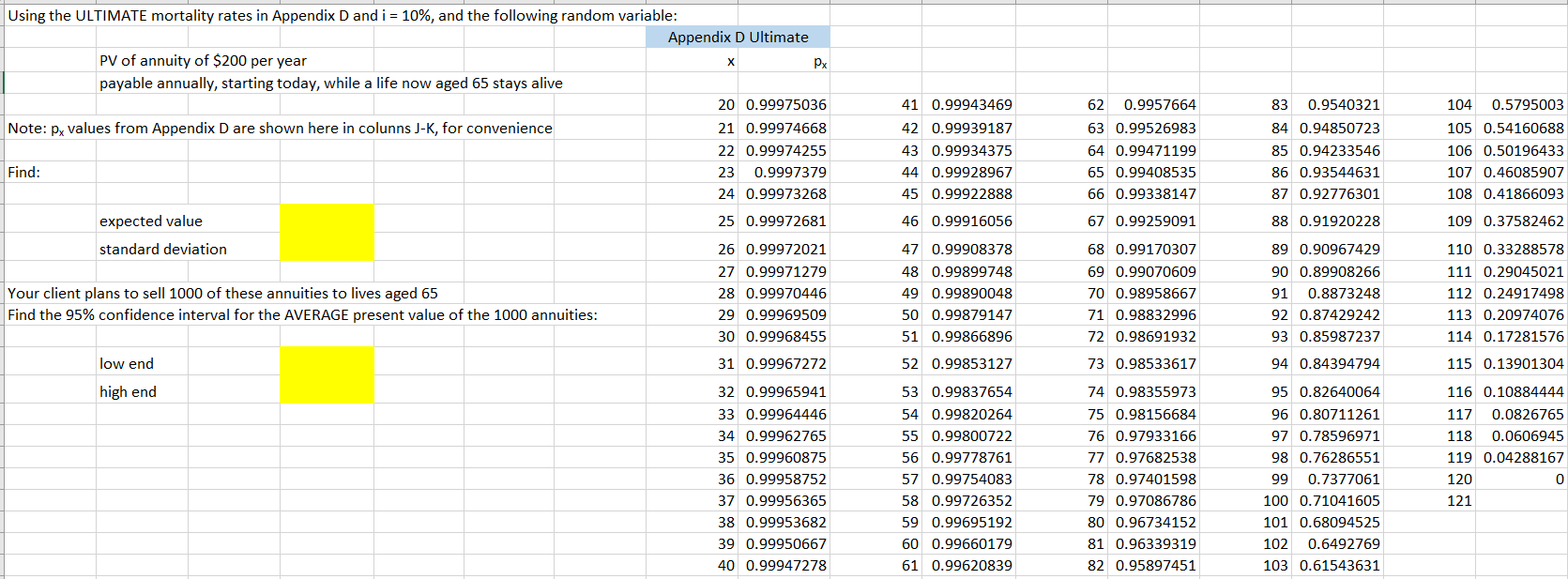

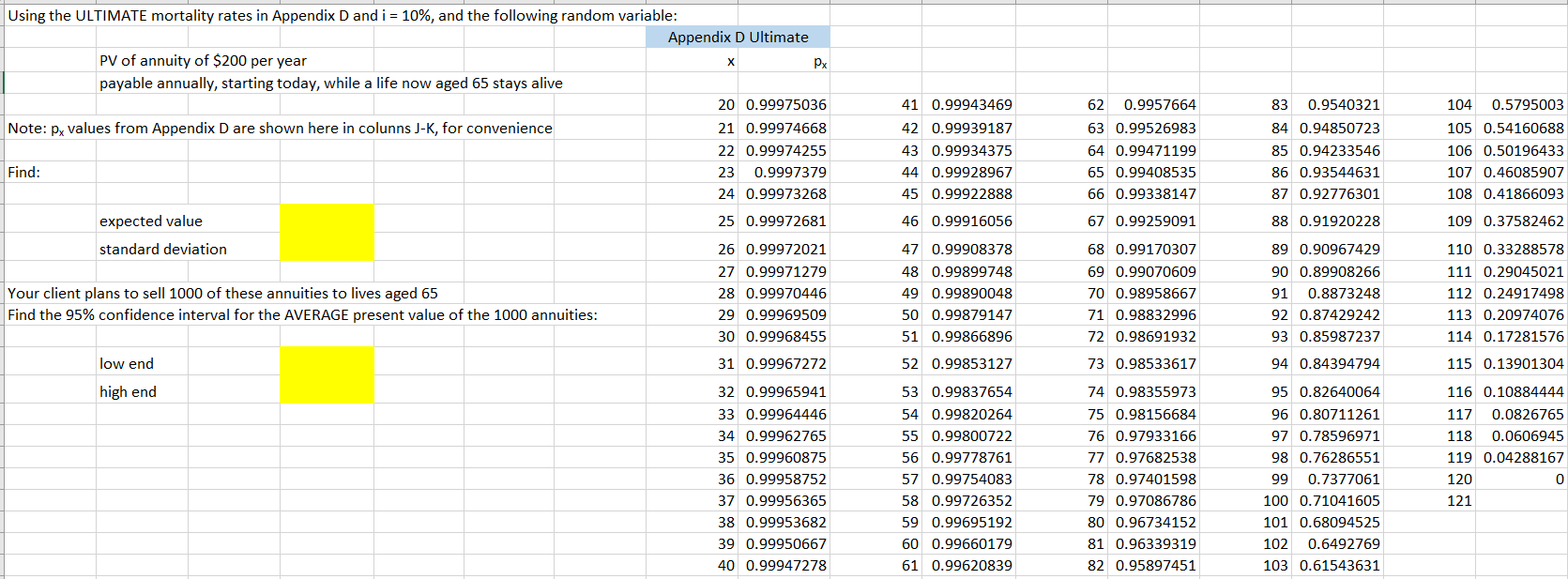

X Using the ULTIMATE mortality rates in Appendix D and i = 10%, and the following random variable: Appendix D Ultimate PV of annuity of $200 per year PX payable annually, starting today, while a life now aged 65 stays alive 20 0.99975036 Note: Px values from Appendix D are shown here in colunns J-K, for convenience 21 0.99974668 22 0.99974255 Find: 23 0.9997379 24 0.99973268 83 0.9540321 41 0.99943469 42 0.99939187 43 0.99934375 44 0.99928967 45 0.99922888 62 0.9957664 63 0.99526983 64 0.99471199 65 0.99408535 66 0.99338147 84 0.94850723 85 0.94233546 86 0.93544631 87 0.92776301 104 0.5795003 105 0.54160688 106 0.50196433 107 0.46085907 108 0.41866093 expected value 25 0.99972681 46 0.99916056 67 0.99259091 88 0.91920228 109 0.37582462 standard deviation Your client plans to sell 1000 of these annuities to lives aged 65 Find the 95% confidence interval for the AVERAGE present value of the 1000 annuities: 26 0.99972021 27 0.99971279 28 0.99970446 29 0.99969509 30 0.99968455 47 0.99908378 48 0.99899748 49 0.99890048 50 0.99879147 51 0.99866896 68 0.99170307 69 0.99070609 70 0.98958667 71 0.98832996 72 0.98691932 89 0.90967429 90 0.89908266 91 0.8873248 92 0.87429242 93 0.85987237 110 0.33288578 111 0.29045021 112 0.24917498 113 0.20974076 114 0.17281576 low end 31 0.99967272 52 0.99853127 73 0.98533617 94 0.84394794 115 0.13901304 high end 95 0.82640064 32 0.99965941 33 0.99964446 34 0.99962765 35 0.99960875 36 0.99958752 37 0.99956365 38 0.99953682 39 0.99950667 40 0.99947278 53 0.99837654 54 0.99820264 55 0.99800722 56 0.99778761 57 0.99754083 58 0.99726352 59 0.99695192 60 0.99660179 61 0.99620839 74 0.98355973 75 0.98156684 76 0.97933166 77 0.97682538 78 0.97401598 79 0.97086786 80 0.96734152 81 0.96339319 82 0.95897451 96 0.80711261 97 0.78596971 98 0.76286551 99 0.7377061 100 0.71041605 101 0.68094525 102 0.6492769 103 0.61543631 116 0.10884444 117 0.0826765 118 0.0606945 119 0.04288167 120 0 121 X Using the ULTIMATE mortality rates in Appendix D and i = 10%, and the following random variable: Appendix D Ultimate PV of annuity of $200 per year PX payable annually, starting today, while a life now aged 65 stays alive 20 0.99975036 Note: Px values from Appendix D are shown here in colunns J-K, for convenience 21 0.99974668 22 0.99974255 Find: 23 0.9997379 24 0.99973268 83 0.9540321 41 0.99943469 42 0.99939187 43 0.99934375 44 0.99928967 45 0.99922888 62 0.9957664 63 0.99526983 64 0.99471199 65 0.99408535 66 0.99338147 84 0.94850723 85 0.94233546 86 0.93544631 87 0.92776301 104 0.5795003 105 0.54160688 106 0.50196433 107 0.46085907 108 0.41866093 expected value 25 0.99972681 46 0.99916056 67 0.99259091 88 0.91920228 109 0.37582462 standard deviation Your client plans to sell 1000 of these annuities to lives aged 65 Find the 95% confidence interval for the AVERAGE present value of the 1000 annuities: 26 0.99972021 27 0.99971279 28 0.99970446 29 0.99969509 30 0.99968455 47 0.99908378 48 0.99899748 49 0.99890048 50 0.99879147 51 0.99866896 68 0.99170307 69 0.99070609 70 0.98958667 71 0.98832996 72 0.98691932 89 0.90967429 90 0.89908266 91 0.8873248 92 0.87429242 93 0.85987237 110 0.33288578 111 0.29045021 112 0.24917498 113 0.20974076 114 0.17281576 low end 31 0.99967272 52 0.99853127 73 0.98533617 94 0.84394794 115 0.13901304 high end 95 0.82640064 32 0.99965941 33 0.99964446 34 0.99962765 35 0.99960875 36 0.99958752 37 0.99956365 38 0.99953682 39 0.99950667 40 0.99947278 53 0.99837654 54 0.99820264 55 0.99800722 56 0.99778761 57 0.99754083 58 0.99726352 59 0.99695192 60 0.99660179 61 0.99620839 74 0.98355973 75 0.98156684 76 0.97933166 77 0.97682538 78 0.97401598 79 0.97086786 80 0.96734152 81 0.96339319 82 0.95897451 96 0.80711261 97 0.78596971 98 0.76286551 99 0.7377061 100 0.71041605 101 0.68094525 102 0.6492769 103 0.61543631 116 0.10884444 117 0.0826765 118 0.0606945 119 0.04288167 120 0 121