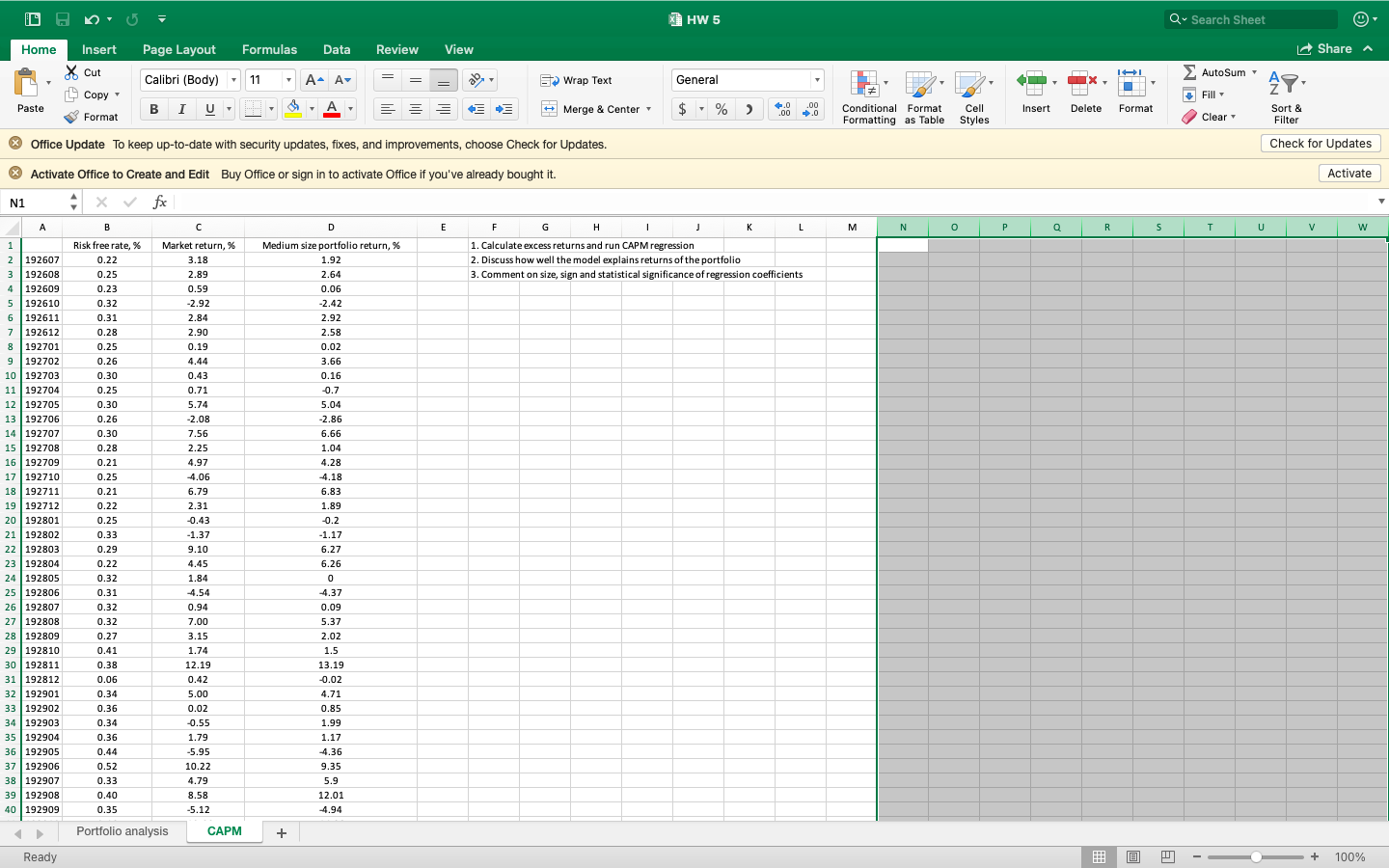

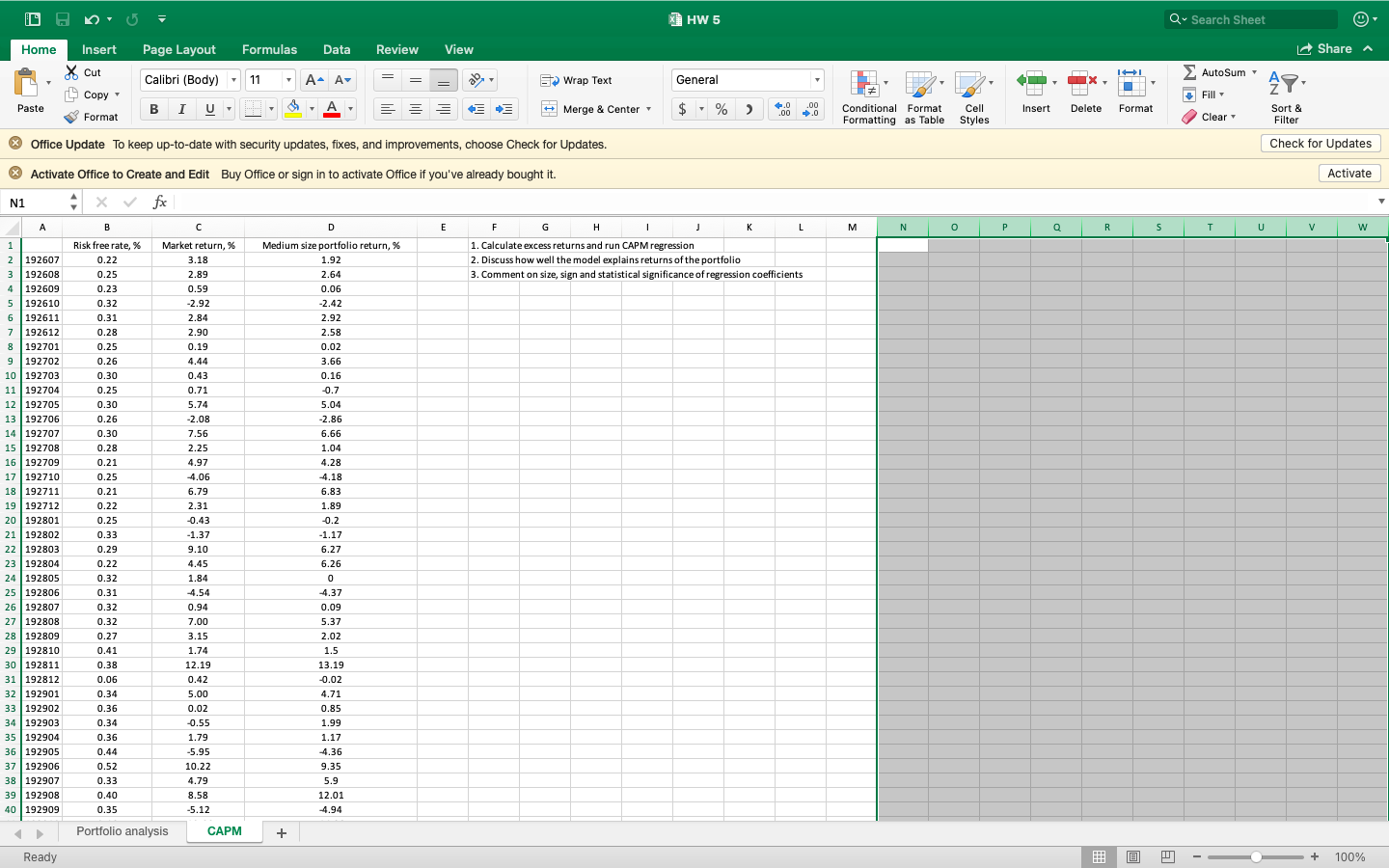

X HW 5 Q Search Sheet Home Page Layout Formulas Data Review View Share a AutoSum , Insert * Cut Copy Format A- A- Wrap Text General ND 49 Calibri (Body) - 11 BIU U- H Fill Paste A + Merge & Center $ % ) % ..0 .00 .00 0 Insert Conditional Format Formatting as Table Cell Styles Format Delete Clear Sort & Filter Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. Check for Updates Activate Activate Office to Create and Edit Buy Office or sign in to activate Office if you've already bought it. N1 4 x v fx A B D E F G . 1 J L M N N 0 P R S S T U V w 1. Calculate excess returns and run CAPM regression 2. Discuss how well the model explains returns of the portfolio 3. Comment on size, sign and statistical significance of regression coefficients Market return, % 3.18 2.89 0.59 -2.92 2.84 2.90 0.19 4.44 0.43 0.71 5.74 -2.08 1 2 192607 3 192608 4 192609 5 192610 6 192611 7 192612 8 8 192701 9 192702 10 192703 11 192704 12 192705 13 192706 14 192707 15 192708 16 192709 17 192710 18 192711 19 192712 20 192801 21 192802 22 192803 23 192804 24 192805 25 192806 26 192807 27 192808 28 192809 29 192810 30 192811 31 192812 32 192901 33 | 192902 34 | 192903 35 | 192904 36 192905 37 192906 38 192907 39 192908 40 192909 7.56 Risk free rate, % 0.22 0.25 0.23 0.32 0.31 0.28 0.25 0.26 0.30 0.25 0.30 0.26 0.30 0.28 0.21 0.25 0.21 0.22 0.25 0.33 0.29 0.22 0.32 0.31 0.32 0.32 0.27 0.41 0.38 0.06 0.34 0.36 0.34 0.36 0.44 0.52 0.33 0.40 0.35 Medium size portfolio return, % 1.92 2.64 0.06 -2.42 2.92 2.58 0.02 3.66 0.16 -0.7 5.04 -2.86 6.66 1.04 4.28 4.18 6.83 1.89 -0.2 -1.17 6.27 6.26 0 2.25 4.97 -4.06 6.79 2.31 -0.43 -1.37 9.10 4.45 1.84 -4.54 0.94 7.00 3.15 1.74 12.19 0.42 5.00 0.02 -0.55 1.79 -4.37 0.09 5.37 2.02 1.5 13.19 -0.02 4.71 0.85 1.99 1.17 -4.36 9.35 5.9 12.01 4.94 -5.95 10.22 4.79 8.58 -5.12 Portfolio analysis CAPM + Ready @ + 100% X HW 5 Q Search Sheet Home Page Layout Formulas Data Review View Share a AutoSum , Insert * Cut Copy Format A- A- Wrap Text General ND 49 Calibri (Body) - 11 BIU U- H Fill Paste A + Merge & Center $ % ) % ..0 .00 .00 0 Insert Conditional Format Formatting as Table Cell Styles Format Delete Clear Sort & Filter Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. Check for Updates Activate Activate Office to Create and Edit Buy Office or sign in to activate Office if you've already bought it. N1 4 x v fx A B D E F G . 1 J L M N N 0 P R S S T U V w 1. Calculate excess returns and run CAPM regression 2. Discuss how well the model explains returns of the portfolio 3. Comment on size, sign and statistical significance of regression coefficients Market return, % 3.18 2.89 0.59 -2.92 2.84 2.90 0.19 4.44 0.43 0.71 5.74 -2.08 1 2 192607 3 192608 4 192609 5 192610 6 192611 7 192612 8 8 192701 9 192702 10 192703 11 192704 12 192705 13 192706 14 192707 15 192708 16 192709 17 192710 18 192711 19 192712 20 192801 21 192802 22 192803 23 192804 24 192805 25 192806 26 192807 27 192808 28 192809 29 192810 30 192811 31 192812 32 192901 33 | 192902 34 | 192903 35 | 192904 36 192905 37 192906 38 192907 39 192908 40 192909 7.56 Risk free rate, % 0.22 0.25 0.23 0.32 0.31 0.28 0.25 0.26 0.30 0.25 0.30 0.26 0.30 0.28 0.21 0.25 0.21 0.22 0.25 0.33 0.29 0.22 0.32 0.31 0.32 0.32 0.27 0.41 0.38 0.06 0.34 0.36 0.34 0.36 0.44 0.52 0.33 0.40 0.35 Medium size portfolio return, % 1.92 2.64 0.06 -2.42 2.92 2.58 0.02 3.66 0.16 -0.7 5.04 -2.86 6.66 1.04 4.28 4.18 6.83 1.89 -0.2 -1.17 6.27 6.26 0 2.25 4.97 -4.06 6.79 2.31 -0.43 -1.37 9.10 4.45 1.84 -4.54 0.94 7.00 3.15 1.74 12.19 0.42 5.00 0.02 -0.55 1.79 -4.37 0.09 5.37 2.02 1.5 13.19 -0.02 4.71 0.85 1.99 1.17 -4.36 9.35 5.9 12.01 4.94 -5.95 10.22 4.79 8.58 -5.12 Portfolio analysis CAPM + Ready @ + 100%