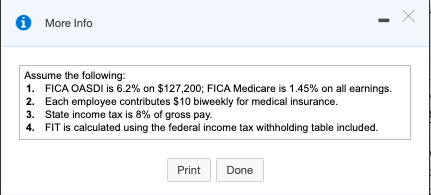

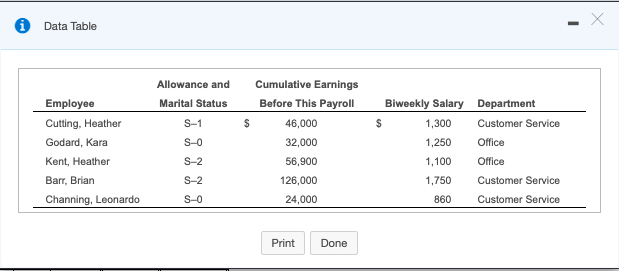

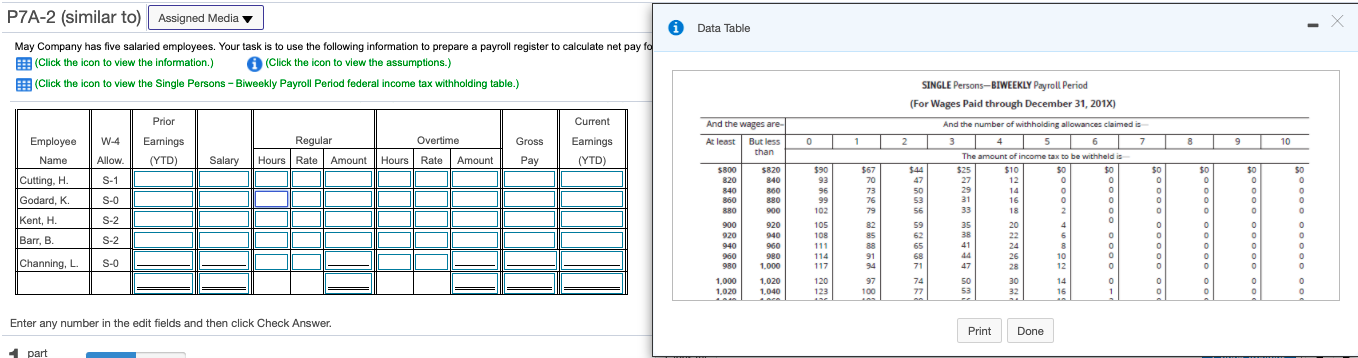

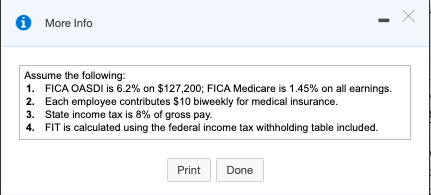

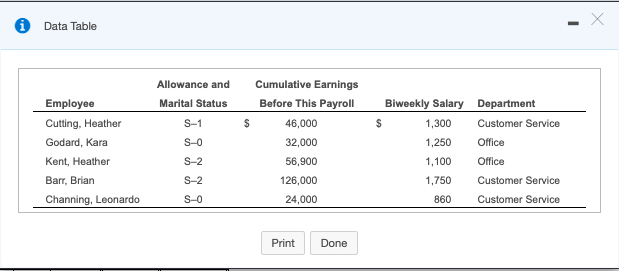

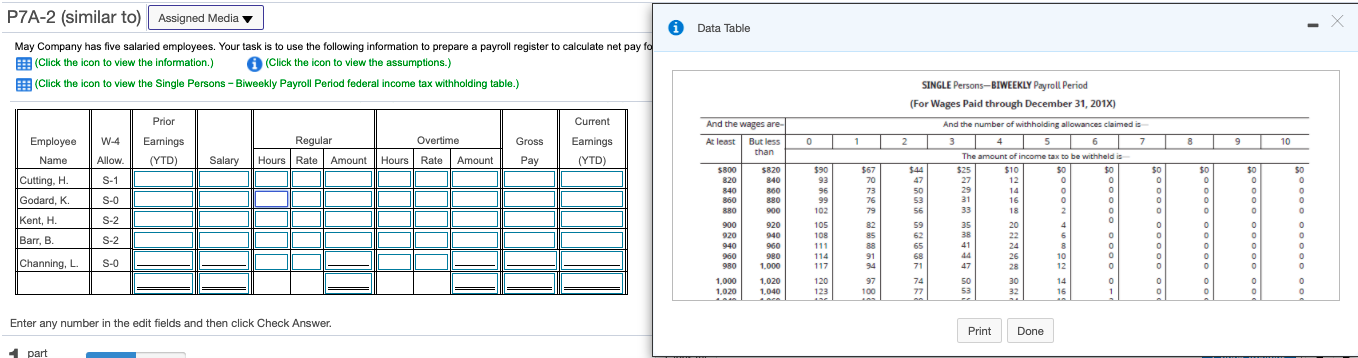

X More Info Assume the following: 1. FICA OASDI is 6.2% on $127,200; FICA Medicare is 1.45% on all earnings. 2. Each employee contributes $10 biweekly for medical insurance. 3. State income tax is 8% of gross pay. 4. FIT is calculated using the federal income tax withholding table included. Print Done Data Table Allowance and Marital Status S-1 $ $ Employee Cutting, Heather Godard, Kara Kent, Heather Barr, Brian Channing, Leonardo S-0 S-2 Cumulative Earnings Before This Payroll 46,000 32,000 56,900 126,000 24,000 Biweekly Salary Department 1,300 Customer Service 1,250 Office 1,100 Office 1,750 Customer Service 860 Customer Service S-2 S-0 Print Done Data Table P7A-2 (similar to) Assigned Media May Company has five salaried employees. Your task is to use the following information to prepare a payroll register to calculate net pay fo (Click the icon to view the information.) (Click the icon to view the assumptions.) (Click the icon to view the Single Persons -Biweekly Payroll Period federal income tax withholding table.) Prior Current W-4 Gross Eamings 0 1 And the wages are- At least But less than 8 Employee Name 9 Earnings (YTD) 10 SINGLE Person-BIWEEKLY Payroll Period (For Wages Paid through December 31, 201x) And the number of withholding allowances claimed is 2 3 5 6 7 The amount of income tax to be withheld is $44 $25 $10 $0 47 12 29 14 53 31 16 0 Regular Hours Rate Amount Overtime Hours Rate Amount Allow. Salary Pay (YTD) $0 $0 0 S-1 27 SO 0 0 0 5800 820 840 860 880 $67 70 73 76 Cutting, H. Godard, K Kent, H. 50 O $90 93 96 99 102 105 108 S-O 0 0 0 $0 O 0 O 0 0 0 0 0 0 0 0 56 33 18 2 0 O 0 S-2 59 $820 840 860 880 900 920 940 960 980 1.000 1,020 1,040 4 6 0 35 38 41 Barr, B. S-2 0 82 85 89 91 2 0 0 0 0 0 0 0 0 0 900 920 940 960 980 1,000 1,020 0 0 O O 0 55 68 71 114 Channing, L. S-0 20 22 24 26 28 30 32 117 10 12 0 0 47 0 74 0 0 0 120 123 97 100 50 53 14 16 0 0 1 0 0 0 Enter any number in the edit fields and then click Check Answer. Print Done 1 part X More Info Assume the following: 1. FICA OASDI is 6.2% on $127,200; FICA Medicare is 1.45% on all earnings. 2. Each employee contributes $10 biweekly for medical insurance. 3. State income tax is 8% of gross pay. 4. FIT is calculated using the federal income tax withholding table included. Print Done Data Table Allowance and Marital Status S-1 $ $ Employee Cutting, Heather Godard, Kara Kent, Heather Barr, Brian Channing, Leonardo S-0 S-2 Cumulative Earnings Before This Payroll 46,000 32,000 56,900 126,000 24,000 Biweekly Salary Department 1,300 Customer Service 1,250 Office 1,100 Office 1,750 Customer Service 860 Customer Service S-2 S-0 Print Done Data Table P7A-2 (similar to) Assigned Media May Company has five salaried employees. Your task is to use the following information to prepare a payroll register to calculate net pay fo (Click the icon to view the information.) (Click the icon to view the assumptions.) (Click the icon to view the Single Persons -Biweekly Payroll Period federal income tax withholding table.) Prior Current W-4 Gross Eamings 0 1 And the wages are- At least But less than 8 Employee Name 9 Earnings (YTD) 10 SINGLE Person-BIWEEKLY Payroll Period (For Wages Paid through December 31, 201x) And the number of withholding allowances claimed is 2 3 5 6 7 The amount of income tax to be withheld is $44 $25 $10 $0 47 12 29 14 53 31 16 0 Regular Hours Rate Amount Overtime Hours Rate Amount Allow. Salary Pay (YTD) $0 $0 0 S-1 27 SO 0 0 0 5800 820 840 860 880 $67 70 73 76 Cutting, H. Godard, K Kent, H. 50 O $90 93 96 99 102 105 108 S-O 0 0 0 $0 O 0 O 0 0 0 0 0 0 0 0 56 33 18 2 0 O 0 S-2 59 $820 840 860 880 900 920 940 960 980 1.000 1,020 1,040 4 6 0 35 38 41 Barr, B. S-2 0 82 85 89 91 2 0 0 0 0 0 0 0 0 0 900 920 940 960 980 1,000 1,020 0 0 O O 0 55 68 71 114 Channing, L. S-0 20 22 24 26 28 30 32 117 10 12 0 0 47 0 74 0 0 0 120 123 97 100 50 53 14 16 0 0 1 0 0 0 Enter any number in the edit fields and then click Check Answer. Print Done 1 part