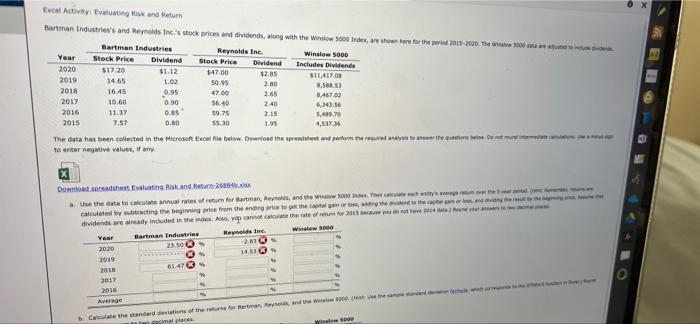

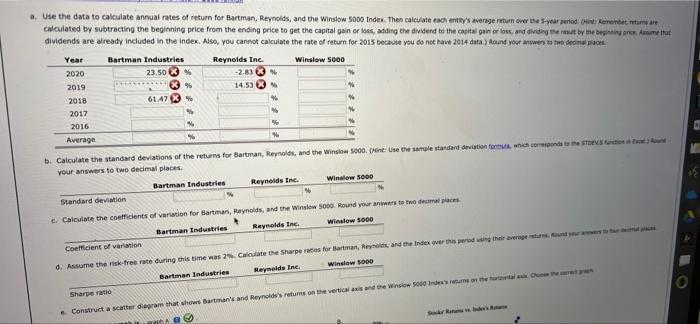

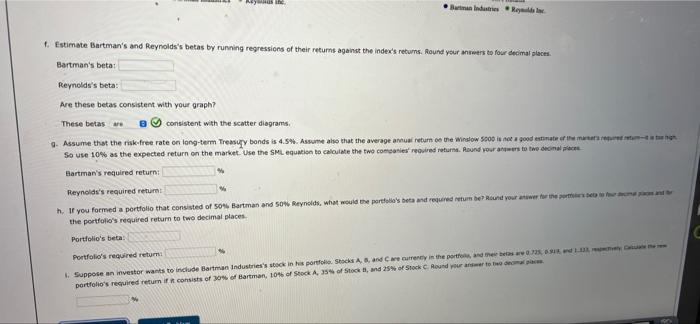

x Excel Activity Evaluating kok w Return Bartman Industries's and Reynolds Inc.'s stock prices and dividends on the Wind 000, where for the per 5-20W Bartman Industries Reynolds Inc. Year Winslow 5000 Stock Price Dividend Stock Price Dividend Includes Dividende 2020 $17.20 $1.12 347.00 $2.85 511,417.05 2019 1.02 50.95 2.00 3.588.53 2018 16.45 0.95 47.00 265 8.467.00 2017 10.60 0.90 56.40 2.40 4.343.56 2016 11.37 0.85 59.75 2.15 549.10 2015 7.57 0.60 55.30 1.95 The data has been collected in the Microsoft Excel e below. Download the spreadsheet and performed a team to enter negative values, if any 1465 Download der Evaluating Risk and Retu26864 Use the data to calculate annual rates of turn for Batman, Reynol, and news There calculated by wbtracting the beginning price from the ending nice to get the growth dividends are already included in the index iso, y canto calculate the rate ofre for 2015 Sete ou do not have to Year Bartman Industries Heynolds Inc Winslow 5000 20.20 23.50 X 2.1 2019 3453 2018 6147 2017 2016 Average Calculate the standard wins of the return artmas the al places OOR a. Use the data to calculate annual rates of return for Bartman, Reynolds, and the Winstow 5000 Index. Then calculate each entity's average retum over the year periodont tumer calculated by subtracting the beginning price from the ending price to get the capital gain or loss, adding the dividend to the capital pain or low, and dividing emut by the beginner dividends are already included in the Index. Also, you cannot calculate the rate of return for 2015 because you do not have 2014 data) Round your answers to the decimal place Year Bartman Industries Reynolds Inc. Winslow 5000 2020 23.50 % -2.89 2019 % 14.53 2018 61.47 Yo 2017 2016 Average b. Calculate the standard deviations of the returns for Bartman, Reynolds, and the Winslow 5000. Mint Use the sample standard deviation for which your answers to two decimal places Bartman Industries Reynolds Inc. Winslow 5000 Standard deviation e. Calculate the coefficients of variation for Bartman, Reynolds, and the Winslow 5000. Round your anwers to two female Bartman Industries Reynolds Inc. Winslow 5000 Coefficient of variation d. Astume the risk tree rate during this time was 2. Calidate the sharpers for Batman, and the Indes verden Bartman Industries Reymelde Inc. Winslow 5000 Sharpe ratio Construct a scatter diagram that shows Batman's and Reynolds's returns on the verticale Winslow 5000 euron the total 1. Estimate Bartman's and Reynolds's betas by running regressions of their returns against the index's returns. Round your answers to four decimal places Bartman's beta Reynolds's beta: Are these betas consistent with your graph? These tetas consistent with the scatter diagrams 9. Assume that the risk-free rate on long-term Treasury bonds is 4.5%. Assume also that the average annual return on the Winslow 5000 is not good estimate of the web So use 10% as the expected return on the market. Use the SMLegution to calculate the two companies' prouired returns. Round your awers to two roma Bartman's required return; Reynolds's required return h. If you formed a portfolio that consisted of son Bartman and son Reynolds, what would the porte beta and required retum be? Rund your wer where the portfolio's required return to two decimal places Portfolio's beta Portfolio's required return 1. Suppose an investor wants to include Bartman Industries's stock in his portfolio Stacks A, and Currently in the port 2 portfolio's required return is consists of os of Bartman, 104 of Stock A, 35% of Stock, and 25 of Stock C. Round your answer to x Excel Activity Evaluating kok w Return Bartman Industries's and Reynolds Inc.'s stock prices and dividends on the Wind 000, where for the per 5-20W Bartman Industries Reynolds Inc. Year Winslow 5000 Stock Price Dividend Stock Price Dividend Includes Dividende 2020 $17.20 $1.12 347.00 $2.85 511,417.05 2019 1.02 50.95 2.00 3.588.53 2018 16.45 0.95 47.00 265 8.467.00 2017 10.60 0.90 56.40 2.40 4.343.56 2016 11.37 0.85 59.75 2.15 549.10 2015 7.57 0.60 55.30 1.95 The data has been collected in the Microsoft Excel e below. Download the spreadsheet and performed a team to enter negative values, if any 1465 Download der Evaluating Risk and Retu26864 Use the data to calculate annual rates of turn for Batman, Reynol, and news There calculated by wbtracting the beginning price from the ending nice to get the growth dividends are already included in the index iso, y canto calculate the rate ofre for 2015 Sete ou do not have to Year Bartman Industries Heynolds Inc Winslow 5000 20.20 23.50 X 2.1 2019 3453 2018 6147 2017 2016 Average Calculate the standard wins of the return artmas the al places OOR a. Use the data to calculate annual rates of return for Bartman, Reynolds, and the Winstow 5000 Index. Then calculate each entity's average retum over the year periodont tumer calculated by subtracting the beginning price from the ending price to get the capital gain or loss, adding the dividend to the capital pain or low, and dividing emut by the beginner dividends are already included in the Index. Also, you cannot calculate the rate of return for 2015 because you do not have 2014 data) Round your answers to the decimal place Year Bartman Industries Reynolds Inc. Winslow 5000 2020 23.50 % -2.89 2019 % 14.53 2018 61.47 Yo 2017 2016 Average b. Calculate the standard deviations of the returns for Bartman, Reynolds, and the Winslow 5000. Mint Use the sample standard deviation for which your answers to two decimal places Bartman Industries Reynolds Inc. Winslow 5000 Standard deviation e. Calculate the coefficients of variation for Bartman, Reynolds, and the Winslow 5000. Round your anwers to two female Bartman Industries Reynolds Inc. Winslow 5000 Coefficient of variation d. Astume the risk tree rate during this time was 2. Calidate the sharpers for Batman, and the Indes verden Bartman Industries Reymelde Inc. Winslow 5000 Sharpe ratio Construct a scatter diagram that shows Batman's and Reynolds's returns on the verticale Winslow 5000 euron the total 1. Estimate Bartman's and Reynolds's betas by running regressions of their returns against the index's returns. Round your answers to four decimal places Bartman's beta Reynolds's beta: Are these betas consistent with your graph? These tetas consistent with the scatter diagrams 9. Assume that the risk-free rate on long-term Treasury bonds is 4.5%. Assume also that the average annual return on the Winslow 5000 is not good estimate of the web So use 10% as the expected return on the market. Use the SMLegution to calculate the two companies' prouired returns. Round your awers to two roma Bartman's required return; Reynolds's required return h. If you formed a portfolio that consisted of son Bartman and son Reynolds, what would the porte beta and required retum be? Rund your wer where the portfolio's required return to two decimal places Portfolio's beta Portfolio's required return 1. Suppose an investor wants to include Bartman Industries's stock in his portfolio Stacks A, and Currently in the port 2 portfolio's required return is consists of os of Bartman, 104 of Stock A, 35% of Stock, and 25 of Stock C. Round your answer to