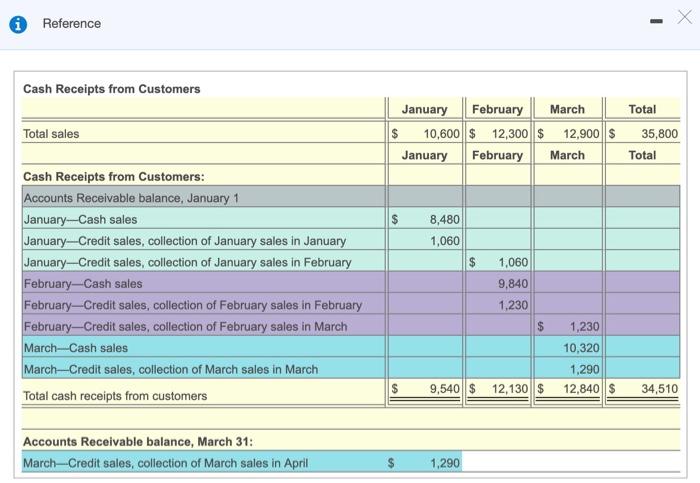

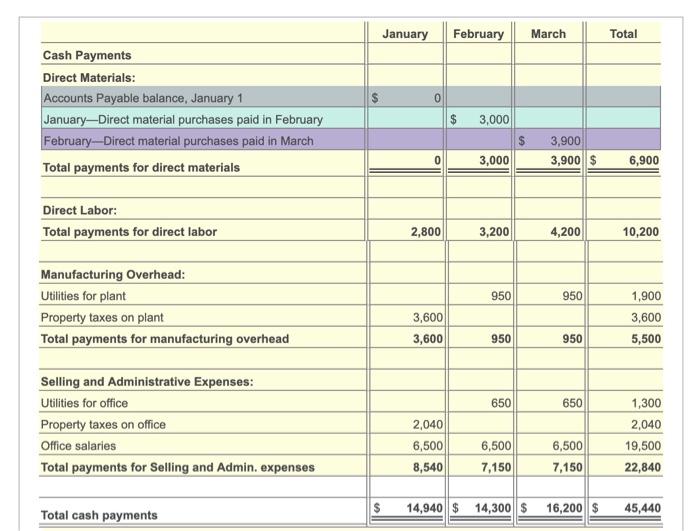

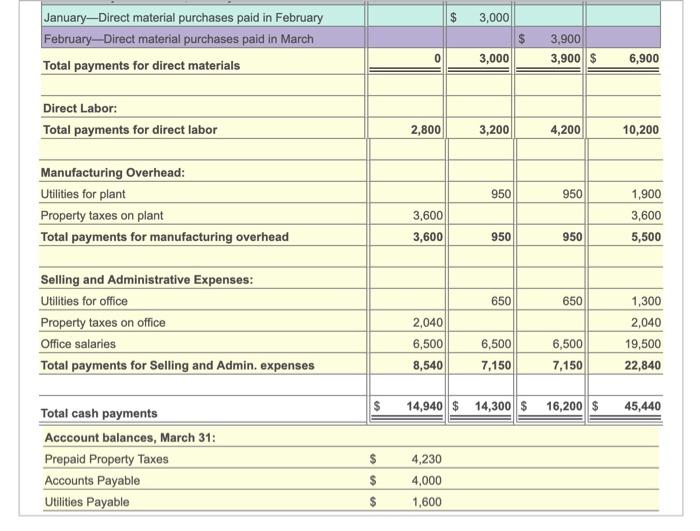

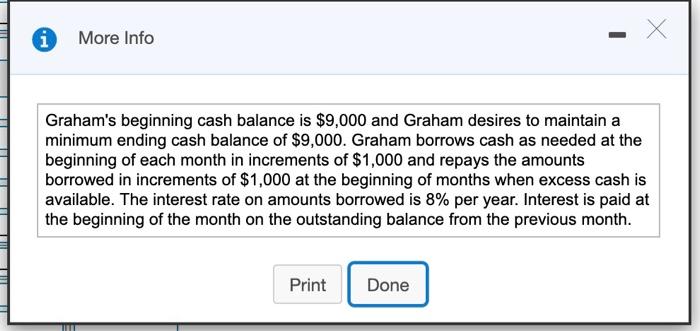

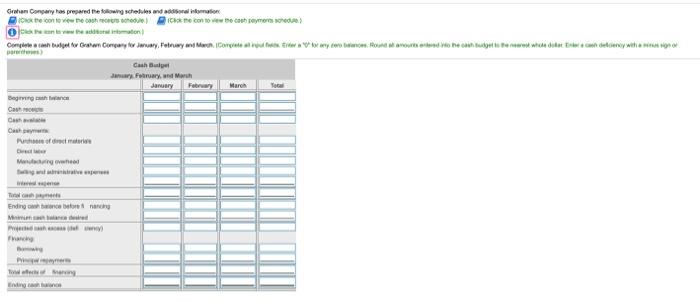

- X Reference Cash Receipts from Customers Total sales January February March $ 10,600 $ 12,300 $ 12,900 $ January February March Total 35,800 Total $ 8,480 1,060 $ Cash Receipts from Customers: Accounts Receivable balance, January 1 January-Cash sales January-Credit sales, collection of January sales in January January-Credit sales, collection of January sales in February February-Cash sales February-Credit sales, collection of February sales in February February-Credit sales, collection of February sales in March March-Cash sales March-Credit sales, collection of March sales in March Total cash receipts from customers 1,060 9,840 1,230 $ 1,230 10,320 1,290 12,840 $ $ 9,540 $ 12,130 $ 34,510 Accounts Receivable balance, March 31: March-Credit sales, collection of March sales in April 1,290 January February March Total 0 Cash Payments Direct Materials: Accounts Payable balance, January 1 January-Direct material purchases paid in February FebruaryDirect material purchases paid in March Total payments for direct materials $ 3,000 3,900 3,900 $ 3,000 6,900 Direct Labor: Total payments for direct labor 2,800 3,200 4,200 10,200 950 950 Manufacturing Overhead: Utilities for plant Property taxes on plant Total payments for manufacturing overhead 3,600 3,600 1,900 3,600 5,500 950 950 650 650 Selling and Administrative Expenses: Utilities for office Property taxes on office Office salaries Total payments for Selling and Admin. expenses 2,040 6,500 8,540 1,300 2,040 19,500 22,840 6,500 7,150 6,500 7,150 14,940 $ 14,300 16,200 $ 45,440 Total cash payments 3,000 January-Direct material purchases paid in February February-Direct material purchases paid in March Total payments for direct materials $ 3,900 3,900 $ 0 3,000 6,900 Direct Labor: Total payments for direct labor 2,800 3,200 4,200 10,200 950 950 Manufacturing Overhead: Utilities for plant Property taxes on plant Total payments for manufacturing overhead 3,600 3,600 1,900 3,600 5,500 950 950 650 650 Selling and Administrative Expenses: Utilities for office Property taxes on office Office salaries Total payments for Selling and Admin. expenses 2,040 6,500 8,540 1,300 2,040 19,500 22,840 6,500 7,150 6,500 7,150 $ $ 14,940 $ 14,300 $ 16,200 $ 45,440 Total cash payments Acccount balances, March 31: Prepaid Property Taxes Accounts Payable Utilities Payable $ $ $ 4,230 4,000 1,600 i More Info X Graham's beginning cash balance is $9,000 and Graham desires to maintain a minimum ending cash balance of $9,000. Graham borrows cash as needed at the beginning of each month in increments of $1,000 and repays the amounts borrowed in increments of $1,000 at the beginning of months when excess cash is available. The interest rate on amounts borrowed is 8% per year. Interest is paid at the beginning of the month on the outstanding balance from the previous month. Print Done Gran Company has prepared the following schedules and admin ook the contexte conto como Otomation Complete Graham Canganytor www.Patrwy w Galery. How does the date delen with Cash Bule Fray March January February Bogen Maro Ca Predare D Mangwe Ending on Me Fach