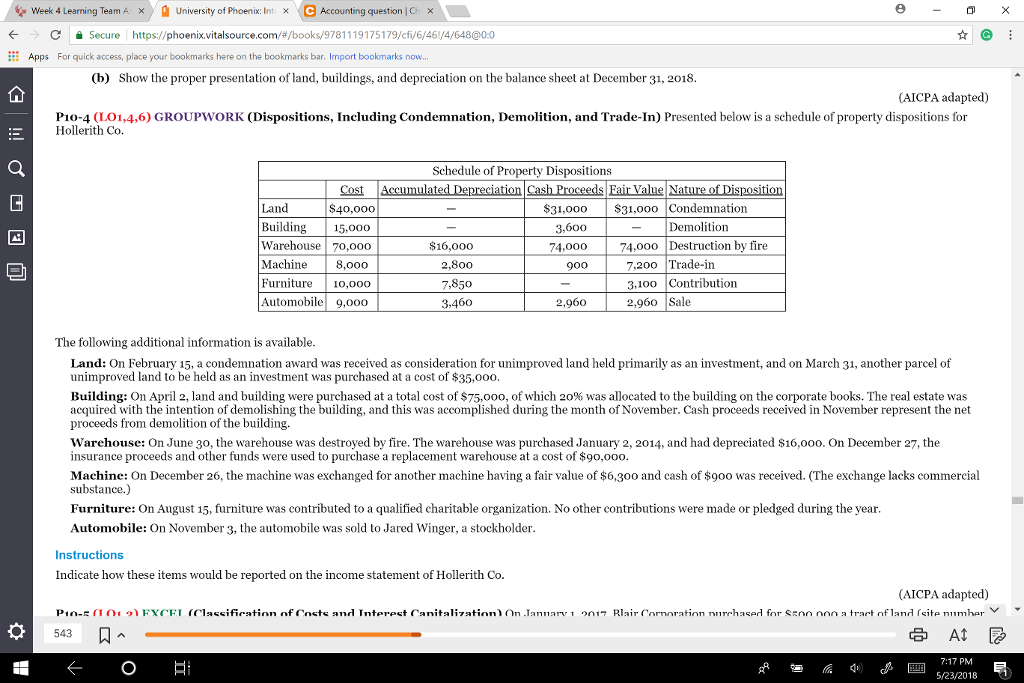

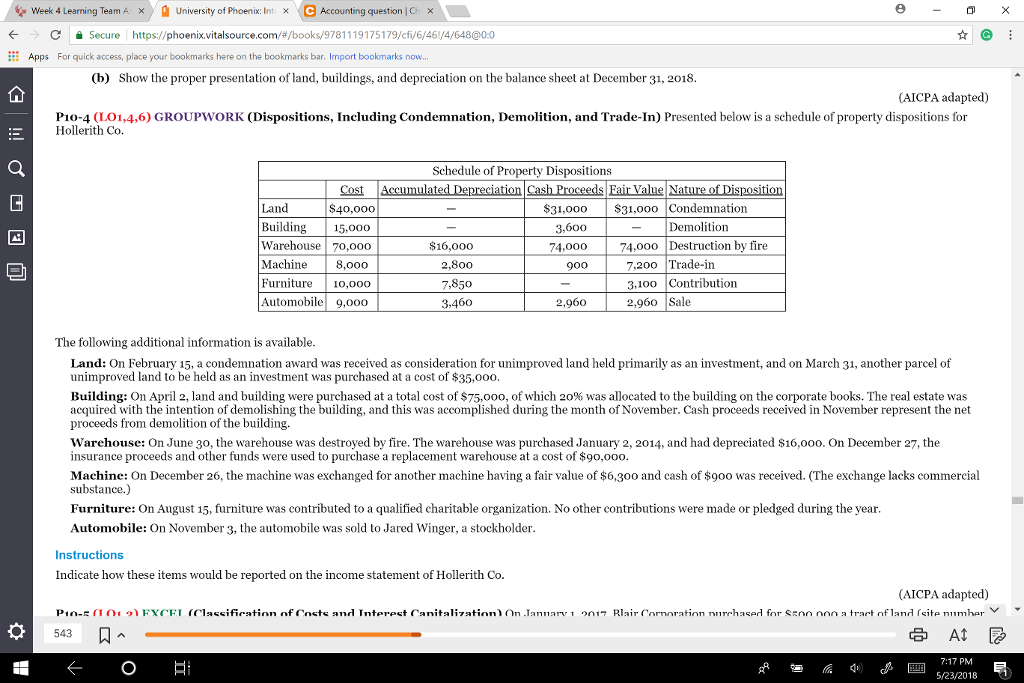

x e Week 4 Learning Team A X A University of Phoenix: Intx Accounting question Chx e - - > C A Secure https://phoenix.vitalsource.com/#/books/9781119175179/cfi/6/46/4/648@0:0 Apps For quick access, place your bookmarks here on the bookmarks bar. Import bookmarks now.. (b) Show the proper presentation of land, buildings, and depreciation on the balance sheet at December 31, 2018. (AICPA adapted) P10-4 (L01,4,6) GROUPWORK (Dispositions, Including Condemnation, Demolition, and Trade-In) Presented below is a schedule of property dispositions for Hollerith Co. EN O O O O Schedule of Property Dispositions Cost Accumulated Depreciation Cash Proceeds Fair Value Nature of Disposition Land $40,000 $31,000 $31,000 Condemnation Building 15,000 3,600 - Demolition Warehouse 70,000 $16,000 74,000 74,000 Destruction by fire Machine 8,000 2,800 900 7,200 Trade-in Furniture 10,000 7,850 3,100 Contribution Automobile 9,000 3,460 2,960 2,960 Sale The following additional information is available. Land: On February 15, a condemnation award was received as consideration for unimproved land held primarily as an investment, and on March 31, another parcel of unimproved land to be held as an investment was purchased at a cost of $35,000. Building: On April 2, land and building were purchased at a total cost of $75,000, of which 20% was allocated to the building on the corporate books. The real estate was acquired with the intention of demolishing the building, and this was accomplished during the month of November. Cash proceeds received in November represent the net proceeds from demolition of the building. Warehouse: On June 30, the warehouse was destroyed by fire. The warehouse was purchased January 2, 2014, and had depreciated $16,000. On December 27, the insurance proceeds and other funds were used to purchase a replacement warehouse at a cost of $90,000. Machine: On December 26, the machine was exchanged for another machine having a fair value of $6,300 and cash of $900 was received. (The exchange lacks commercial substance.) Furniture: On August 15, furniture was contributed to a qualified charitable organization. No other contributions were made or pledged during the year. Automobile: On November 3, the automobile was sold to Jared Winger, a stockholder. Instructions Indicate how these items would be reported on the income statement of Hollerith Co. (AICPA adapted) on a trart of land (site numher V Pio- (1019) EXCEL (Classification of Costs and Interest Canitalization On January 1 2017 Blair Cornoration murrhased for SRO 543 - ? At 2 4 + - B 7:17 PM la ) W 5/23/2018