Answered step by step

Verified Expert Solution

Question

1 Approved Answer

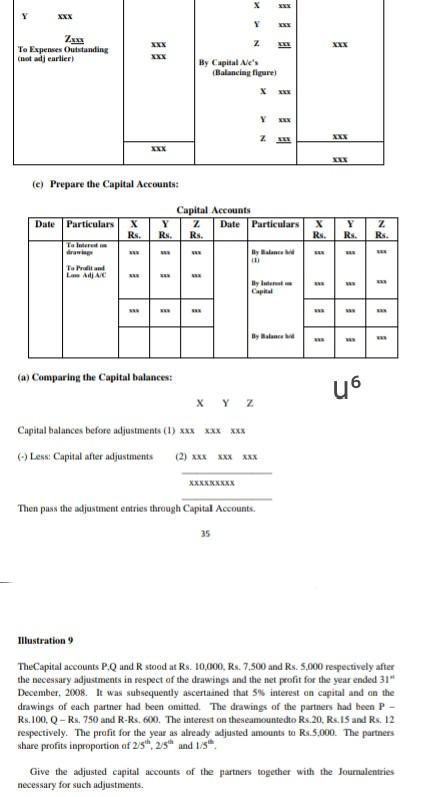

X XXX Y Z XXX To Expenses Outstanding (not wij earlier) XXX XXX By Capital Ae's Balancing figure Y Z XXX (e) Prepare the Capital

X XXX Y Z XXX To Expenses Outstanding (not wij earlier) XXX XXX By Capital Ae's Balancing figure Y Z XXX (e) Prepare the Capital Accounts: Date Particulars Rs. Capital Accounts Y Z Date Particulars Rs. Rs. X Rs. Y Rs. Z Rs. Taller 10 LAJAR Hyller Capital Bly Balm uo (a) Comparing the Capital balances: X Y Z Cupital balances before adjustments (1) xxx xxx xxx Lex: Capital after adjustments (2 (2) XXX XXX XXX XXXXXXXXX Then pass the adjustment entries through Capital Accounts. 35 Illustration 9 TheCapital accounts P.Q and R stood at Rs. 10,000, Rs. 7.500 and Rs.5.000 respectively after the necessary adjustments in respect of the drawings and the net profit for the year ended 31" December, 2008. It was subsequently ascertained that 5% interest en capital and on the drawings of each partner had been omitted. The drawings of the partners had heen P - Rs.100,- Rs.750 and R-Rs.600. The interest on theseamounted to R.20 Rs. 15 and Rs. 12 respectively. The profit for the year as already adjusted amounts to Rs.5.000. The partners share profits inproportion of 2/5" 25" and 1/5 Give the adjusted capital accounts of the partners together with the Journalentries necessary for such adjustments

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started