be indifferent between accepting the special order and continuing to sell to its regular customers at $36 per bal Blaster would be indifferent between accepting the special cher and continung to soil to its regular customers at 335 per bat if the special selling price words ] (c) What other factors should Blaster consider in deciding whether to accept the one time special order? O A Can the company atford to adopt the special order price long-term or with other customers who may ask for price concessions? OB. What is the effect on customer relationships when refusing sales from existing customers? Oc is the possibility of future long term sales from Ortiz likely D. All of the above - X Costs Ort Corporation wants to place a one-time special order Bester is currently producing and selling 45,000 bats nur no variable selling costs for this special order Shou perating income of the order is accepted (Enter decrease Direct matons Dect manatacung labour Viru manufacturing overhead Faxed tacturing overhead Viable singaponses Food sing expenses Coat per Bar Total Costs 10 5 565 000 100.000 1 58.500 330.000 1 55.500 330.000 275 1.525,500 Total costs getting income order is accepted One's special order because it operatind post viester is current producing and selling 56 500 calculations by On financial considerations alone at w ther to accept the one time special order? itions alone should Blaster accept this one time special penting come the order is accepted Enter decrease (a) on financial considerations alone should be accept los rogular customers at $35 per bar) What other factors Print Done Time Remaining 0245 Requirement 1. Suppose Blaster is currently producing and selling 45,000 bats. At this level of production and sales, its fixed costs are the same as provided in the preceding at $2 each Blaster will incur no variable selling costs for this special order Should Blaster accept this one-time special order? Show your calculations Determine the effect on operating income if the order is accepted (Enter decreases in operating income with parentheses or a minus sign) Increase (decrease) in operating income if order is accepted Blaster should Ortiz's special order because it operating income by $ Requirement 2. Now suppose Blaster is currently produong and selling 56,500 bats | Blaster accepts Ortizis offer, it will have to sell 11,500 fewer bats to its regular custome special order? Show your calculations (b) On financial considerations alone, at what price would Blaster be indifferent between accepting the special order and continuing to consider in deciding whether to accept the one-time special order? (a) on financial considerations alone, should Blaster accept this one-time special order? Show your calculations Determine the effect on operating income if the order is accepted (Enter decreases in operating income with parentheses or a minus sign.) Increase (decreaso) in operating income if order is accepted On financial consideration alone, Blaster should Ortiz's special order because it operating income by $ (6) on financial considerations alone, at what price would Blaster be indifferent between accepting the special order and continuing to sell to its regular customers at $36 per bal Blaster would be indifferent between accepting the special cher and continung to soil to its regular customers at 335 per bat if the special selling price words ] (c) What other factors should Blaster consider in deciding whether to accept the one time special order? O A Can the company atford to adopt the special order price long-term or with other customers who may ask for price concessions? OB. What is the effect on customer relationships when refusing sales from existing customers? Oc is the possibility of future long term sales from Ortiz likely D. All of the above