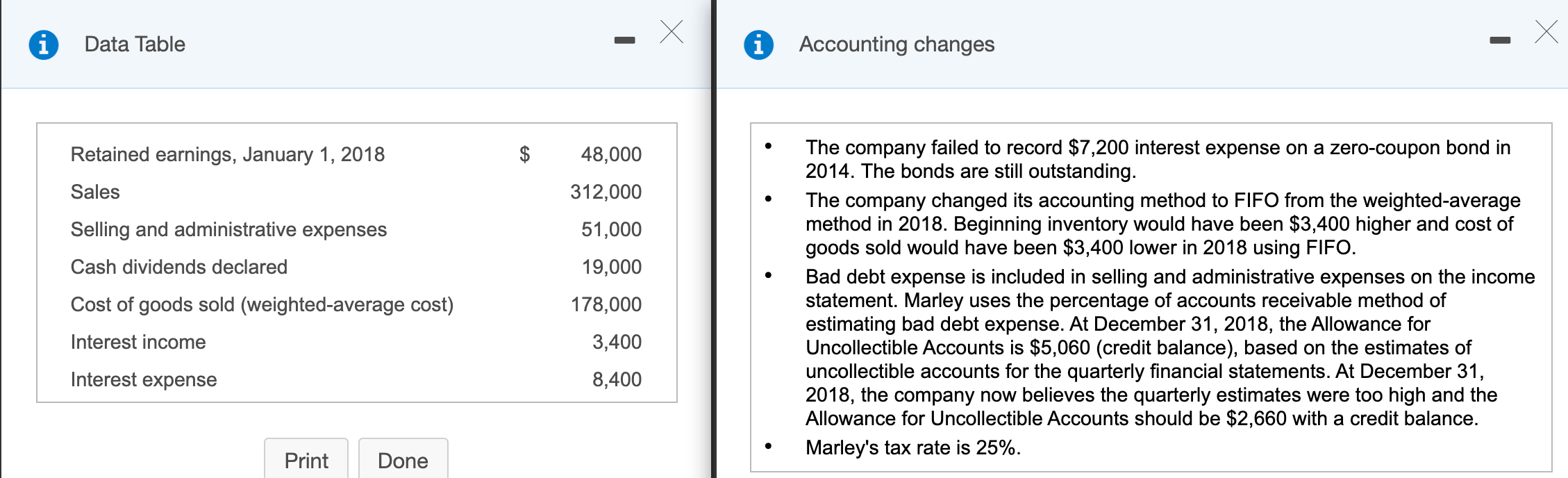

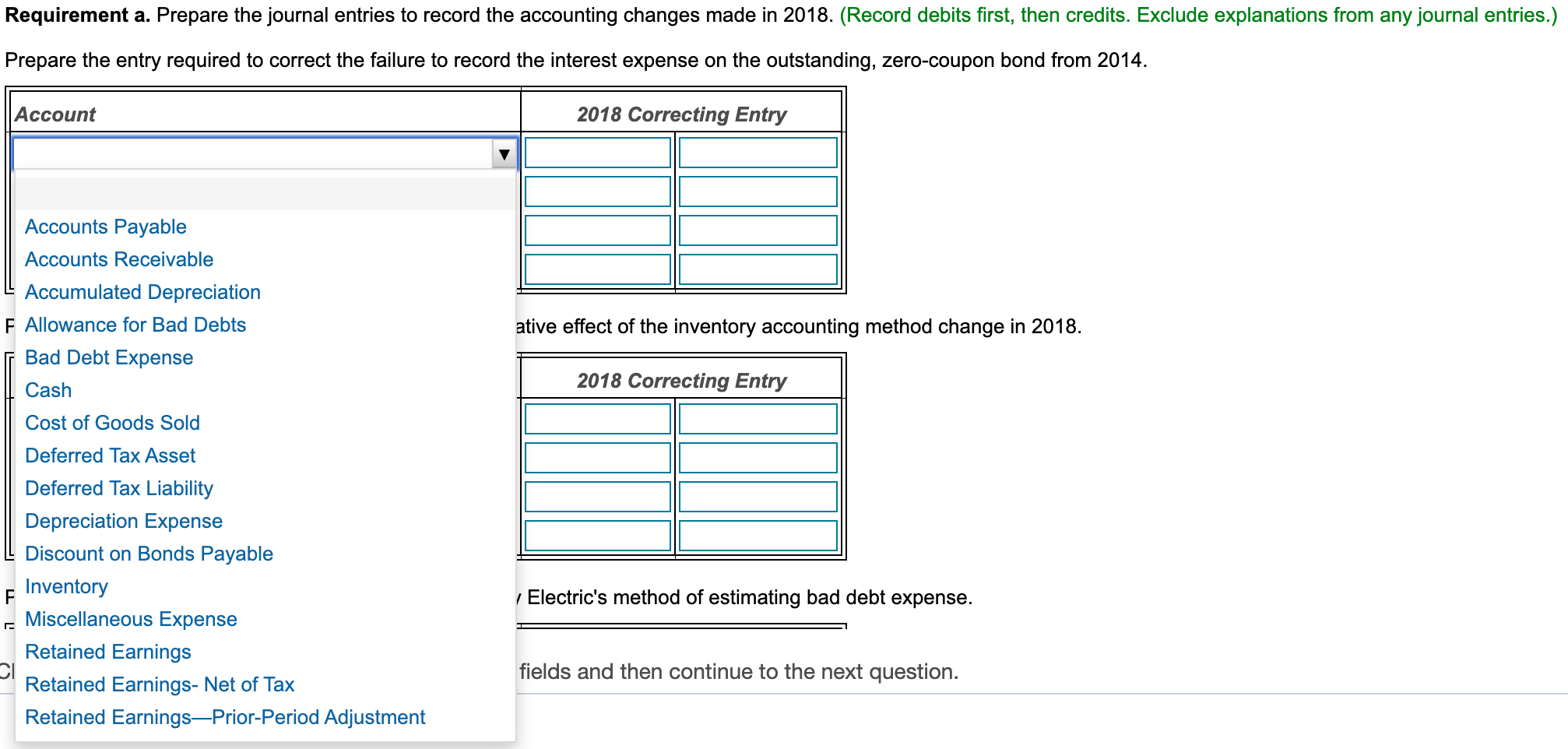

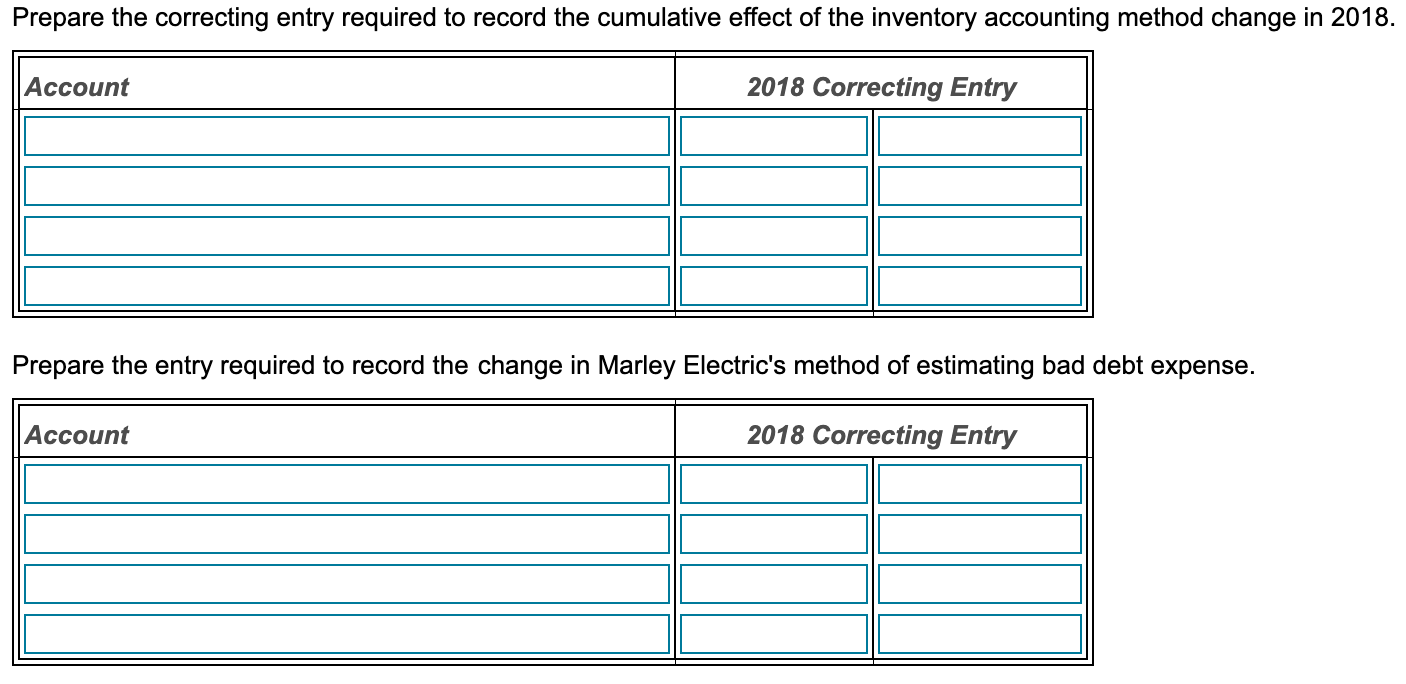

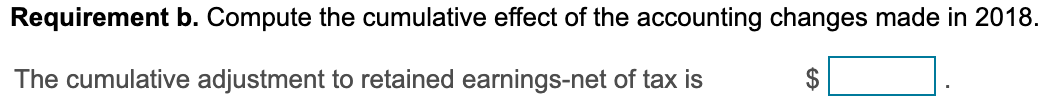

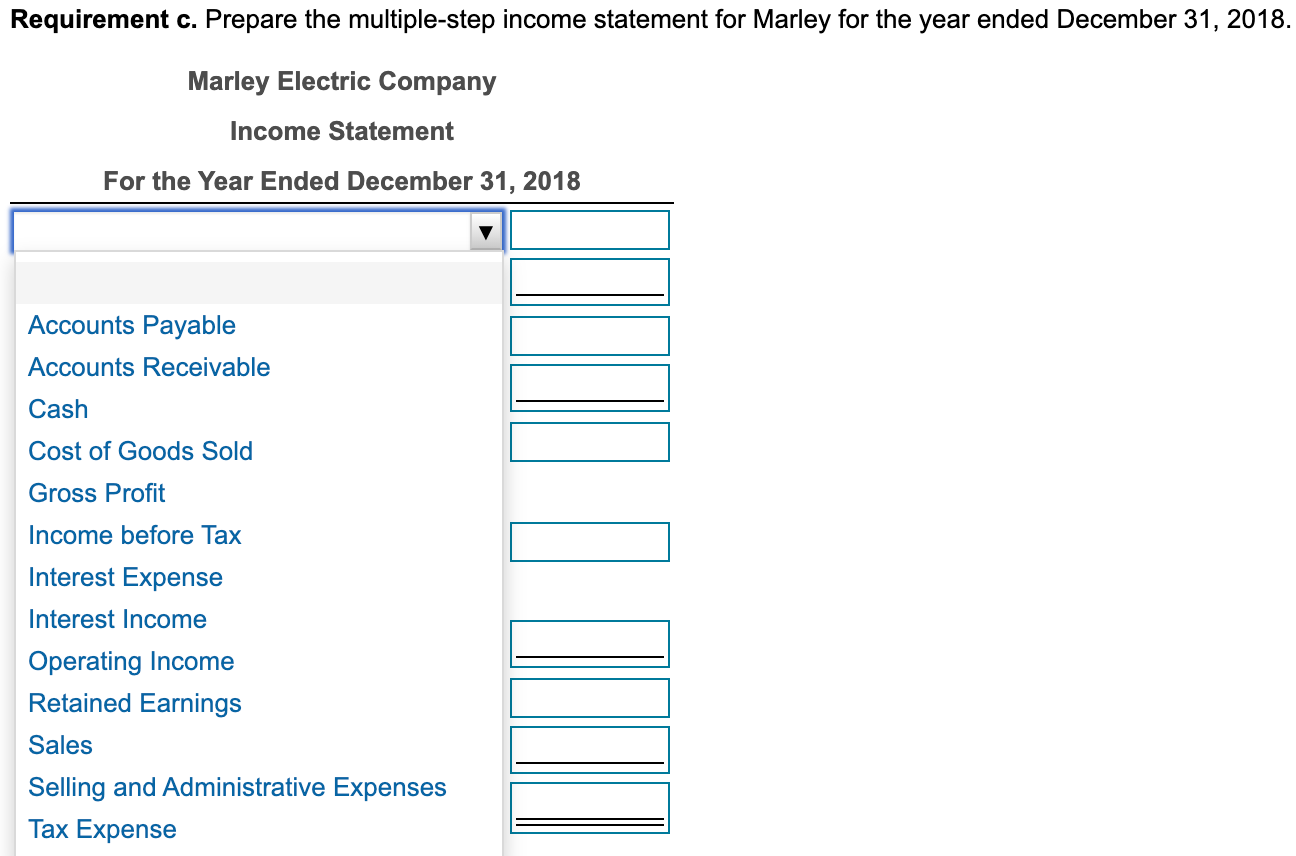

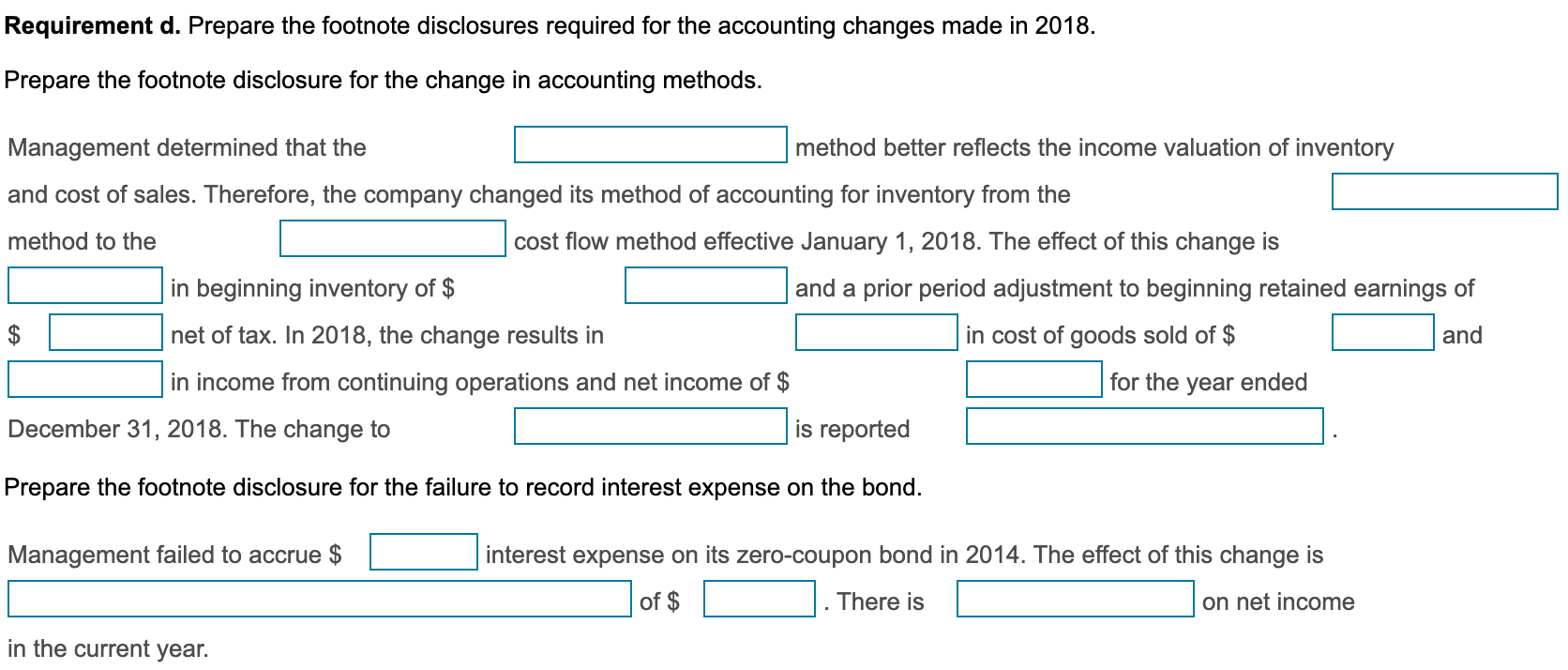

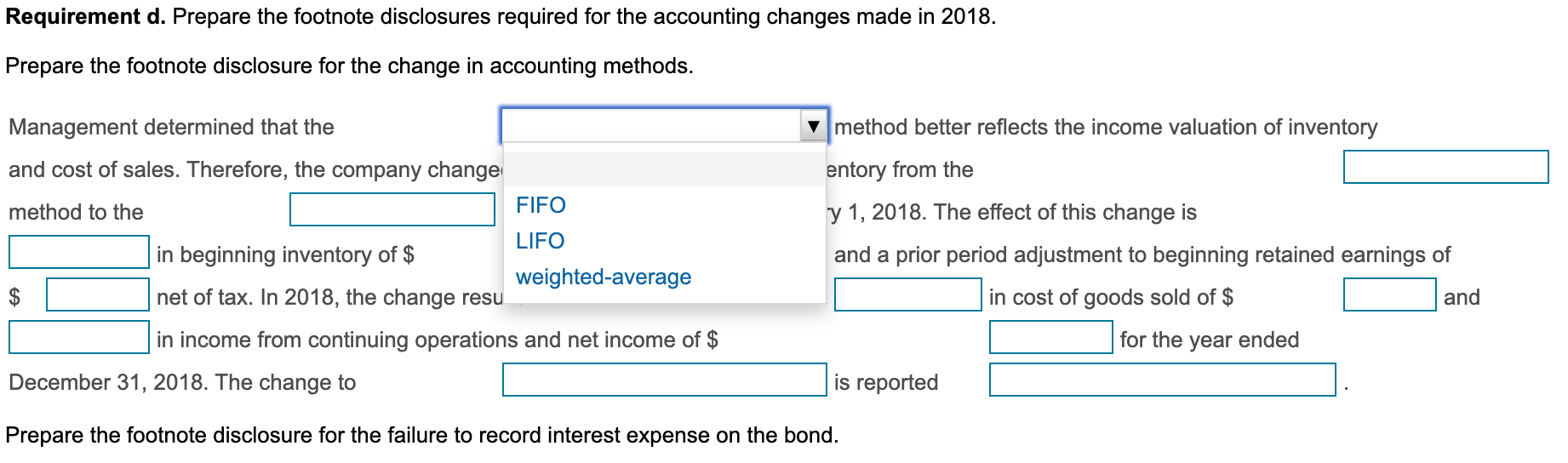

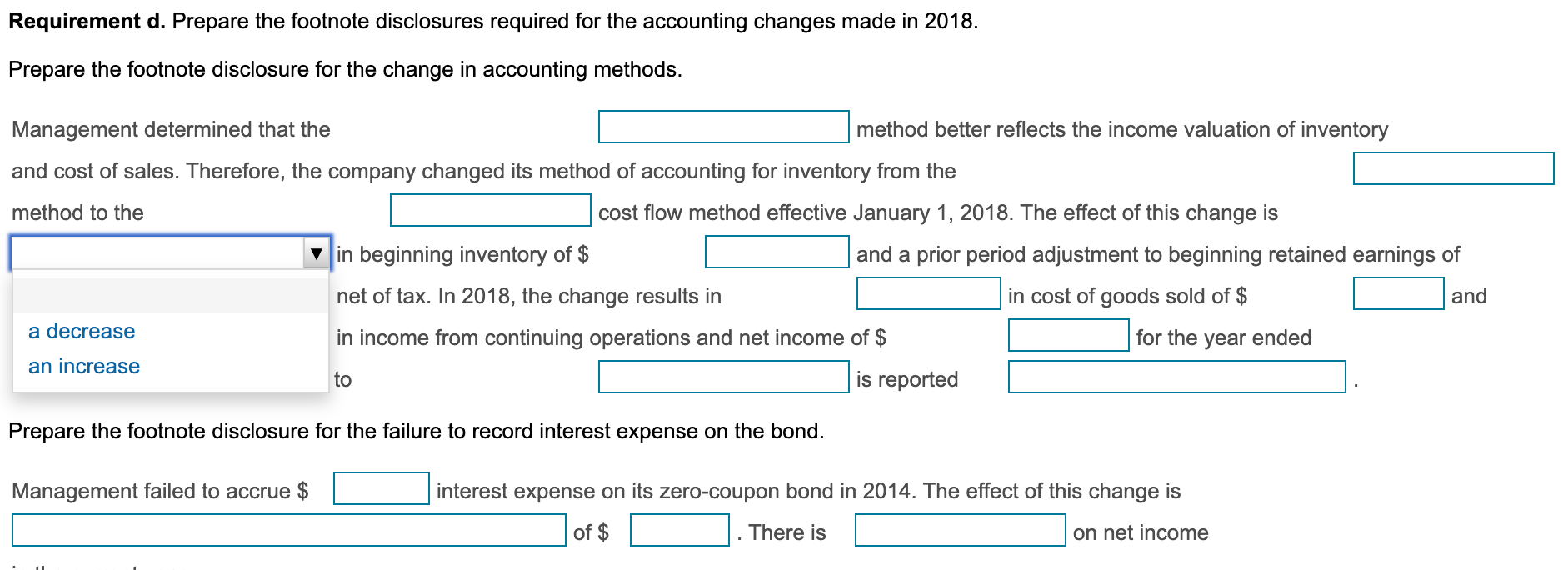

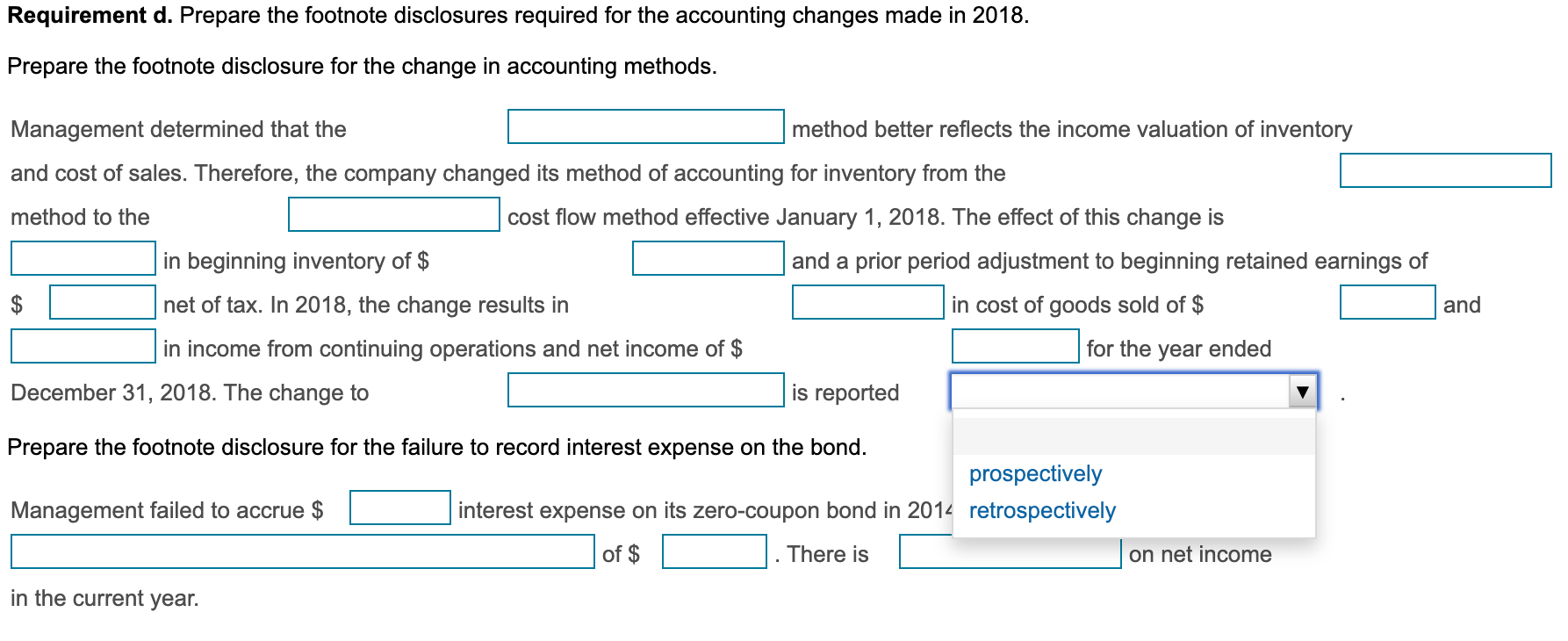

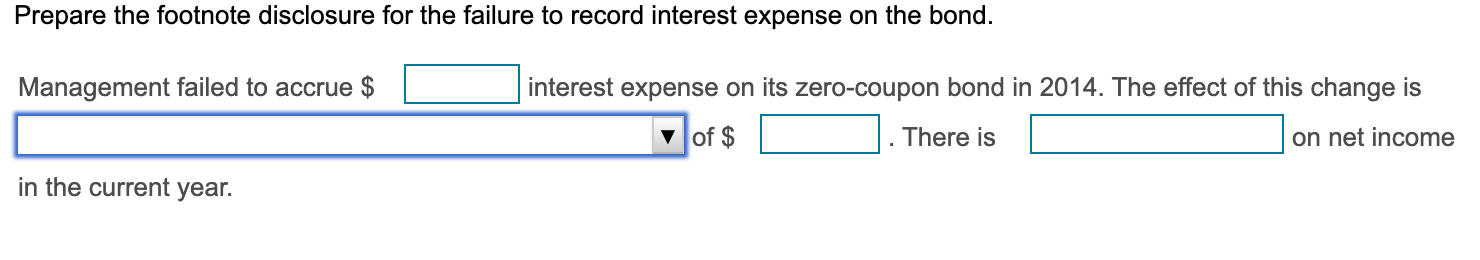

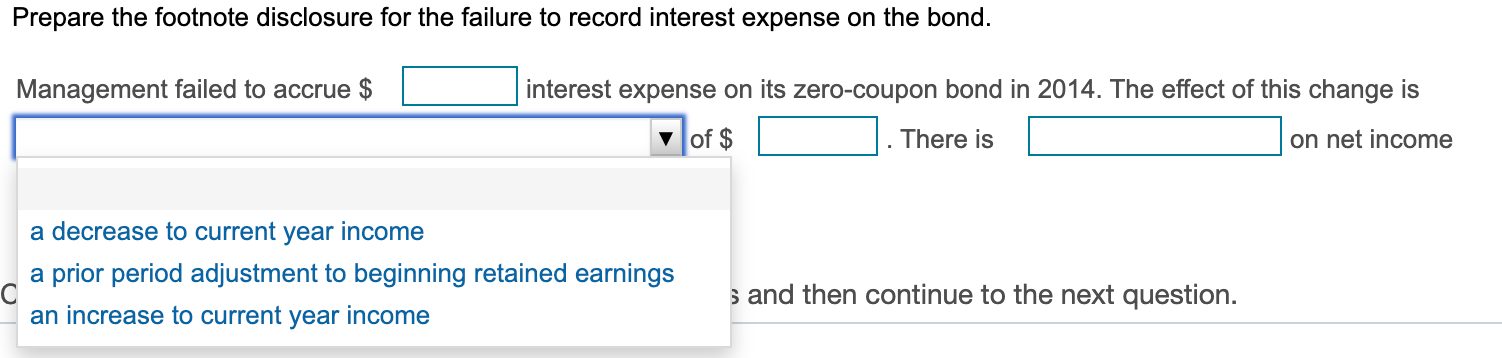

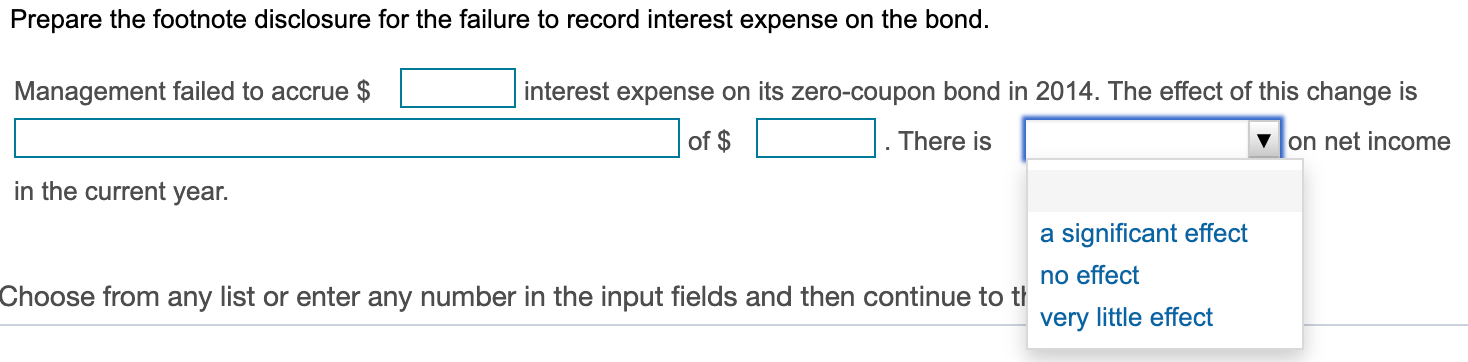

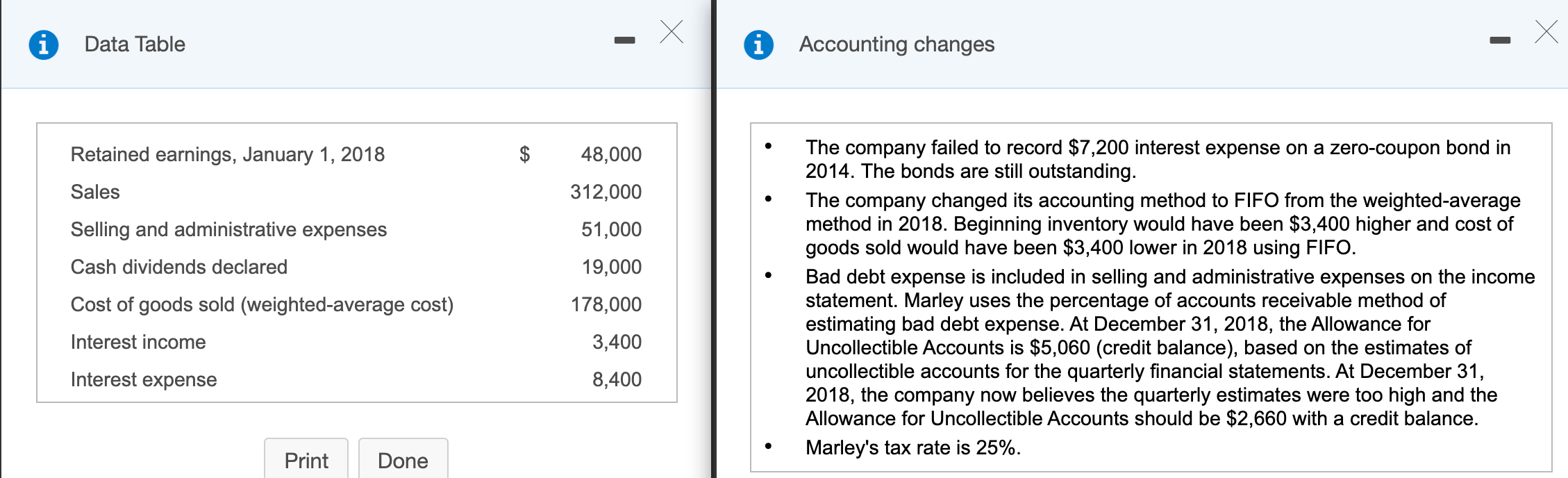

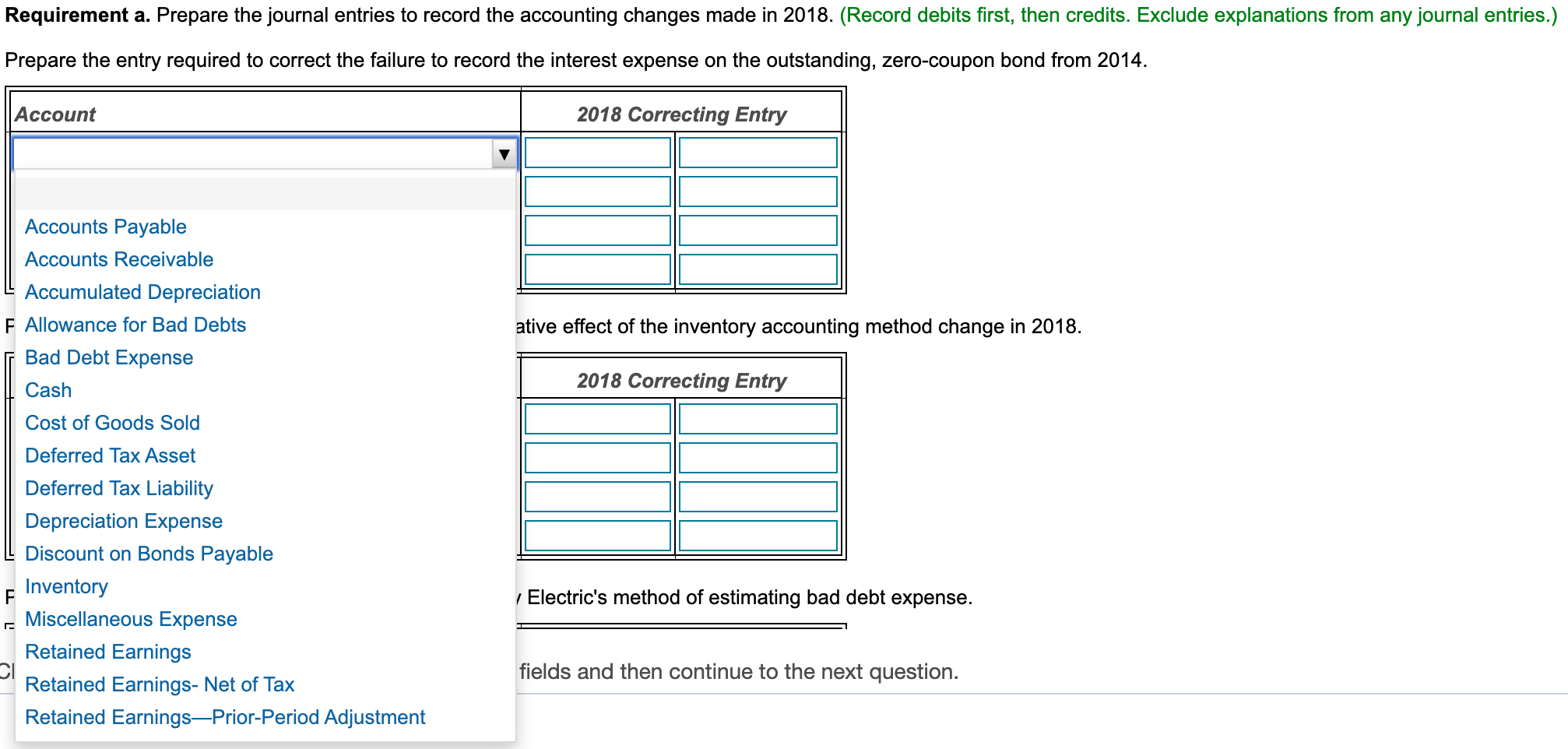

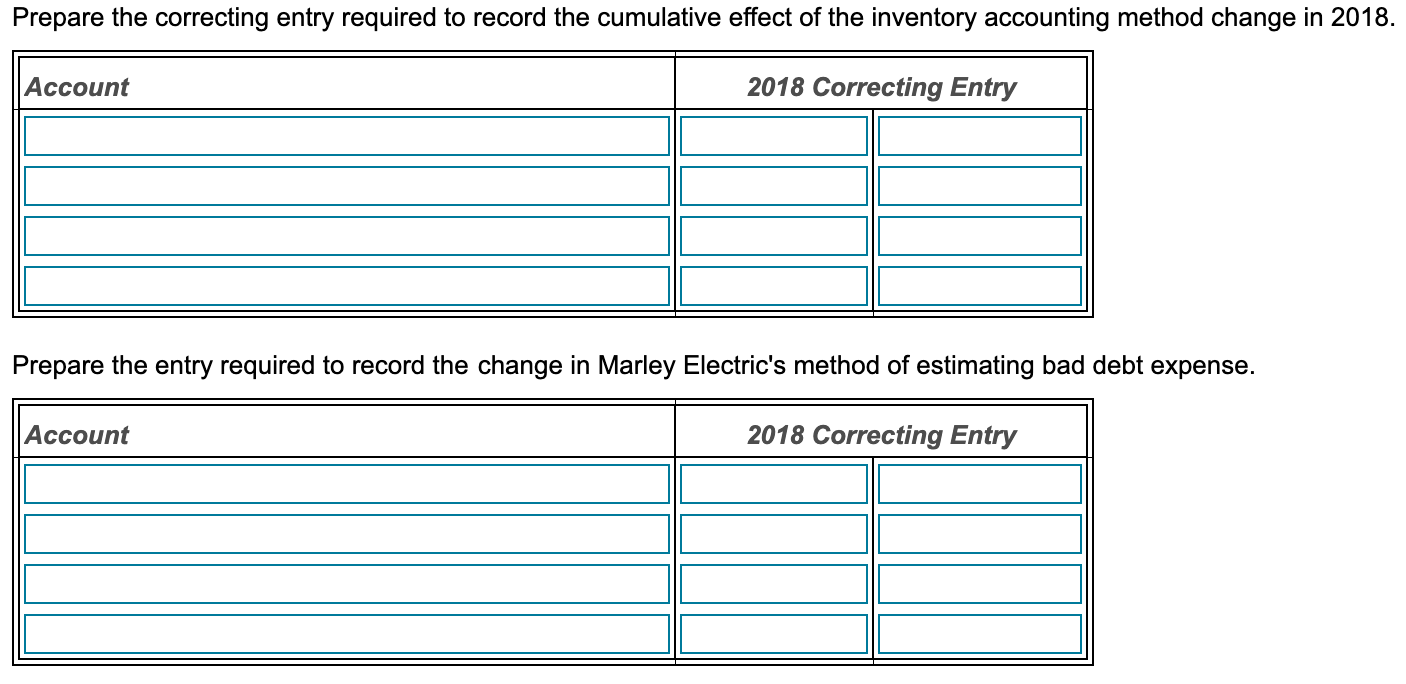

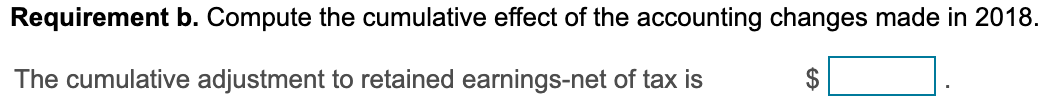

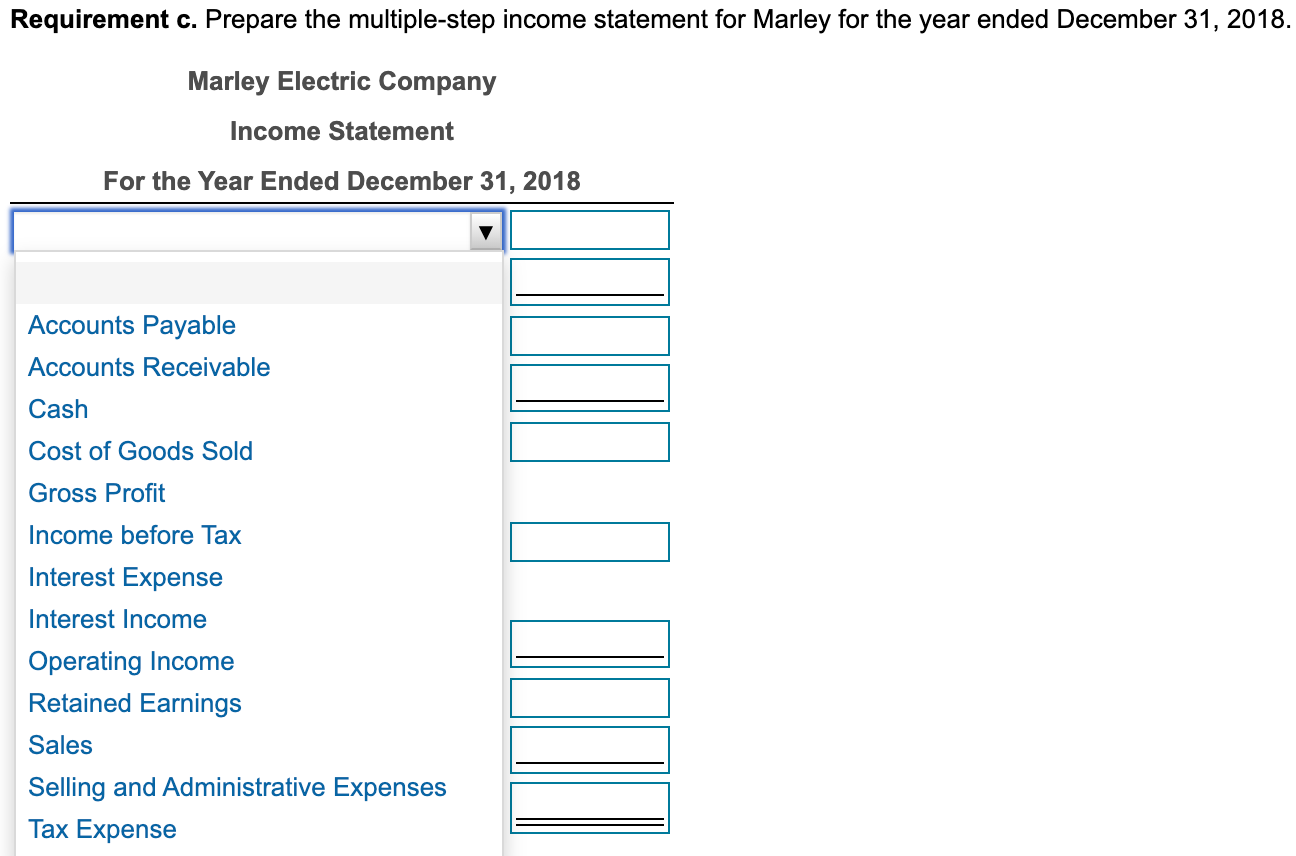

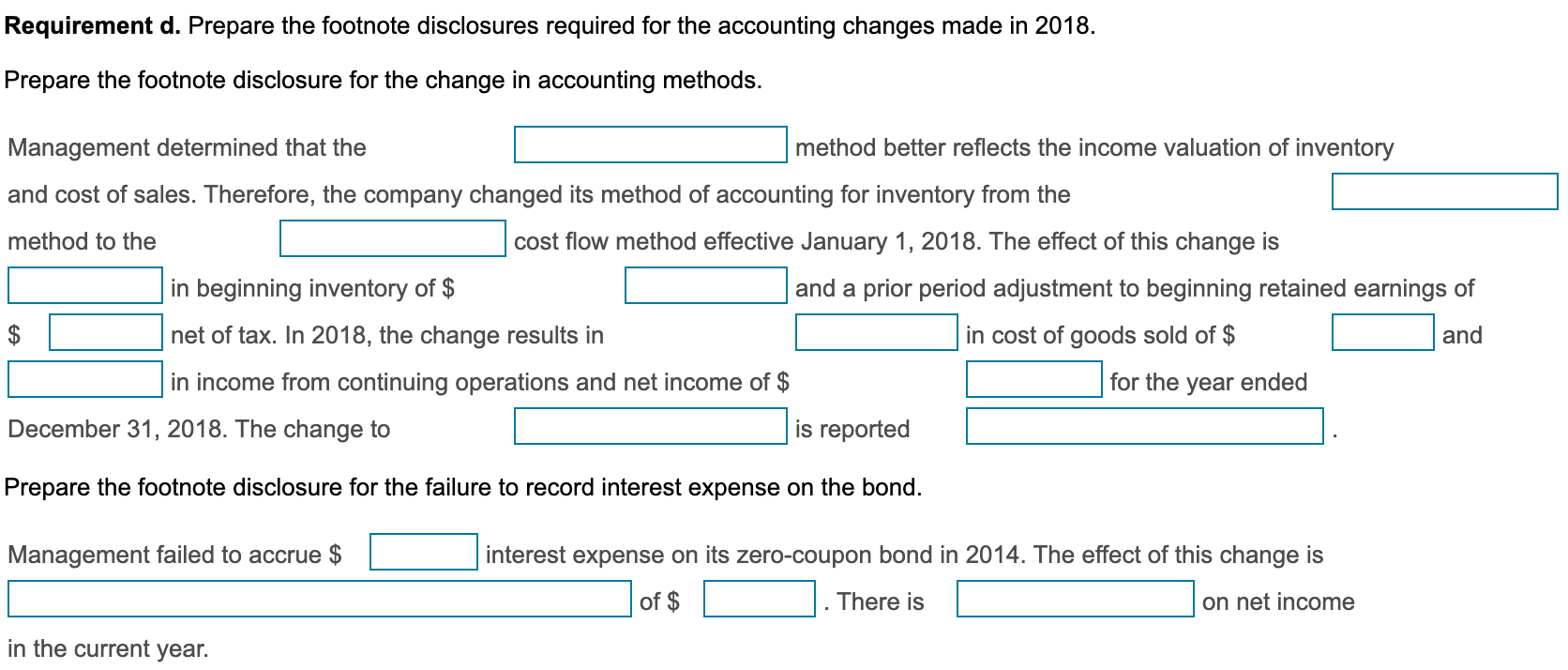

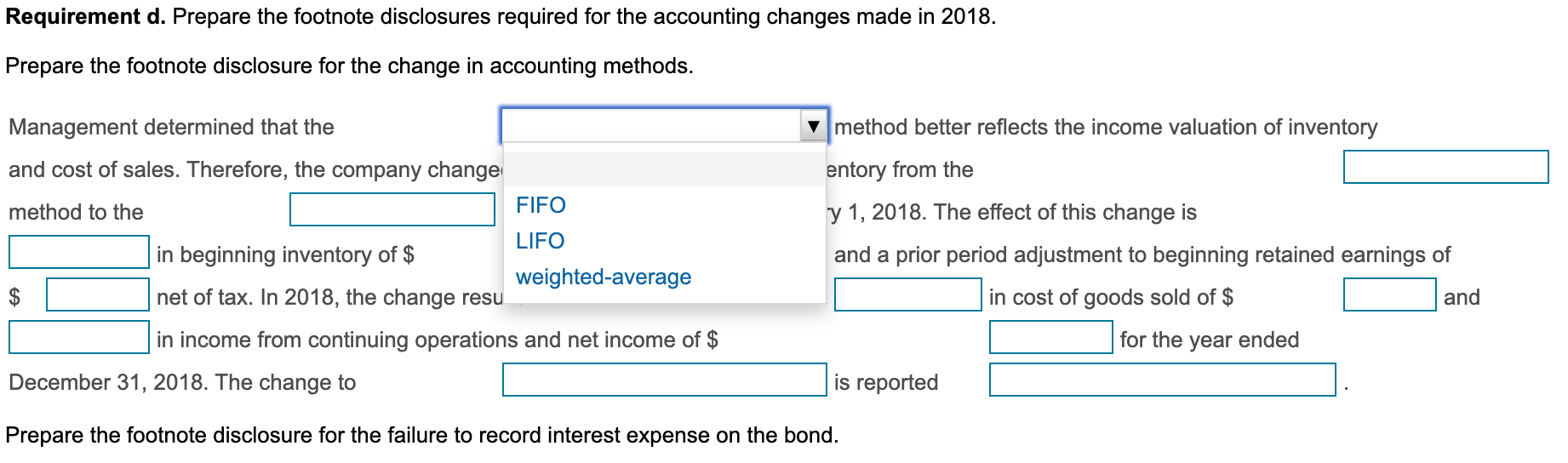

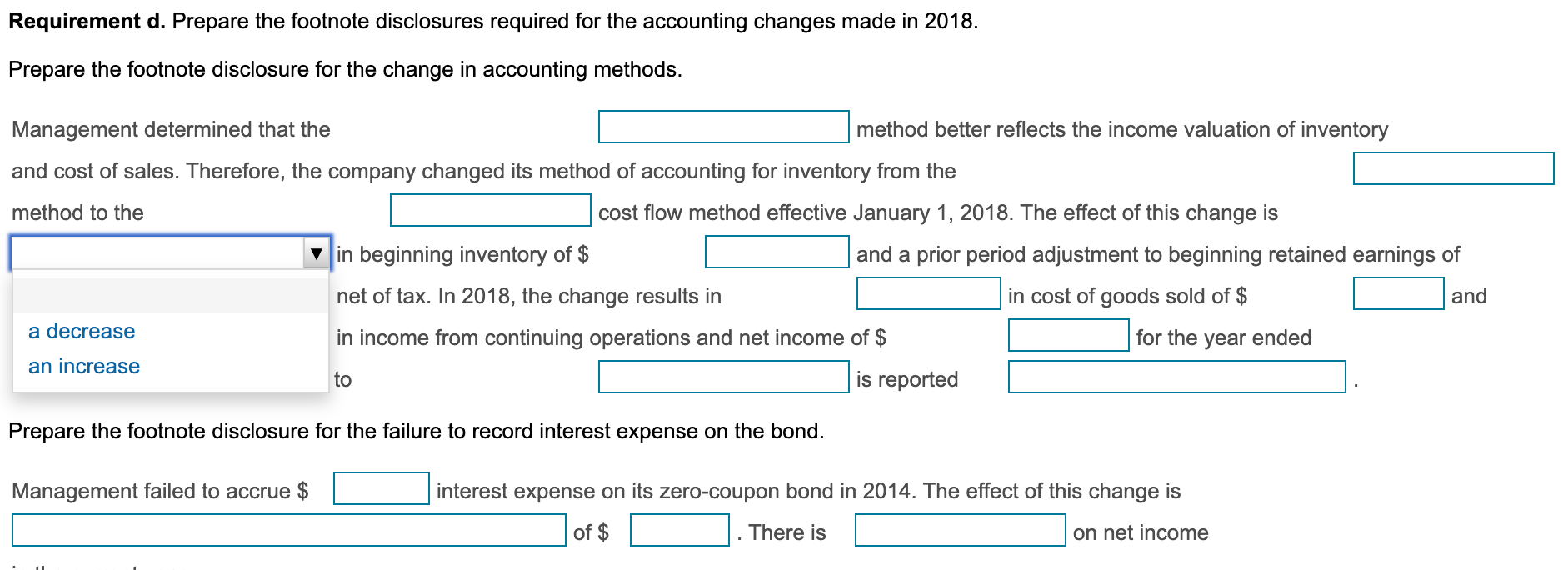

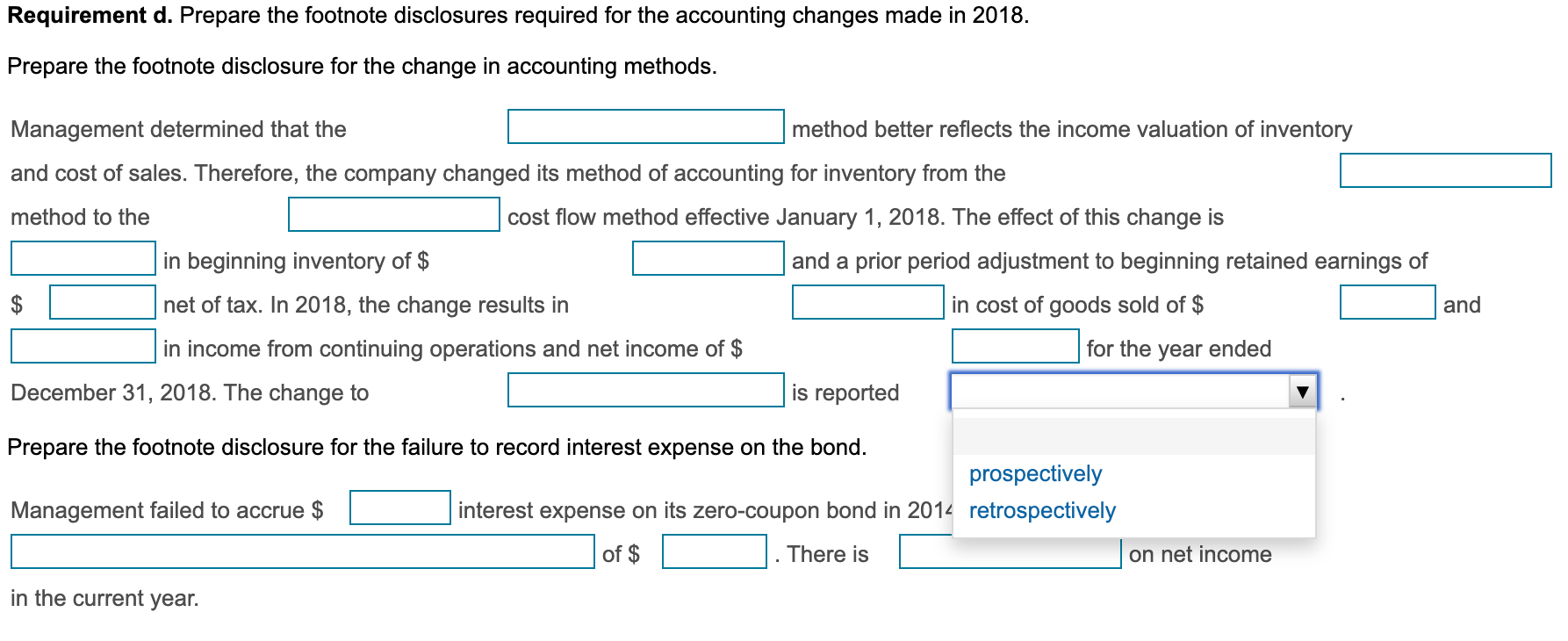

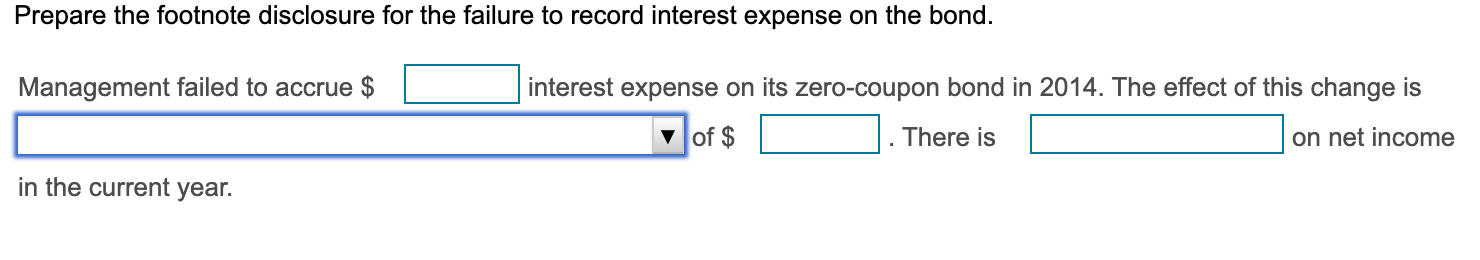

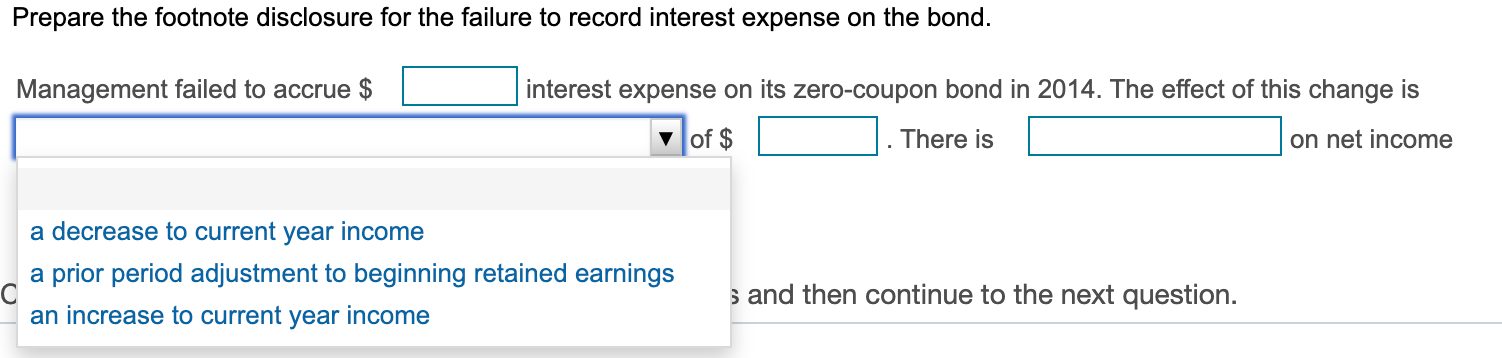

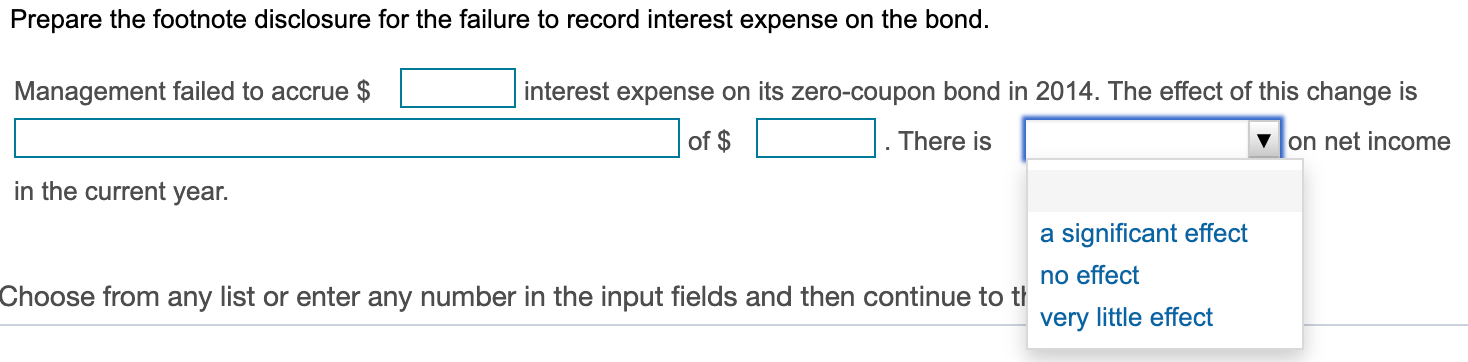

X - X i Data Table i Accounting changes Retained earnings, January 1, 2018 48,000 Sales 312,000 Selling and administrative expenses Cash dividends declared Cost of goods sold (weighted average cost) Interest income 51,000 19,000 178,000 3,400 The company failed to record $7,200 interest expense on a zero-coupon bond in 2014. The bonds are still outstanding. The company changed its accounting method to FIFO from the weighted-average method in 2018. Beginning inventory would have been $3,400 higher and cost of goods sold would have been $3,400 lower in 2018 using FIFO. Bad debt expense is included in selling and administrative expenses on the income statement. Marley uses the percentage of accounts receivable method of estimating bad debt expense. At December 31, 2018, the Allowance for Uncollectible Accounts is $5,060 (credit balance), based on the estimates of uncollectible accounts for the quarterly financial statements. At December 31, 2018, the company now believes the quarterly estimates were too high and the Allowance for Uncollectible Accounts should be $2,660 with a credit balance. Marley's tax rate is 25%. Interest expense 8,400 Print Done Requirement a. Prepare the journal entries to record the accounting changes made in 2018. (Record debits first, then credits. Exclude explanations from any journal entries.) Prepare the entry required to correct the failure to record the interest expense on the outstanding, zero-coupon bond from 2014. Account 2018 Correcting Entry Accounts Payable Accounts Receivable Accumulated Depreciation F Allowance for Bad Debts Bad Debt Expense Cash ative effect of the inventory accounting method change in 2018. 2018 Correcting Entry Cost of Goods Sold Deferred Tax Asset Deferred Tax Liability Depreciation Expense Discount on Bonds Payable F Inventory Electric's method of estimating bad debt expense. Miscellaneous Expense Retained Earnings Retained Earnings- Net of Tax Retained EarningsPrior-Period Adjustment fields and then continue to the next question. Prepare the correcting entry required to record the cumulative effect of the inventory accounting method change in 2018. Account 2018 Correcting Entry Prepare the entry required to record the change in Marley Electric's method of estimating bad debt expense. Account 2018 Correcting Entry Requirement b. Compute the cumulative effect of the accounting changes made in 2018. The cumulative adjustment to retained earnings-net of tax is $ Requirement c. Prepare the multiple-step income statement for Marley for the year ended December 31, 2018. Marley Electric Company Income Statement For the Year Ended December 31, 2018 Accounts Payable Accounts Receivable Cash Cost of Goods Sold Gross Profit Income before Tax Interest Expense Interest Income Operating Income Retained Earnings Sales Selling and Administrative Expenses Tax Expense HUI Requirement d. Prepare the footnote disclosures required for the accounting changes made in 2018. Prepare the footnote disclosure for the change in accounting methods. Management determined that the method better reflects the income valuation of inventory and cost of sales. Therefore, the company changed its method of accounting for inventory from the method to the cost flow method effective January 1, 2018. The effect of this change is in beginning inventory of $ and a prior period adjustment to beginning retained earnings of $ net of tax. In 2018, the change results in in cost of goods sold of $ and in income from continuing operations and net income of $ for the year ended December 31, 2018. The change to is reported Prepare the footnote disclosure for the failure to record interest expense on the bond. Management failed to accrue $ interest expense on its zero-coupon bond in 2014. The effect of this change is of $ There is on net income in the current year. Requirement d. Prepare the footnote disclosures required for the accounting changes made in 2018. Prepare the footnote disclosure for the change in accounting methods. Management determined that the and cost of sales. Therefore, the company change method to the FIFO LIFO in beginning inventory of $ weighted average net of tax. In 2018, the change resu in income from continuing operations and net income of $ December 31, 2018. The change to v method better reflects the income valuation of inventory entory from the y 1, 2018. The effect of this change is and a prior period adjustment to beginning retained earnings of in cost of goods sold of $ and for the year ended is reported Prepare the footnote disclosure for the failure to record interest expense on the bond. Requirement d. Prepare the footnote disclosures required for the accounting changes made in 2018. Prepare the footnote disclosure for the change in accounting methods. Management determined that the method better reflects the income valuation of inventory and cost of sales. Therefore, the company changed its method of accounting for inventory from the method to the cost flow method effective January 1, 2018. The effect of this change is v in beginning inventory of $ and a prior period adjustment to beginning retained earnings of net of tax. In 2018, the change results in in cost of goods sold of $ and a decrease in income from continuing operations and net income of $ for the year ended an increase to is reported Prepare the footnote disclosure for the failure to record interest expense on the bond. Management failed to accrue $ interest expense on its zero-coupon bond in 2014. The effect of this change is of $ There is on net income Requirement d. Prepare the footnote disclosures required for the accounting changes made in 2018. Prepare the footnote disclosure for the change in accounting methods. Management determined that the method better reflects the income valuation of inventory and cost of sales. Therefore, the company changed its method of accounting for inventory from the method to the cost flow method effective January 1, 2018. The effect of this change is in beginning inventory of $ and a prior period adjustment to beginning retained earnings of $ net of tax. In 2018, the change results in in cost of goods sold of $ in income from continuing operations and net income of $ for the year ended December 31, 2018. The change to is reported and Prepare the footnote disclosure for the failure to record interest expense on the bond. prospectively Management failed to accrue interest expense on its zero-coupon bond in 2014 retrospectively of $ There is on net income in the current year. Prepare the footnote disclosure for the failure to record interest expense on the bond. Management failed to accrue $ interest expense on its zero-coupon bond in 2014. The effect of this change is of $ There is on net income in the current year. Prepare the footnote disclosure for the failure to record interest expense on the bond. Management failed to accrue $ interest expense on its zero-coupon bond in 2014. The effect of this change is of $ There is on net income a decrease to current year income a prior period adjustment to beginning retained earnings an increase to current year income s and then continue to the next question. Prepare the footnote disclosure for the failure to record interest expense on the bond. Management failed to accrue $ interest expense on its zero-coupon bond in 2014. The effect of this change is of $ There is von net income in the current year. a significant effect no effect Choose from any list or enter any number in the input fields and then continue to th very little effect X - X i Data Table i Accounting changes Retained earnings, January 1, 2018 48,000 Sales 312,000 Selling and administrative expenses Cash dividends declared Cost of goods sold (weighted average cost) Interest income 51,000 19,000 178,000 3,400 The company failed to record $7,200 interest expense on a zero-coupon bond in 2014. The bonds are still outstanding. The company changed its accounting method to FIFO from the weighted-average method in 2018. Beginning inventory would have been $3,400 higher and cost of goods sold would have been $3,400 lower in 2018 using FIFO. Bad debt expense is included in selling and administrative expenses on the income statement. Marley uses the percentage of accounts receivable method of estimating bad debt expense. At December 31, 2018, the Allowance for Uncollectible Accounts is $5,060 (credit balance), based on the estimates of uncollectible accounts for the quarterly financial statements. At December 31, 2018, the company now believes the quarterly estimates were too high and the Allowance for Uncollectible Accounts should be $2,660 with a credit balance. Marley's tax rate is 25%. Interest expense 8,400 Print Done Requirement a. Prepare the journal entries to record the accounting changes made in 2018. (Record debits first, then credits. Exclude explanations from any journal entries.) Prepare the entry required to correct the failure to record the interest expense on the outstanding, zero-coupon bond from 2014. Account 2018 Correcting Entry Accounts Payable Accounts Receivable Accumulated Depreciation F Allowance for Bad Debts Bad Debt Expense Cash ative effect of the inventory accounting method change in 2018. 2018 Correcting Entry Cost of Goods Sold Deferred Tax Asset Deferred Tax Liability Depreciation Expense Discount on Bonds Payable F Inventory Electric's method of estimating bad debt expense. Miscellaneous Expense Retained Earnings Retained Earnings- Net of Tax Retained EarningsPrior-Period Adjustment fields and then continue to the next question. Prepare the correcting entry required to record the cumulative effect of the inventory accounting method change in 2018. Account 2018 Correcting Entry Prepare the entry required to record the change in Marley Electric's method of estimating bad debt expense. Account 2018 Correcting Entry Requirement b. Compute the cumulative effect of the accounting changes made in 2018. The cumulative adjustment to retained earnings-net of tax is $ Requirement c. Prepare the multiple-step income statement for Marley for the year ended December 31, 2018. Marley Electric Company Income Statement For the Year Ended December 31, 2018 Accounts Payable Accounts Receivable Cash Cost of Goods Sold Gross Profit Income before Tax Interest Expense Interest Income Operating Income Retained Earnings Sales Selling and Administrative Expenses Tax Expense HUI Requirement d. Prepare the footnote disclosures required for the accounting changes made in 2018. Prepare the footnote disclosure for the change in accounting methods. Management determined that the method better reflects the income valuation of inventory and cost of sales. Therefore, the company changed its method of accounting for inventory from the method to the cost flow method effective January 1, 2018. The effect of this change is in beginning inventory of $ and a prior period adjustment to beginning retained earnings of $ net of tax. In 2018, the change results in in cost of goods sold of $ and in income from continuing operations and net income of $ for the year ended December 31, 2018. The change to is reported Prepare the footnote disclosure for the failure to record interest expense on the bond. Management failed to accrue $ interest expense on its zero-coupon bond in 2014. The effect of this change is of $ There is on net income in the current year. Requirement d. Prepare the footnote disclosures required for the accounting changes made in 2018. Prepare the footnote disclosure for the change in accounting methods. Management determined that the and cost of sales. Therefore, the company change method to the FIFO LIFO in beginning inventory of $ weighted average net of tax. In 2018, the change resu in income from continuing operations and net income of $ December 31, 2018. The change to v method better reflects the income valuation of inventory entory from the y 1, 2018. The effect of this change is and a prior period adjustment to beginning retained earnings of in cost of goods sold of $ and for the year ended is reported Prepare the footnote disclosure for the failure to record interest expense on the bond. Requirement d. Prepare the footnote disclosures required for the accounting changes made in 2018. Prepare the footnote disclosure for the change in accounting methods. Management determined that the method better reflects the income valuation of inventory and cost of sales. Therefore, the company changed its method of accounting for inventory from the method to the cost flow method effective January 1, 2018. The effect of this change is v in beginning inventory of $ and a prior period adjustment to beginning retained earnings of net of tax. In 2018, the change results in in cost of goods sold of $ and a decrease in income from continuing operations and net income of $ for the year ended an increase to is reported Prepare the footnote disclosure for the failure to record interest expense on the bond. Management failed to accrue $ interest expense on its zero-coupon bond in 2014. The effect of this change is of $ There is on net income Requirement d. Prepare the footnote disclosures required for the accounting changes made in 2018. Prepare the footnote disclosure for the change in accounting methods. Management determined that the method better reflects the income valuation of inventory and cost of sales. Therefore, the company changed its method of accounting for inventory from the method to the cost flow method effective January 1, 2018. The effect of this change is in beginning inventory of $ and a prior period adjustment to beginning retained earnings of $ net of tax. In 2018, the change results in in cost of goods sold of $ in income from continuing operations and net income of $ for the year ended December 31, 2018. The change to is reported and Prepare the footnote disclosure for the failure to record interest expense on the bond. prospectively Management failed to accrue interest expense on its zero-coupon bond in 2014 retrospectively of $ There is on net income in the current year. Prepare the footnote disclosure for the failure to record interest expense on the bond. Management failed to accrue $ interest expense on its zero-coupon bond in 2014. The effect of this change is of $ There is on net income in the current year. Prepare the footnote disclosure for the failure to record interest expense on the bond. Management failed to accrue $ interest expense on its zero-coupon bond in 2014. The effect of this change is of $ There is on net income a decrease to current year income a prior period adjustment to beginning retained earnings an increase to current year income s and then continue to the next question. Prepare the footnote disclosure for the failure to record interest expense on the bond. Management failed to accrue $ interest expense on its zero-coupon bond in 2014. The effect of this change is of $ There is von net income in the current year. a significant effect no effect Choose from any list or enter any number in the input fields and then continue to th very little effect