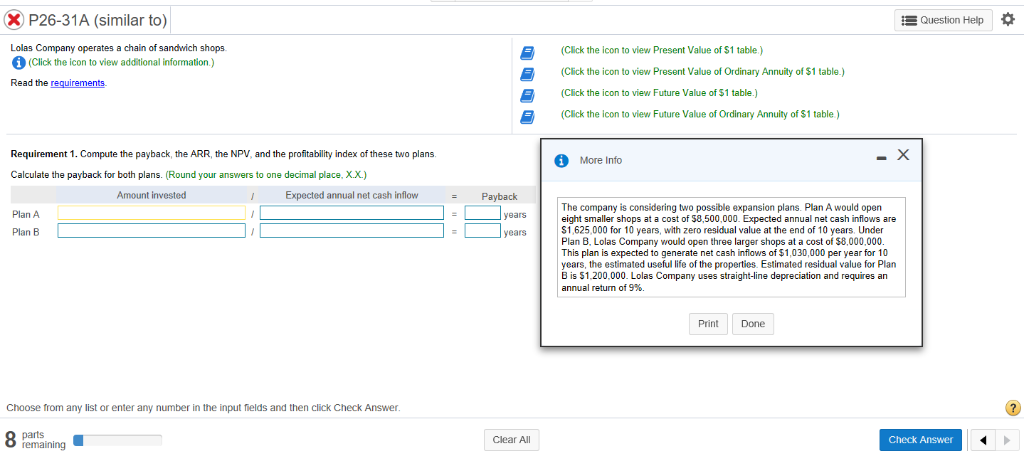

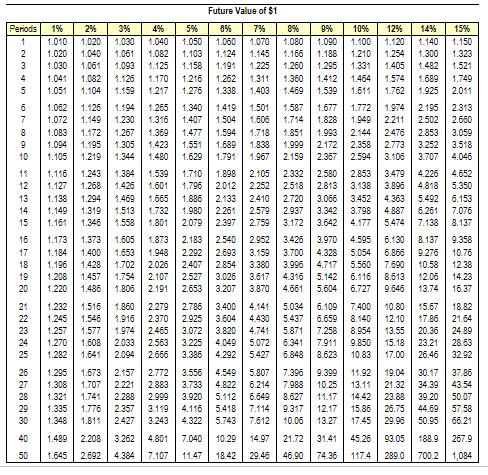

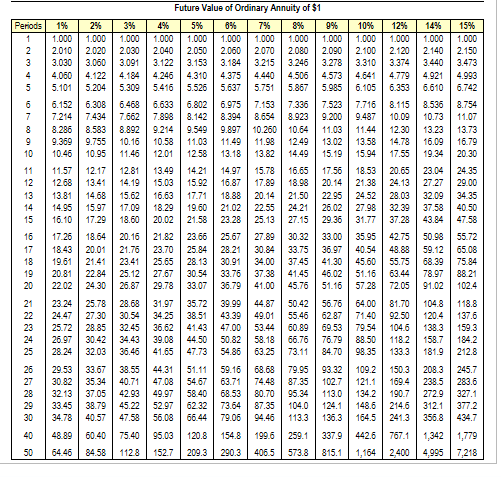

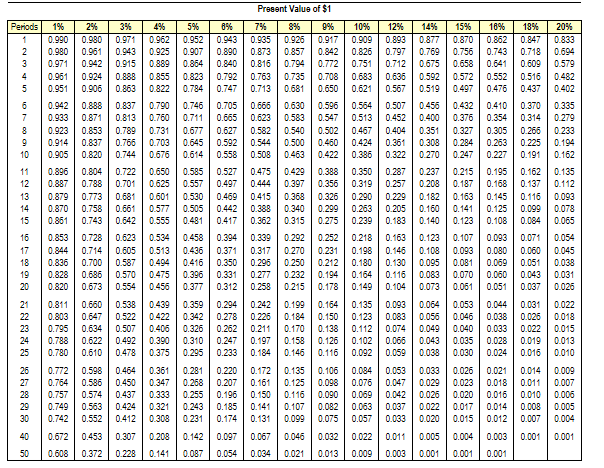

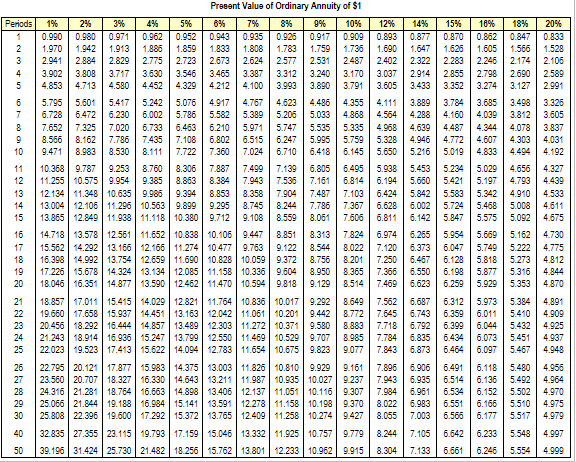

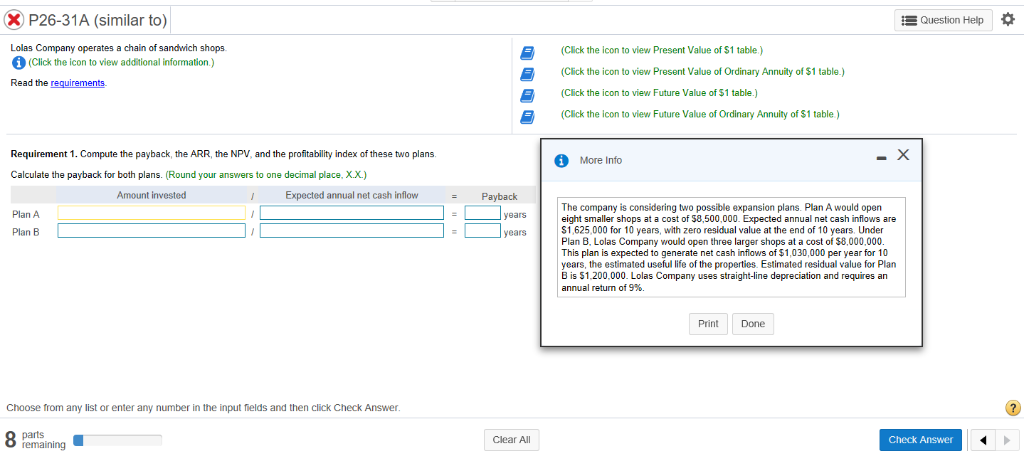

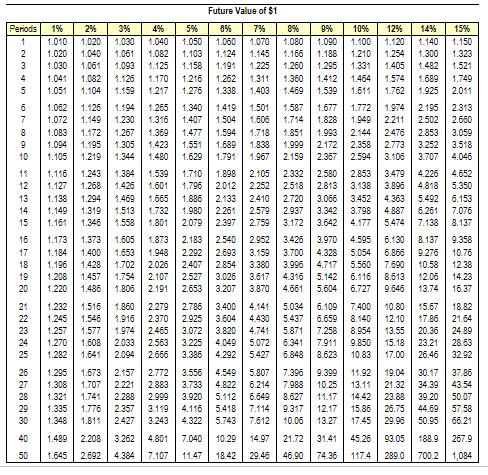

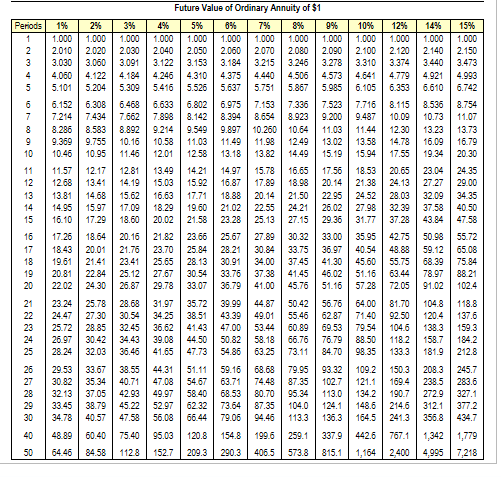

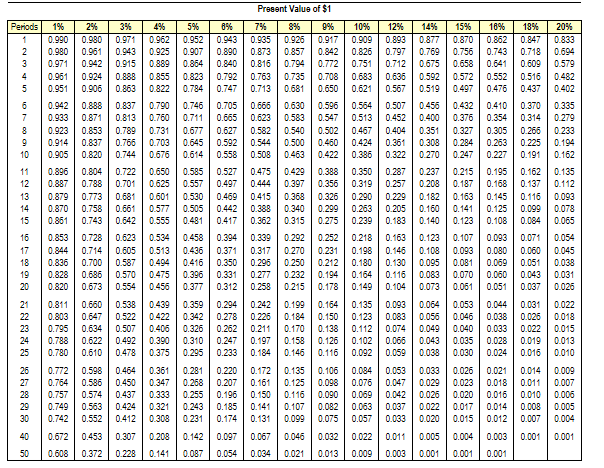

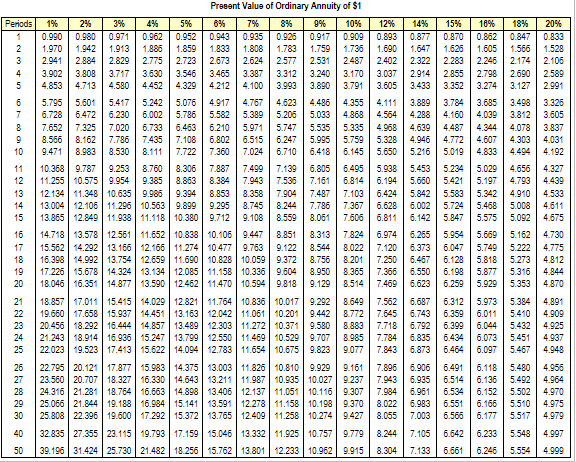

X P26-31A (similar to) Question Help Lolas Company operates a chain of sandwich shops (Click the icon to view additional information) Read the requirements (Click the icon to view Present Value of $1 table) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the icon to view Future Value of $1 table.) (Click the icon to view Future Value of Ordinary Annuity of $1 table) Requirement 1. Compute the payback, the ARR the NPV and the profitability Index of these two plans More Info Calculate the payback for both plans. (Round your answers to one decimal place, X.X.) Amount invested Expected annual net cash inflow Plan A Plan B = Payback years = years The company is considering two possible expansion plans. Plan A would open eight smaller shops at a cost of 58,500,000. Expected annual net cash inflows are $1,625,000 for 10 years, with zero residual value at the end of 10 years. Under Plan B. Lolas Company would open three larger shops at a cost of $8,000,000 This plan is expected to generate net cash inflows of $1,030,000 per year for 10 years, the estimated useful life of the properties. Estimated residual value for Plan B is $1.200.000. Lolas Company uses straight-line depreciation and requires an annual return of 9% Print Done Choose from any list or enter any number in the input fields and then click Check Answer 8 A parts remaining Clear All Check Answer Future Value of $1 Periods 1% | 1.616 15% 150 1 23 1.2 1. LED 12 1.25 1 250 12 1231 360 10 128174% 1. Co 1.20 1140 110 124 20 1.4TS | 482 1.454 1.76 1.682 1.412 1.532 1.521 1.742 2.011 ) ; %s% 1. 105 1.16 1.127 1.138 4. 1 4.652 5.350 5.153 7.076 3.137 2.358 1232 6.865 7.90 8.213 9.545 10.80 5.116 5.727 12.05 3.7 1 22 2% a%%% %s %n%%%% 21.4 mmmt=8 = % n T% %%% % = 1,545 12.14 | 147 22 = oma+, ??uroup 4428 45 7. 0.15 530 | 5275 18 16.53 15.03 3.49 2.0; 365 | 220 | 1.00 ; 2 | 1. ?ago 63 5537 3 | | 1 Future Value of Ordinary Annuity of $1 1. 0.250 a mpos = a. ::: 11.00 : : Fore | -- 16 as - 3d ! ]= n us - 6.105 hat 4. 33 200 1.00 1,000 | 176 , Tai 96 | Fu Tai o or | A.24 dissass=da . 3472 2.150 | Present Value of $1 Periods 1% 0.990 0.980 2% 0.980 0.971 3% 0.971 0.943 0.915 0.888 0.963 4% 0.962 0.925 0.889 0.855 0.822 5% 0.952 0.907 0.854 0.823 0.784 0.746 0.711 0.677 0.645 0.614 0.961 0.951 0.942 6% 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 18% 0.847 0.718 0609 0.516 0437 0.370 8% 9% 0.025 0.917 0.8570.842 0.7940.772 0.735 0.708 0.681 0.650 0.630 0.583 0.540 0.500 0.790 7% 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 0.475 0.444 0.415 0.388 0.760 0.731 0.703 0312 OS 0.592 0.225 0.191 0.585 0429 SSSSSSS 0.558 0.527 0.497 0.469 0.442 0.162 OOOOOOOOOOOOOOOOOO 0.557 0.137 . 0.505 0.417 20% 0.833 0.694 0.579 0.482 0.402 0.335 0.279 0.233 0.194 0.162 0.135 0.112 0.00 0.078 0.065 0.054 0.045 0.038 0.031 0.026 0.022 0.018 0.015 0.013 0.010 0.362 10% 12% 14% 0.909 0.893 0.877 0.826 0.797 0.769 0.751 0.712 0.675 0.683 0.636 0.592 0.621 0.567 0.519 0.456 0.400 0.351 0.308 0.270 0.237 0.208 0.182 0.160 0.140 0.123 0.108 0.005 0.116 0.083 0.104 0.073 0.093 0.064 0.083 0.056 0.049 0.043 0.038 0.084 0.053 0.033 0.076 0.047 0.029 0.069 0.042 0.025 0.063 0.037 0.022 0.057 0.033 0.020 0.022 0.0110 .005 0.009 0.003 0.001 0.099 0.084 0.071 15% 16% 0.870 0.862 0.756 0.743 0.658 0.641 0.572 0.552 0.497 0.476 0.432 0.410 0.376 0.354 0.327 0.305 0.284 0.263 0.247 0.227 0.215 0.195 0.187 0.168 0.163 0.145 0.141 0.125 0.123 0.108 0.107 0.093 0.093 0.080 0.081 | 0.069 | 0.070 | 0.060 0.051 0.051 0.053 0.044 0.046 0.038 0.040 0.033 0.035 0.028 0.030 0.024 0.025 0.021 0.023 0.018 0.020 | 0.016 0.017 | 0.014 0.015 0.012 0.0040.003 0.001 0.001 0.438 0.060 0.081 0.828 0.820 OOOOOOOOOOOOOOOOOOO 0.394 0.339 0.371 0.317 0.350 0.295 0.331 0.277 0.258 0.2940.242 0.278 0.225 0.262 0.211 0.197 0.396 0.312 0.043 0.037 0.031 0.025 0.022 0.315 0.292 0.270 0.250 0.232 0.215 0.1990.164 0.1840.150 0.170 0.138 0.158 0.145 0.116 0.135 0.106 0.125 0.098 0.116 0.090 0.107 0.082 0.099 0.075 0.046 0.032 0.021 0.013 * 0.326 0.112 0.126 0.019 0.184 2018 0.014 001 OD 0.281 0.220 0.172 0.268 0.207 0.161 0.255 0.1960.150 0.243 0.185 0.141 0.231 0.174 0.131 0.142 0.097 0.067 0.087 0.054 0.034 0.008 0.007 0.308 0.208 0.141 0.608 0.372 0.228 Periods 1% 0.990 1.970 2.941 5% 0.952 2% 3% 0.9800.971 1.942 1.913 2.884 2.829 4% 0.962 1.885 Present Value of Ordinary Annuity of $1 6% 7% 10% 0.943 0.035 0.925 0.917 0.909 1.808 1.783 1.759 1.735 12% 14% 0.893 0.877 1.6901.647 15% 0.870 1.625 2.283 18% 0.862 1.605 18% 0.847 1.566 2.174 2.246 20% 0.833 1.528 2.106 2.589 2.991 3.717 2.799 oooo 8.983 GO 8.530 9.253 9.954 10.635 11.296 9.996 13.004 13.865 9.899 9.295 11.938 10.3809712 9. 108 10.563 11.118 11.652 12.166 12.659 13.134 15562 ni ww www to DNNN od odood oo oi oi oi oi oi oi oi 99 9.763 16.398 14.995 13.166 13.754 14.324 10.059 10.838 10.106 11.274 10.477 11.690 10.828 12.085 11.158 12.452 11.470 12.821 11.764 13.163 12.042 15.678 16.351 18.046 13.590 & SNS X &&& 20.12117.87715.983 14.375 13.003 11.825 20.707 18.327 16.330 14.643 13.211 11.987 21.28118.764 16.663 14.898 13.406 12.137 21.844 19.188 16.984 15.141 13.591 12.278 11.158 22.396 19.600 17.292 15.372 13.765 12.409 11.258 10.274 27.355 23.115 19.793 17.159 15.045 13.332 11.925 10.757 31.424 25.730 21.482 18.256 15.762 13.801 12.233 10.962 32835 7.105 6.542 7.133 6.661 4997 39.196 9.915 8.304 4.999