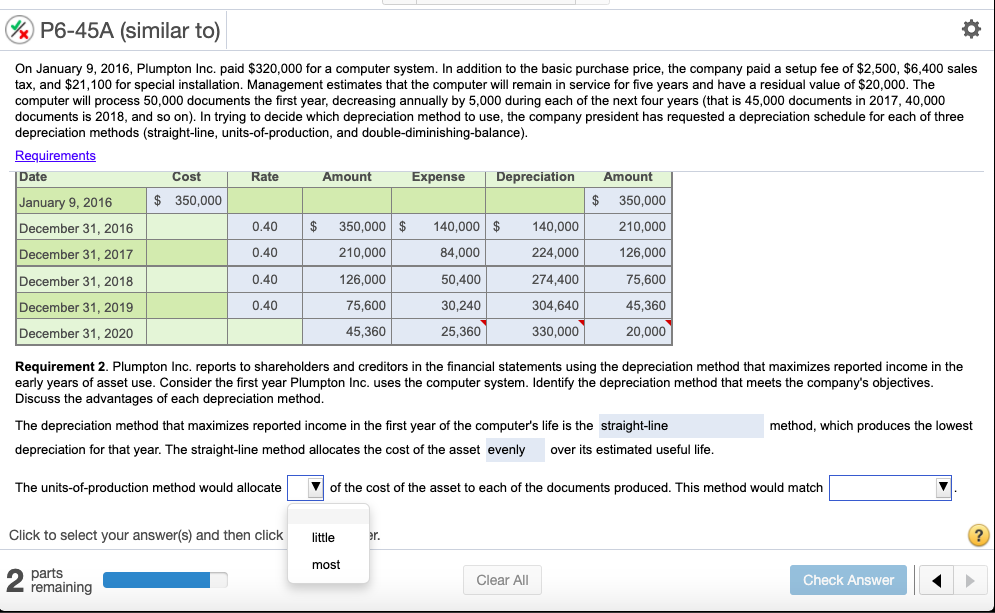

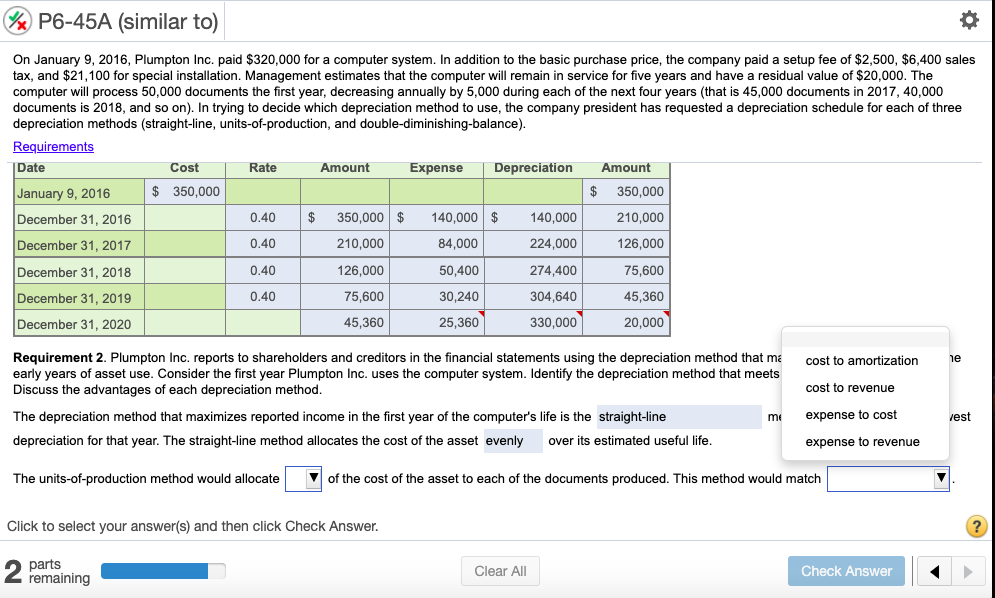

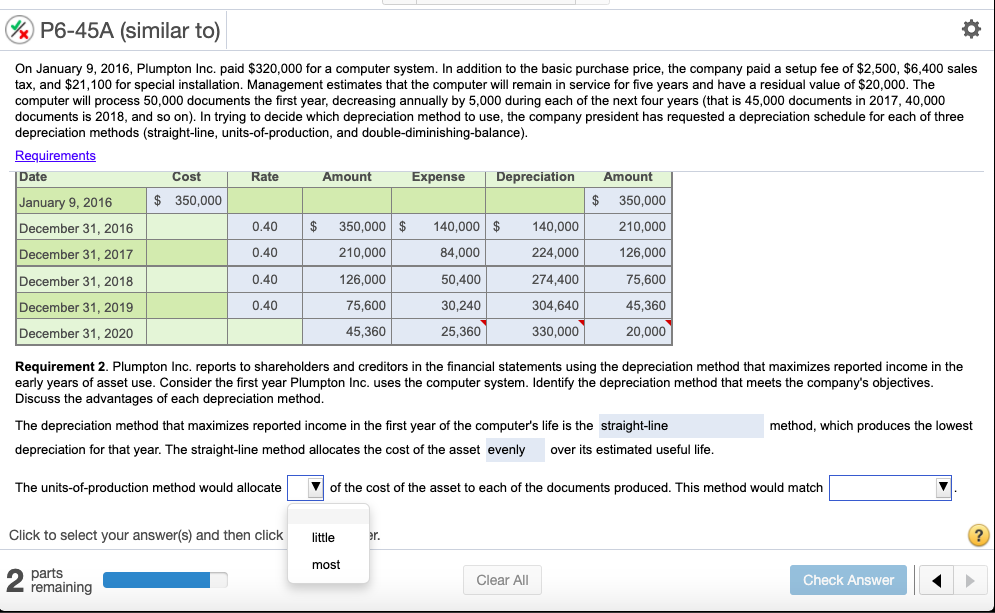

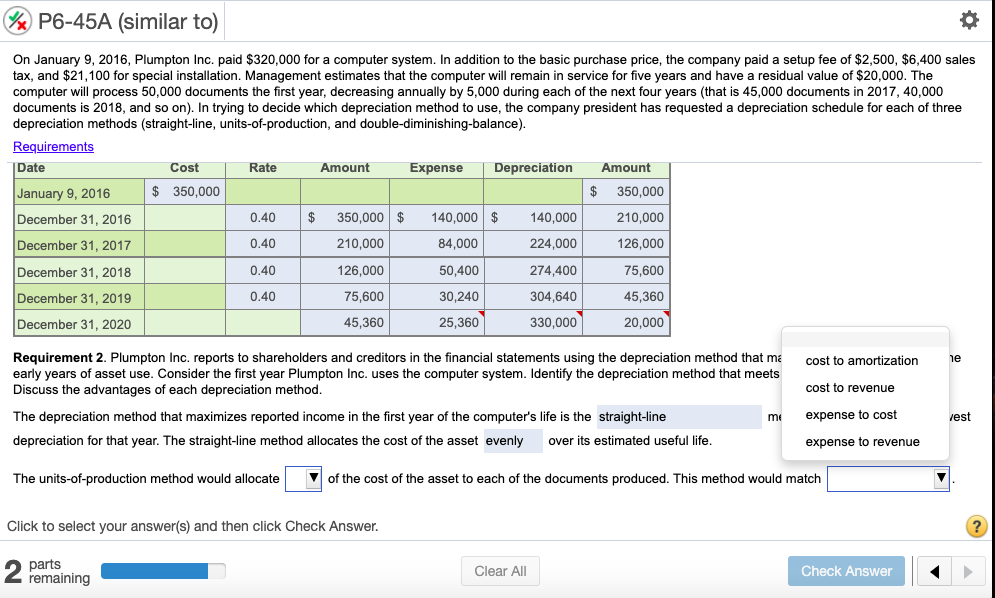

%x P6-45A (similar to) On January 9, 2016, Plumpton Inc. paid $320,000 for a computer system. In addition to the basic purchase price, the company paid a setup fee of $2,500, $6,400 sales tax, and $21,100 for special installation. Management estimates that the computer will remain in service for five years and have a residual value of $20,000. The computer will process 50,000 documents the first year, decreasing annually by 5,000 during each of the next four years (that is 45,000 documents in 2017, 40,000 documents is 2018, and so on). In trying to decide which depreciation method to use, the company president has requested a depreciation schedule for each of three depreciation methods (straight-line, units-of-production, and double-diminishing-balance). Requirements Date Cost Rate Amount Expense Depreciation Amount January 9, 2016 $ 350,000 $ 350,000 December 31, 2016 0.40 $ 350,000 $ 140,000 $ 140,000 210,000 December 31, 2017 0.40 210,000 84,000 224,000 126,000 December 31, 2018 0.40 126,000 50,400 274,400 75,600 December 31, 2019 0.40 30,240 304,640 45,360 75,600 December 31, 2020 45,360 25,360 330,000 20,000 Requirement 2. Plumpton Inc. reports to shareholders and creditors in the financial statements using the depreciation method that maximizes reported income in the early years of asset use. Consider the first year Plumpton Inc. uses the computer system. Identify the depreciation method that meets the company's objectives. Discuss the advantages of each depreciation method. The depreciation method that maximizes reported income in the first year of the computer's life is the straight-line method, which produces the lowest depreciation for that year. The straight-line method allocates the cost of the asset evenly over its estimated useful life. The units-of-production method would allocate V of the cost of the asset to each of the documents produced. This method would match Click to select your answer(s) and then click little er. ? most parts remaining Clear All Check Answer P6-45A (similar to) On January 9, 2016, Plumpton Inc. paid $320,000 for a computer system. In addition to the basic purchase price, the company paid a setup fee of $2,500, $6,400 sales tax, and $21,100 for special installation. Management estimates that the computer will remain in service for five years and have a residual value of $20,000. The computer will process 50,000 documents the first year, decreasing annually by 5,000 during each of the next four years (that is 45,000 documents in 2017, 40,000 documents is 2018, and so on). In trying to decide which depreciation method to use, the company president has requested a depreciation schedule each of three depreciation methods (straight-line, units-of-production, and double-diminishing-balance). Requirements Date Cost Rate Amount Expense Depreciation Amount January 9, 2016 $ 350,000 $ 350,000 December 31, 2016 0.40 $ 350,000 $ 140,000 $ 140,000 210,000 December 31, 2017 0.40 210,000 84,000 224,000 126,000 0.40 126,000 50,400 274,400 75,600 December 31, 2018 December 31, 2019 0.40 75,600 30,240 304,640 45,360 December 31, 2020 45,360 25,360 330,000 20,000 cost to amortization ne cost to revenue Requirement 2. Plumpton Inc. reports to shareholders and creditors in the financial statements using the depreciation method that ma early years of asset use. Consider the first year Plumpton Inc. uses the computer system. Identify the depreciation method that meets Discuss the advantages of each depreciation method. The depreciation method that maximizes reported income in the first year of the computer's life is the straight-line depreciation for that year. The straight-line method allocates the cost of the asset evenly over its estimated useful life. mi expense to cost rest expense to revenue The units-of-production method would allocate of the cost of the asset to each of the documents produced. This method would match Click to select your answer(s) and then click Check Answer. 2 parts remaining Clear All Check