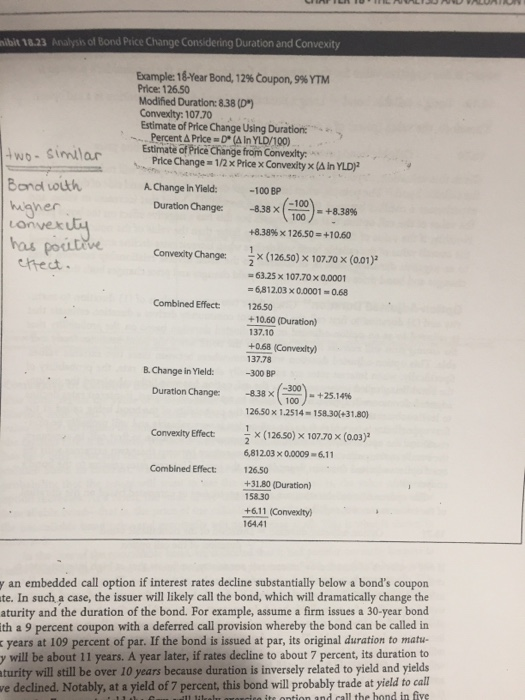

x v A (b) Two year forward rate, 2 year from now As a fixed income portfolio manager, you are considering purchasing one of two bond issues from diversified chemical companies, DowDuPont and BASF Corporation, for Bank of America Merrill Lynch. You are a conservative risk-averse investment portfolio manager. DowDuPont offers $596.97 The bond convexity for DowDuPont is 122.47. The BASF offers a 9%, 20-Year corporate bond, with a 10% YTM, priced at $914.86. The bond convexity for BASF is 119.97. Bank of America Merrilt Lynch Market Strategists and Economists are projecting interest rates may possibly increase by 100 basis points, consistent with Janet Yellen's FRB forecast. Bloomberg recently reported that financial market considerable weakness based on job reports and low consumer spending and that rates may possibly fall by 300 basis points. You must perform the inte a 4%, 15-Year corporate bond with a 9% YTM, priced at rest rate sensitivity lysis of these two bond issues for the Head of Fixed Income, closely evaluating the tion and convexity, and determining which bond is the most appropriate investment for Bank of America Merrill Lynch's fixed income oints or increase by 100 basis points. One bond must be effective under both basis p interest rate scenarios. Substantiate your argument. Note: You must prepare a Bond Duration Worksheet (refer to Financial Markets, Practic Exercises and Problems Worksheets A-C) for each bond and present the prcentage changes and additional information in a format similar to Page 653, Chaptel 18, The nalysis and Valuation of Bonds. Also, round all percentage changes to two decimal places ibit 18.23 Analysis of Bond Price Change Considering Duration and Convexity Example: 1g-Year Bond, 12% Coupon, 9% YTM Price: 126.50 Modified Duration: 838(D") Convexlity: 107.70 Estimate of Price Change Using Duration Percent A Price D (A In YLD/100) Estimate of Price Change from Convexity: Pice Change -1xPiceCvy x (AIh YLDy A.Change In Yield: 100BP Bond LOut igher Lonvex ( )-+838% Durat onChange: -838 (-100 )-+8.38% +10.50 -8.38 10 +8.38% x 126.50 bas poutve Convexity Change: (12650) 10770 x (001)2 63.25 x 107.70 x 0.0001 -6,812.03 x 0.0001 0.68 hect Combined Effect: 12650 +10.60(Duration) 37.10 +0.68 (Convexity) 137.78 B.Change in Tield: 300 BP Duration Change:-838 X -838-G ).+25 14% Duration Change: T )-+25.14% 12650x 1.2514 158.30+31.80) Convexity Effect x (126.50) x 107.70 x (003) 6,81203 x 0.0009 6.11 Combined Effect: 126.50 +31.80 (Duration) 158.30 +6.11 (Convexlty) 64.41 y an embedded call option if interest rates decline substantially below a bond's coupon te. In such a case, the issuer will likely call the bond, which will dramatically change the aturity and the duration of the bond. For example, assume a firm issues a 30-year bond th a 9 percent coupon with a deferred call provision whereby the bond can be called in years at 109 percent of par. If the bond is issued at par, its original duration to matu y will be about 11 years. A year later, if rates decline to about 7 percent, its duration to turity will still be over 10 years because duration is inversely related to yield and yields e declined. Notably, at a yield of 7 percent, this bond will probably trade at yield to call tr ontion and call the hond in five