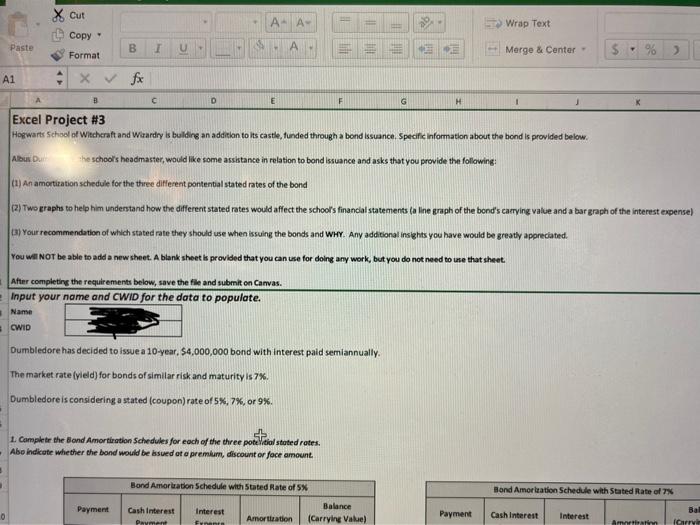

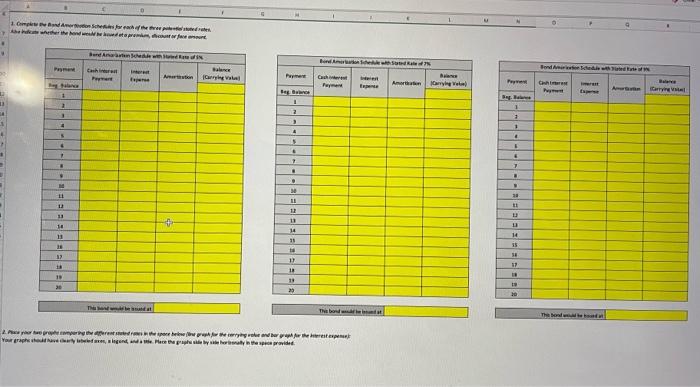

X Cut Copy AAA- Wrap Text Paste B 1 Format Mergo & Center % ) A1 x V fx B D E F G H Excel Project #3 Hogwarts School of Witchcraft and Wizardry is building an addition to its castle, funded through a bond issuance Specific information about the bond is provided below. Albus Du the school's headmaster, would like some assistance in relation to bond issuance and asks that you provide the following 1) An amortization schedule for the three different pontential stated rates of the bond (2) Two praphs to help him understand how the different stated rates would affect the school's financial statements (a Ine graph of the bond's carrying value and a bar graph of the interest expense) Lay Your recommendation of which stated rate they should use when issuing the bonds and WHY. Any additional insights you have would be greatly appreciated. You will not be able to add a new sheet. A blank sheet is provided that you can use for doing any work, but you do not need to use that sheet. After completing the requirements below, save the file and submit on Canvas. = Input your name and CWID for the data to populate. Name CWID Dumbledore has decided to issue a 10-year, $4,000,000 bond with interest paid semiannually. The market rate (yleld) for bonds of similar risk and maturity is 7%. Dumbledore is considering stated (coupon) rate of 5%,7%, 0f9%. 1. Complete the Blond Amortiration Schedules for each of the three policial stated rates. Abo indicate whether the band would be issued at a premium, discount or face amount Bond Amoration Schedule with stated Rate of SX Bond Amortation Schedule with stated Rate of 7 Payment 0 Cash Interest Payment Interest Finants Balance (Carrying Value) Amortization Payment Cash Interest Interest Bal CUT Art alterna Nala Cashier Per Anton areenai | B Antenaryo Pr| Galler N ta T F 1 2 1 4 1 4 1 # 1 . 1 8 7 4 7 . - . M . TE TU 12 11 11 12 13 13 11 18 17 14 14 NE TS ta 17 12 18 29 1 SE - 20 Tata Thanlal Thailanial rahe pape item , Hence X Cut Copy AAA- Wrap Text Paste B 1 Format Mergo & Center % ) A1 x V fx B D E F G H Excel Project #3 Hogwarts School of Witchcraft and Wizardry is building an addition to its castle, funded through a bond issuance Specific information about the bond is provided below. Albus Du the school's headmaster, would like some assistance in relation to bond issuance and asks that you provide the following 1) An amortization schedule for the three different pontential stated rates of the bond (2) Two praphs to help him understand how the different stated rates would affect the school's financial statements (a Ine graph of the bond's carrying value and a bar graph of the interest expense) Lay Your recommendation of which stated rate they should use when issuing the bonds and WHY. Any additional insights you have would be greatly appreciated. You will not be able to add a new sheet. A blank sheet is provided that you can use for doing any work, but you do not need to use that sheet. After completing the requirements below, save the file and submit on Canvas. = Input your name and CWID for the data to populate. Name CWID Dumbledore has decided to issue a 10-year, $4,000,000 bond with interest paid semiannually. The market rate (yleld) for bonds of similar risk and maturity is 7%. Dumbledore is considering stated (coupon) rate of 5%,7%, 0f9%. 1. Complete the Blond Amortiration Schedules for each of the three policial stated rates. Abo indicate whether the band would be issued at a premium, discount or face amount Bond Amoration Schedule with stated Rate of SX Bond Amortation Schedule with stated Rate of 7 Payment 0 Cash Interest Payment Interest Finants Balance (Carrying Value) Amortization Payment Cash Interest Interest Bal CUT Art alterna Nala Cashier Per Anton areenai | B Antenaryo Pr| Galler N ta T F 1 2 1 4 1 4 1 # 1 . 1 8 7 4 7 . - . M . TE TU 12 11 11 12 13 13 11 18 17 14 14 NE TS ta 17 12 18 29 1 SE - 20 Tata Thanlal Thailanial rahe pape item , Hence