Answered step by step

Verified Expert Solution

Question

1 Approved Answer

X EQUALS 3 PLEASE SHOW YOUR ALL CALCULATIONS. THANK YOU SO MUCH 1. Pascal Corporation is a supplier of automotive products. Following free cash flows

X EQUALS 3

PLEASE SHOW YOUR ALL CALCULATIONS. THANK YOU SO MUCH

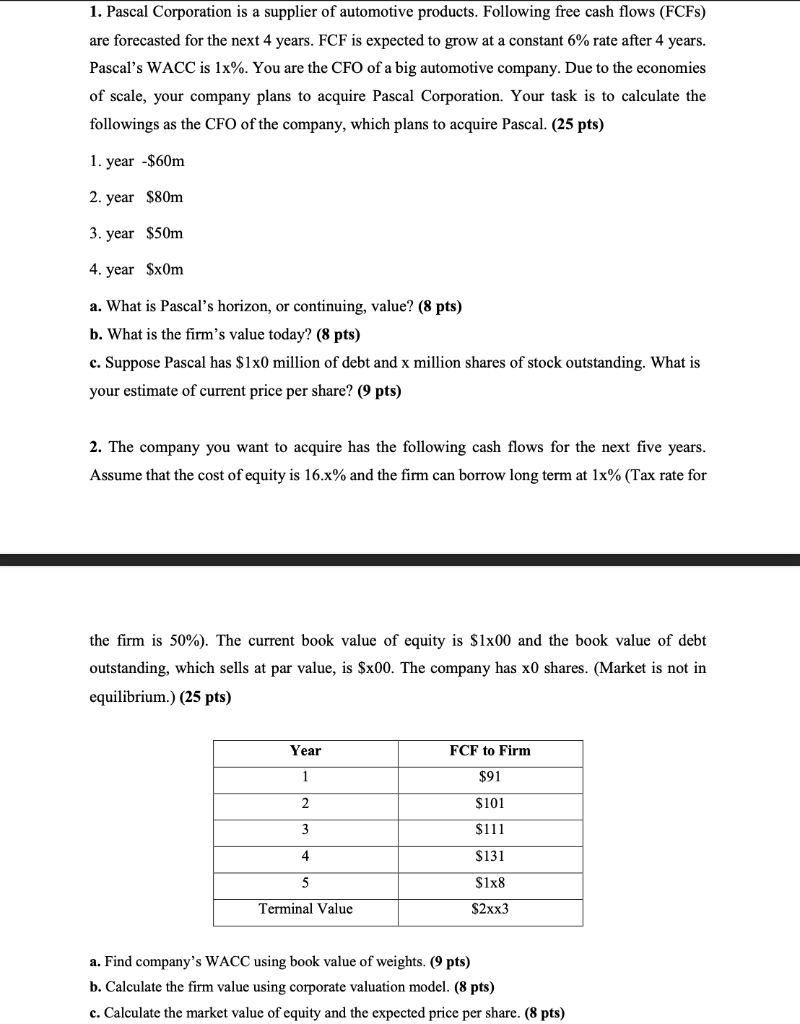

1. Pascal Corporation is a supplier of automotive products. Following free cash flows (FCFS) are forecasted for the next 4 years. FCF is expected to grow at a constant 6% rate after 4 years. Pascal's WACC is 1x%. You are the CFO of a big automotive company. Due to the economies of scale, your company plans to acquire Pascal Corporation. Your task is to calculate the followings as the CFO of the company, which plans to acquire Pascal. (25 pts) 1. year -$60m 2. year $80m 3. year $50m 4. year $xOm a. What is Pascal's horizon, or continuing, value? (8 pts) b. What is the firm's value today? (8 pts) c. Suppose Pascal has $1x0 million of debt and x million shares of stock outstanding. What is your estimate of current price per share? (9 pts) 2. The company you want to acquire has the following cash flows for the next five years. Assume that the cost of equity is 16.x% and the firm can borrow long term at 1x% (Tax rate for the firm is 50%). The current book value of equity is $1x00 and the book value of debt outstanding, which sells at par value, is $x00. The company has x0 shares. (Market is not in equilibrium.) (25 pts) Year FCF to Firm 1 $91 2 $101 3 $111 4 $131 5 $1x8 Terminal Value $2xx3 a. Find company's WACC using book value of weights. (9 pts) b. Calculate the firm value using corporate valuation model. (8 pts) c. Calculate the market value of equity and the expected price per share. (8 pts)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started