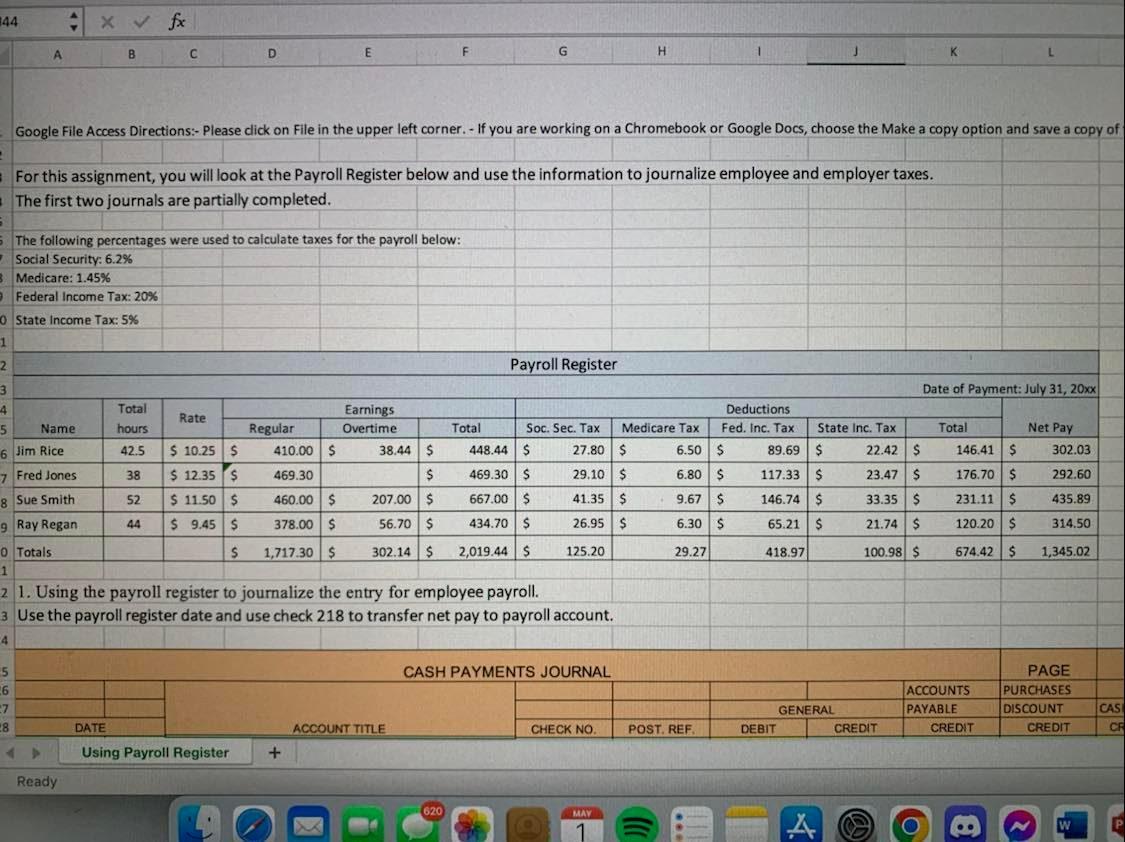

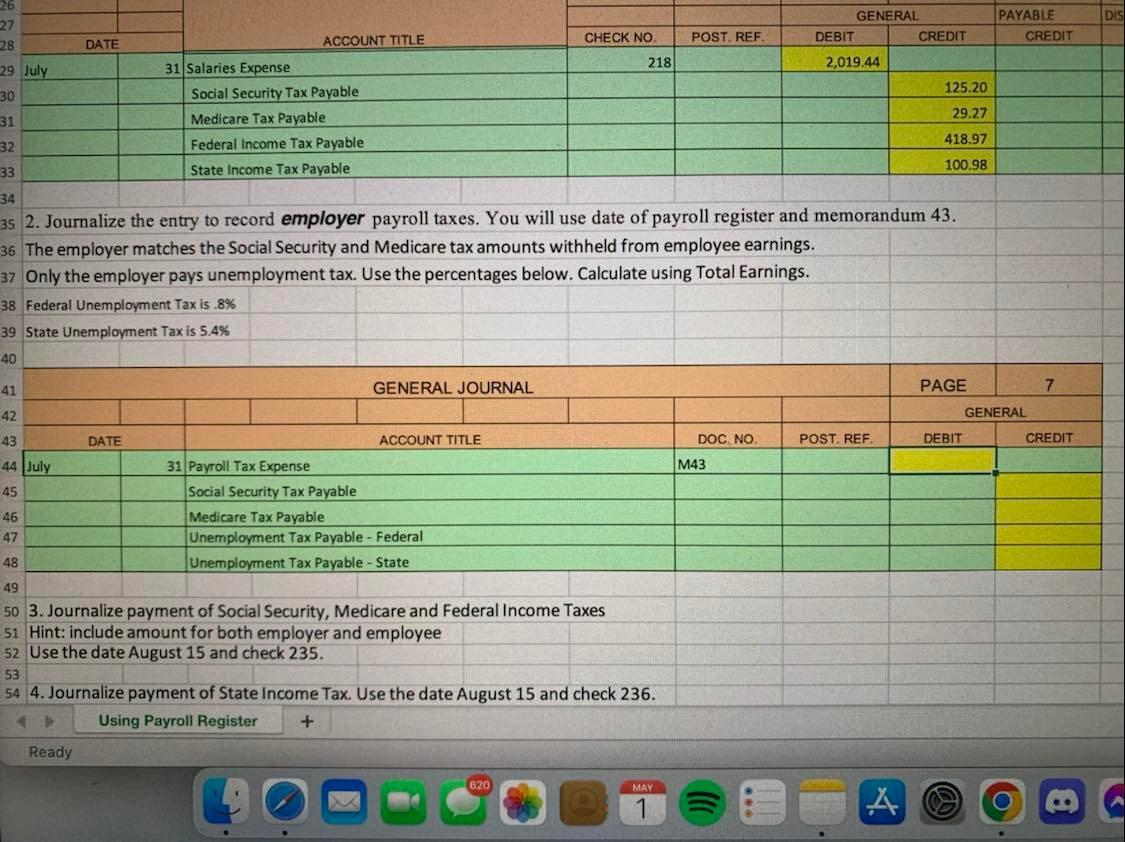

x fx A B C D E F G H Google File Access Directions:- Please click on File in the upper left corner. - If you are working on a Chromebook or Google Docs, choose the Make a copy option and save a copy of For this assignment, you will look at the Payroll Register below and use the information to journalize employee and employer taxes. The first two journals are partially completed. = 5 The following percentages were used to calculate taxes for the payroll below: Social Security: 6.2% Medicare: 1.45% O Federal Income Tax: 20% 0 State Income Tax: 5% 1 2 Payroll Register 3 4 Total hours Rate Earnings Overtime 5 Name Regular Total Deductions Fed. Inc. Tax 6.50 $ 6.80 $ 6 Jim Rice $ 10.25 $ 42.5 38 7 Fred Jones $ 12.35 $ 38.44 $ $ 207.00 $ 56.70 $ Soc. Sec. Tax 27.80 $ 29.10 $ 41.35 $ 26.95 $ 410.00 $ 469.30 460.00 $ 378.00 $ 1,717.30 $ Date of Payment: July 31, 20xx State Inc. Tax Total 89.69 $ 22.42 $ 146.41 $ 117.33 $ 23.47 $ 176.70 $ 146.74 $ 33.35 $ 231.11 $ 65.21 $ 21.74 $ 120.20 $ 100.98 $ 674.42 $ 8 Sue Smith Net Pay 302.03 292.60 435.89 314.50 448.44 $ 469.30 $ 667.00 $ 434.70 $ 2,019.44 $ 52 $ 11.50 $ $9.45 $ 9.67 $ 6.30 $ 9 Ray Regan 44 0 Totals S 302.14 $ 125.20 29.27 418.97 1,345.02 1 2 1. Using the payroll register to journalize the entry for employee payroll. 3 Use the payroll register date and use check 218 to transfer net pay to payroll account. 4 CASH PAYMENTS JOURNAL ACCOUNTS PAYABLE PAGE PURCHASES DISCOUNT CREDIT GENERAL DATE ACCOUNT TITLE CHECK NO CREDIT Using Payroll Register MAY W 1 44 5 6 27 28 4 Ready + M 620 Medicare Tax POST. REF DEBIT A CREDIT CAS CR P 26 27 POST. REF 28 CHECK NO. 218 2,019.44 29 July 125.20 30 Social Security Tax Payable Medicare Tax Payable 29.27 31 418.97 32 Federal Income Tax Payable 100.98 33 State Income Tax Payable 34 35 2. Journalize the entry to record employer payroll taxes. You will use date of payroll register and memorandum 43. 36 The employer matches the Social Security and Medicare tax amounts withheld from employee earnings. 37 Only the employer pays unemployment tax. Use the percentages below. Calculate using Total Earnings. 38 Federal Unemployment Tax is .8% 39 State Unemployment Tax is 5.4% 40 41 GENERAL JOURNAL 42 PAGE DEBIT 43 DATE ACCOUNT TITLE DOC. NO. POST. REF. 44 July 45 Social Security Tax Payable 46 Medicare Tax Payable 47 Unemployment Tax Payable - Federal 48 Unemployment Tax Payable - State 49 50 3. Journalize payment of Social Security, Medicare and Federal Income Taxes 51 Hint: include amount for both employer and employee 52 Use the date August 15 and check 235. 53 54 4. Journalize payment of State Income Tax. Use the date August 15 and check 236. -> Using Payroll Register + Ready 620 MAY DATE 31 Salaries Expense 31 Payroll Tax Expense ACCOUNT TITLE M43 DEBIT GENERAL A CREDIT PAYABLE CREDIT 7 GENERAL CREDIT O DIS