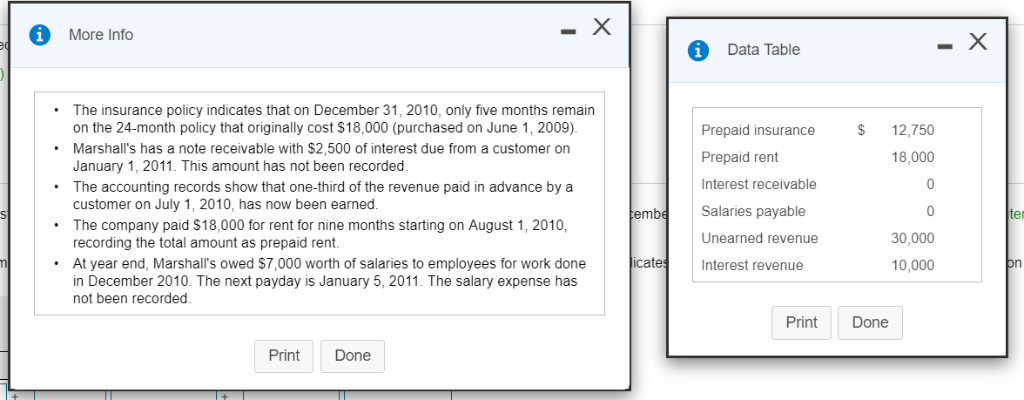

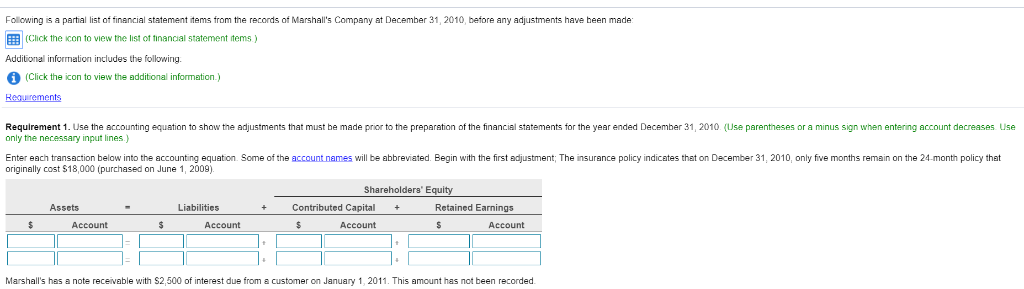

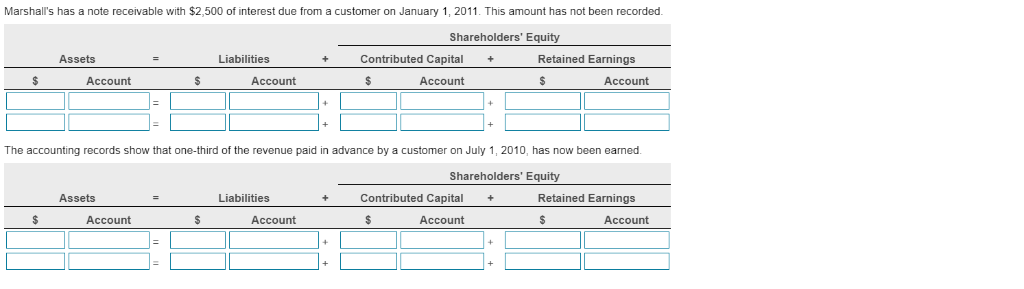

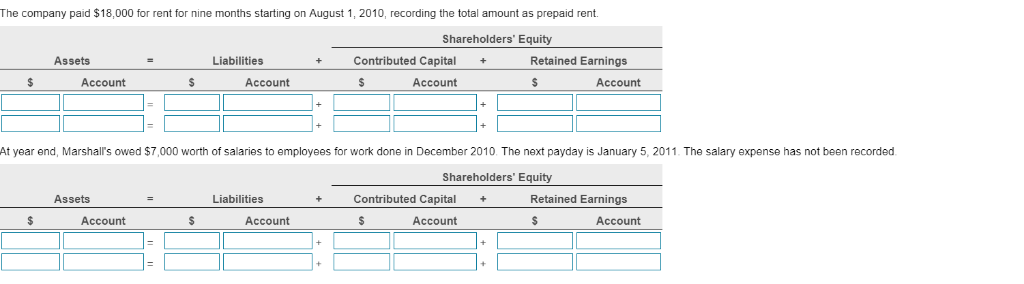

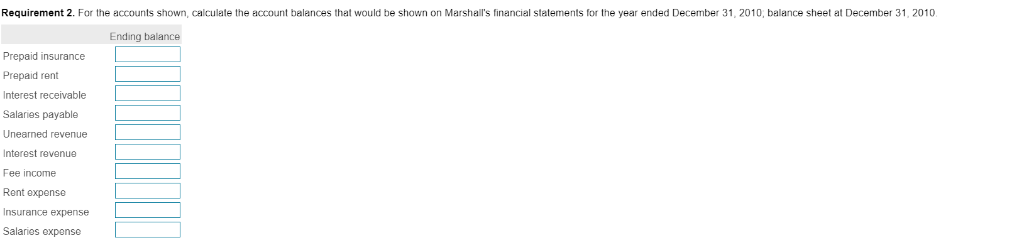

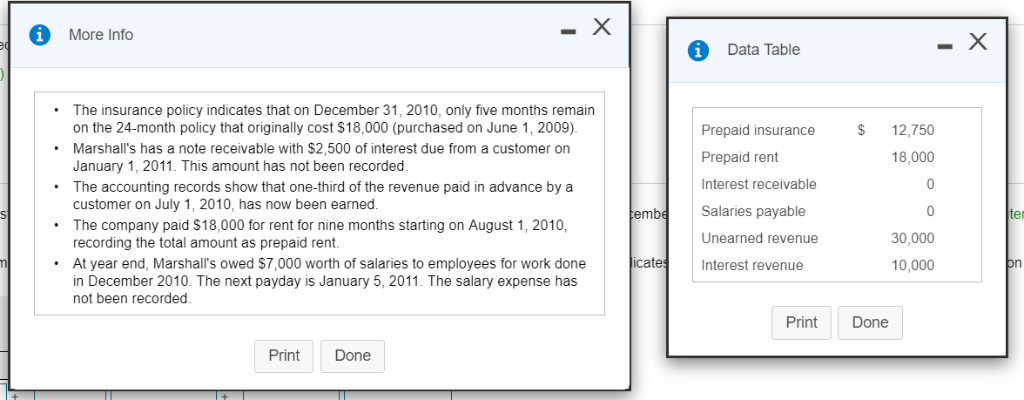

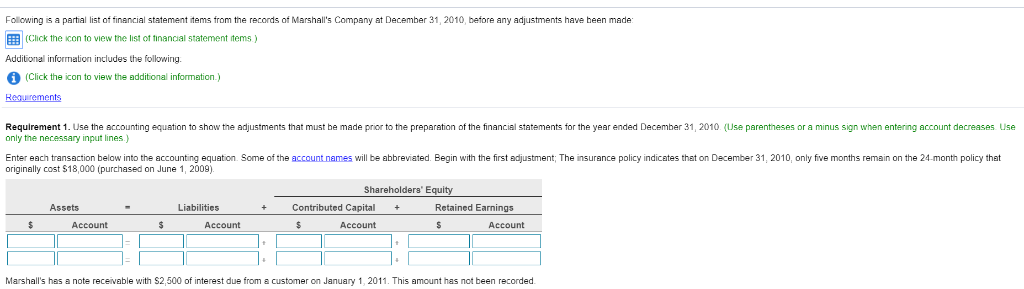

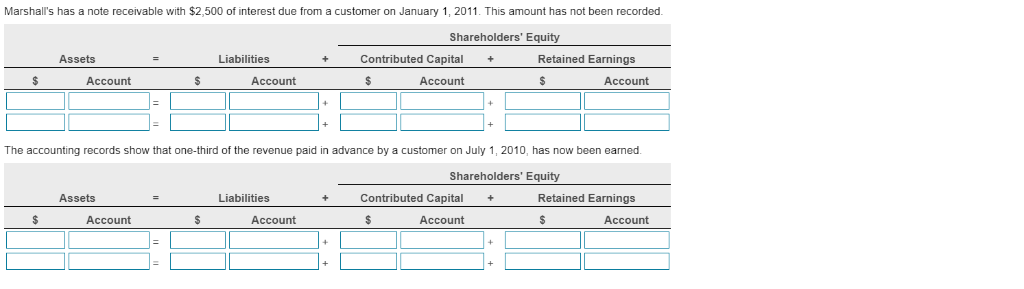

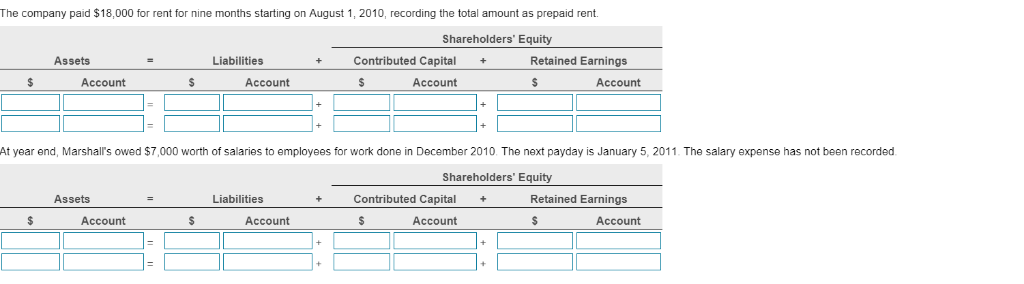

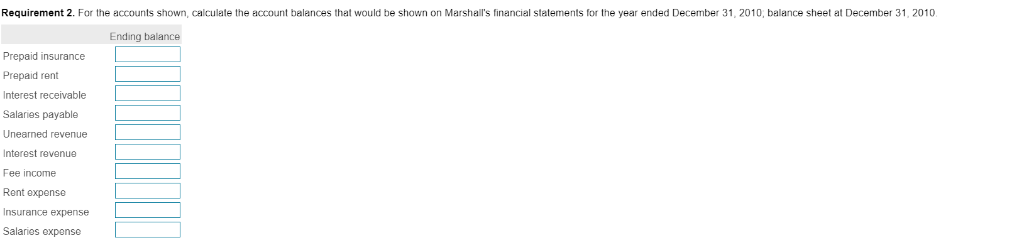

- X More Info -X i Data Table The insurance policy indicates that on December 31, 2010, only five months remain on the 24-month policy that originally cost $18,000 (purchased on June 1, 2009). Prepaid insurance 12,750 Marshall's has a note receivable with $2,500 of interest due from a customer on January 1, 2011. This amount has not been recorded. The accounting records show that one-third of the revenue paid in advance by a customer on July 1, 2010, has now been earned Prepaid rent 18,000 Interest receivable Salaries payable tembe ter The company paid $18,000 for rent for nine months starting on August 1, 2010, recording the total amount as prepaid rent. Unearned revenue 30,000 licates At year end, Marshall's owed $7,000 worth of salaries to employees for work done in December 2010. The next payday is January 5, 2011. The salary expense has not been recorded Interest revenue 10,000 on Print Done Print Done December 31, 2010, before any adiustments have been made: Following is a partial list of finencial statement items from the records of Marshall's Company E(Click the Icon to view the list of financial statement tems ) Additional infoemation includes the following. (Click the icon to view the additional information.) Reguirements a made prior to the preparation of the financial statements for the year ended December 31, 2010. (Use parentheses or a minus sign when entering account decreases Use Requirement 1. Use the accounting equation to show the adjustments that must only the necessary input lines) Enter each transaction below into the accounting equation. Some of the account names will be abbreviated. Begin with the first adjustment; The insurance policy indicates that on December 31, 2010, only five months remain on the 24-month policy that originally cost $18,000 (purchased on June 1, 2009). Shareholders' Equity Retained Earnings Assets Liabilities Contributed Capital + Account Account Account ecount interest due from a customer Marshall's has a note receivable with $2,500 January 1, 2011. This amount has not been recorded. Marshall's has a note receivable with $2,500 of interest due from a customer on January 1, 2011. This amount has not been recorded. Shareholders' Equity Retained Earnings Assets Liabilities Contributed Capital $ Account Account $ Account Account The accounting records show that one-third of the revenue paid in advance by customer on July 1, 2010, has now been earned. Shareholders' Equity Retained Earnings Assets Liabilities Contributed Capital + - S S Account Account Account Account The company paid $18,000 for rent for nine months starting on August 1, 2010, recording the total amount as prepaid rent. Shareholders' Equity Assets Contributed Capital Retained Earnings Liabilities + $ $ Account Account Account Account $ At year end, Marshall's owed $7,000 worth of salaries to employees for work done in December 2010. The next payday is January 5, 2011. The salary expense has not been recorded. Shareholders' Equity Contributed Capital Retained Earnings Assets Liabilities + S Account Account Account Account Requirement 2. For the accounts shown, calculate the account balances that would be shown on Marshall's financial statements for the year ended December 31, 2010, balance sheet December 31, 2010 Ending balance Prepaid insurance Prepaid rent Interest receivable Salaries payable Unearned revenue Interest revenue Fee income Rent oxpense Insurance expense Salarios oxpense