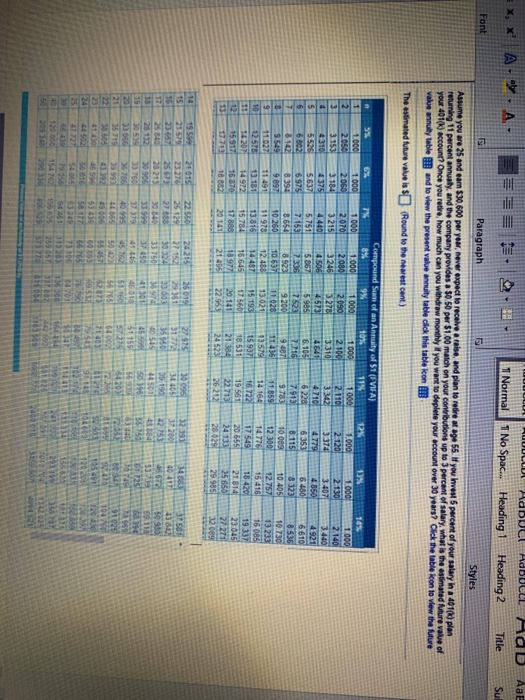

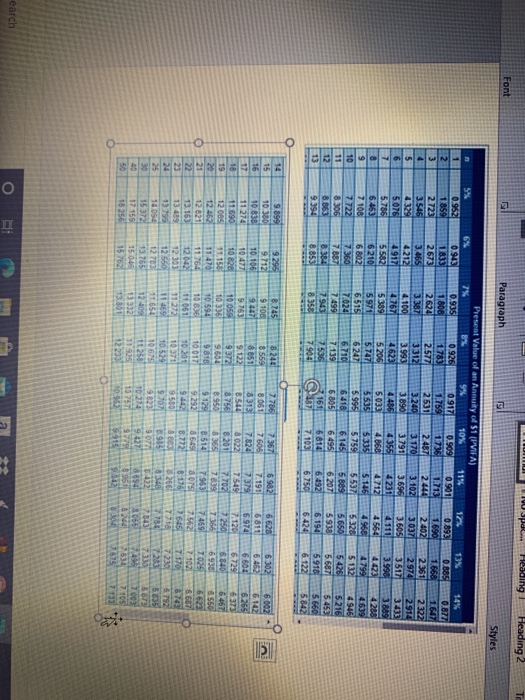

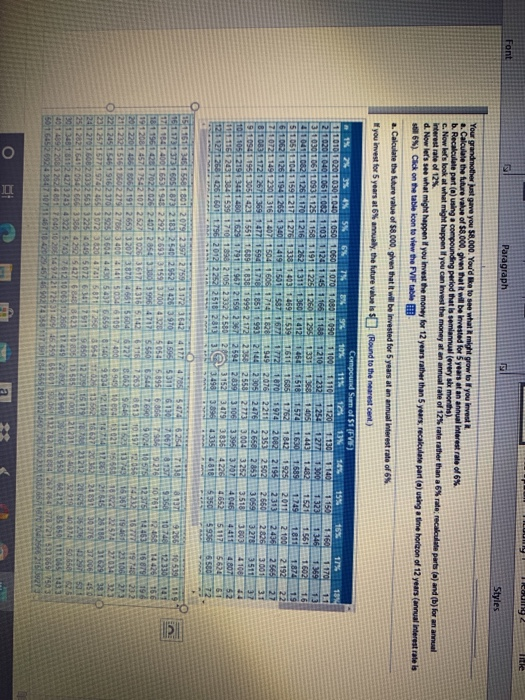

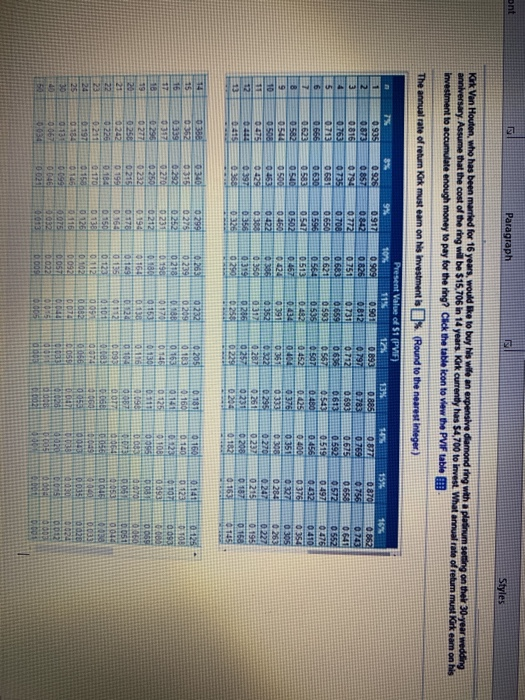

x x A.wy. A E DE 1 Normal 1 No Spac.. Hdbull AdDDEL Hab AaB Heading 1 Heading 2 Title Sul Font Paragraph Styles Assume you are 25 and earn $30.600 per year, never expect to receive a raise and plan to retire at age 55. If you Invest 5 percent of your salary in a 401(k) plan returning 11 percent annualy, and the company provides a $0.50 per $1.00 match on your contributions up to 3 percent of salary, what is the estimated future value of your 401(k) account? Once you retire, how much can you withdraw monthly you want to deplete your account over 30 years? Click the table kon to view the future valve annuity table and to view the present value annuity table click this table icon The estimated tuture values Round to the nearest cent) 1 2 3 4 5 6 1.000 2050 3153 1.000 2.140 3.440 5526 6802 1000 2060 3184 4 375 5.637 6.975 394 9897 11 491 13.181 14.972 16.870 18.882 7% 1000 2070 3215 4440 5.751 7.153 8.654 10.250 11978 13 816 15784 17 86 20141 Compound Sum of an Annuity of $1 (FIFA) 8% 9% 10% 11% 1.000 1000 1.000 1000 2080 2090 2100 2.110 3246 3.276 3310 3342 4.506 4573 4641 4710 5867 5985 6.105 6228 7336 7523 7.716 7913 8.923 9 200 9487 9.783 10637 11 028 11.859 12.488 13021 13579 14 164 14 487 15.193 15 937 16.722 16 645 1760 18.531 19.561 18977 20.141 21 384 22713 21 495 22 953 24523 26 212 12% 1.000 2120 3374 4.779 6 353 8.115 10 089 12 300 14.776 17 549 20655 24133 28 029 13% 1.000 2130 3407 4,850 6.480 3323 10.405 12.757 15 416 18 420 21.814 9 10 11 11027 12 570 14207 15.917 17.713 6610 8.536 10.730 13233 16 005 19337 23.045 27271 32009 29 985 195 24215 21 015 23276 25673 22550 25 129 15 16 350 23651 25015 29361 33.00 3397 30324 33.750 3.450 27.975 3177 55550 4545 25596 5.15 40417 486 30 340 339 37 379 4099 3293 37.280 42 153 45884 5550 30 095 34405 39 190 44501 50.19 5690 54203 30 500 33760 3570 39993 3304 35719 38.505 20 21 22 23 124 ST 6400 81210 46 51 160 56 76 62873 695 767 24.01 2599 5042 55457 GOES 66765 73100 49000 5343 58 177 63243 5446 1596 006 544 47 23 353 120 00 209 30 10 5 2730 3163 LIV SPOR Heading Heading 2 T Font Paragraph Styles 1647 JAUNE 5% 0.952 1859 2.723 3546 4329 5076 5.786 6.453 7 106 7722 8.306 81863 9.394 Present Value of an Annuity of $1 (PVIFA) 6% 7% 844 9% 10% 11% 0.943 0.935 0.926 0917 0.909 0901 1.833 1.808 1783 1.759 1736 1.713 2673 2624 2577 2501 2.487 2444 3.465 3387 3312 3 240 3.170 3.102 4.212 4.100 3.993 3890 3.791 37696 4917 4767 4.486 4355 5582 5389 5 206 5033 4.868 4712 6210 5971 5727 5535 5.335 5.146 6 802 6 515 6 247 5.995 5.759 5537 7360 6710 6418 6.145 5.889 7.887 7.499 7139 6 805 6 495 6 207 8.384 1943 7.536 161 6814 6.492 8.853 8.358 7.904 187 7103 6.750 4623 4231 12% 13% 14% 0893 0.885 0.877 1690 1.668 2402 2361 2322 3037 2974 2914 3.605 3517 3433 4111 3.996 3885 4564 4286 4968 4799 4.639 5.328 5132 4946 5.650 5 426 5216 5938 5.687 5453 6.194 5.916 5.660 6424 6 122 5842 8 9 10 11 12 13 7024 6982 15 16 17 18 19 20 21 9 899 10380 10838 11 274 11.690 12 085 12 463 12 821 13 163 13 499 13.799 14094 15372 17 155 6.628 6811 6.974 7.120 250 9295 9712 10.106 10477 10 82 11.158 11 470 11764 12042 12 303 12.550 12783 13.763 15.045 8.745 9106 94471 9.763 10.059 10 336 10 594 10835 11061 11.272 11465 11550 12-109 3 332 13.30 7.786 8.061 8313 8.544 8756 8950 9129 9.292 9.442 6 002 6142 6.265 6.373 6467 6.550 8 240 8559 8851 9.122 9372 9.604 9818 10.017 10 201 10 31 10.529 10675 11258 1194 12233 7.367 7606 7.824 8022 8.201 8265 8514 8 649 8.772 3800 6 302 6.462 6600 6729 6.840 6936 7025 7102 7.170 230 7283 7330 7.191 7379 7509 7.702 7839 7 953 8075 8.176 8266 838 5.42 8694 8961 9.12 6622 6.6870 23 6743 6.792 E93 7.459 7.562 645 7718 7.784 7343 8.055 8200 5338 9707 9823 10.214 1075 10952 25 30 9077 9421 9775 9915 6.873 7003 105 50 15760 27630 earch o II ng Teous 2 Font Paragraph Styles Your grandmother fint gave you $8,000. You'd like to see what it might grow to you invest a. Calculate the future value of $8.000, given that it will be invested for 5 years at an annual interest rate of 6% b. Recalculate part() using a compounding period that is semiannual every ste months) c. Now let's look at what might happen if you can Invest the money at an annual rate of 12 rata rather than a rate recalculata parta (a) and (b) for an annual d. Now let's see what might happen if you invest the money for 12 years rather than 5 years, recalculate part (n) using a time horizon of 12 years (annual interest rate is 6). Click on the table icon to view the FVF table 2. Calculate the ture value of 58.000. ghen that it will be invested for 5 years at an annual interest rate of 6% you invest for 5 years at 6% annually the future values Round to the nearest cent) Compound Sum of $1 (FV) 5% 11% 106 13% 14% 15% 1050 1060 16% 11% 13 1.129 1.130 1140 1 150 1.103 1160 1277 1323 1346 1 369 1 158 1.443 1482 1521 1561 1.6021 1216 16 16301.689 1.749 1 811 1.872 1276 1338 19 1611 1.762 1842 1925 2011 2.100 2192 1340 22 1974 2082 2.195 2 313 2436 2565 27 1.407 22112353 2.502 2660 2826 1.477 2.144 3.001 230524762656 2855 3059 423 1 551 3.273 3511 37 358 2558 2.1733.004 3.252 3518 3803 4 100 2594 283 3.1063396 117 710 3707 4046 4 411 3152 4807 3836 4226 4652 1601 796 2516 61 3.4993.896 1335 4818 5350 5936 6.580 72 1170 24 5624 079 2391275 17237642 4177 4.595 5054 4 7051347 531 8137 292 2693 0262 407 2854 107 26273026 3617 1912653 3207 275 276 3400 37029253604 72246530723620 2563) 225 409 6633429 92061053919 141 166 196 232 23 6116 5727 400 1.40 25 331 459 537 040 10 20 14914 269484730711 46716420945746902123400173 10000356 2153 BI ant F Paragraph Styles TH 0926 Kirk Van Houten, who has been married for 16 years, would like to buy his wife an expensive diamond ring with a platinum setting on their 30-year wedding anniversary. Assume that the cost of the ring will be $15.706 in 14 years Kirk currently has 54,700 to Invest. What annual rate of return must Kirk eam on his investment to accumulate enough money to pay for the ring? Click the table icon to view the PVIF table ! The annual rate of return Kik must eam on his investment is % (Round to the nearest Integer) Present Value of $1(PVIF) 9% 10% 11% 123 13% 14% 15% 16% 1 0.935 0917 0 90s 0.901 1893 0.885 0.877 0 870 0.862 2 0873 0857 0842 0.826 0812 0.797 0.783 0.769 0.756 0743 3 0816 794 0.772 0751 07311 0.712 0693 0675 0658 0641 4 0.763 735 07700 07659 0636 0613 0592 05772 0552 5 0.713 0650 0621 0 593 01567 0543 0.519 0 497 0.476 6 0.666 0630 0.596 0564 0535 0507 09480 0456 0232 0410 7 0623 0.582 0.547 0513 04492 0.452 0.425 0.400 0 376 0354 B 0.582 0.540 0502 0467 0:404 0.376 0 351 0327 0305 9 0.500 0 460 0424 0.391 0 351 0333 0.398 0280 0.263 0422 0336 0.352 02 0295 0.270 0.247 0227 0380 0.350 0312 0 281 0.261 0237 0215 04195 0397 0356 0319 0286 0257 0208 0187 160 0.326 0290 0.256 0.225 0203 0.163 034 HA 0386 15 16 17 0:339 0 160 01120 0:123 0.100 0 141 0 123 107 000 031 0125 TOE 093 0.00 0059 0.205 0.183 0 16 0.146 0.1301 0.116 0104 0.09 0.1811 0.160 0.141 0 125 0.111 19 0087 bota 0315 0292 0.270 0.250 0232 0215 0199 0.184 0.170 0 150 19 20 0277 0.256 0242 0229 DOS 0 299 0275 0252 0.231 0212 0194 0178 0.164 0.150 0 13 0 126 116 0.075 0.032 0.013 0.265 0239 0218 0190 0.100 0164 0129 0 135 0 123 0 112 0 102 0092 DOSTI 0.022 DO 0.05 0232 0209 018 0.170 0 150 0118 0524 0112 0.101 009 0.092 0.074 0.040 0,015 0.005 22 23 08 25 30 01 0197 0 184 0.131 0067 0.034 0699 0021