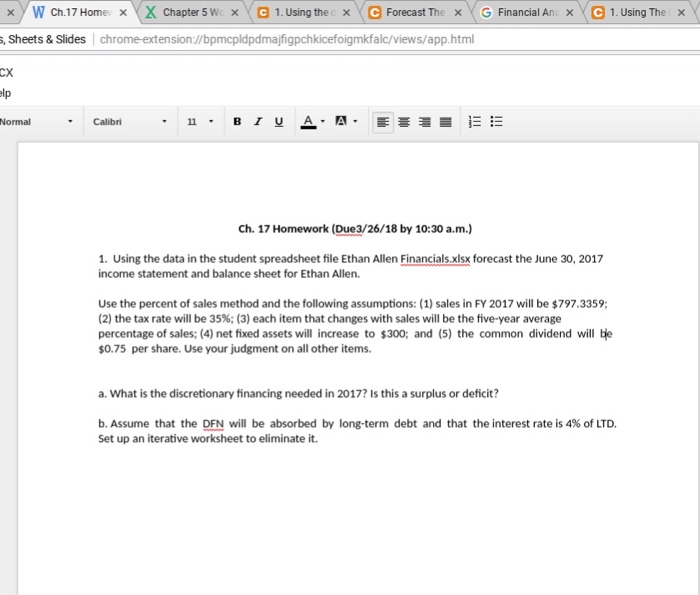

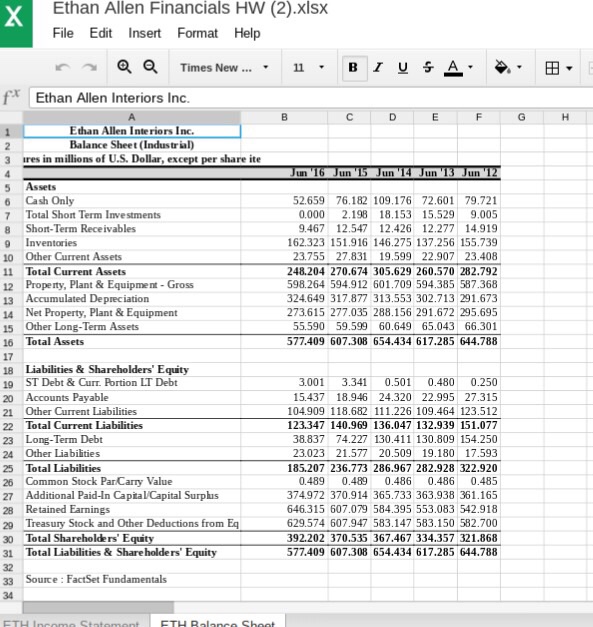

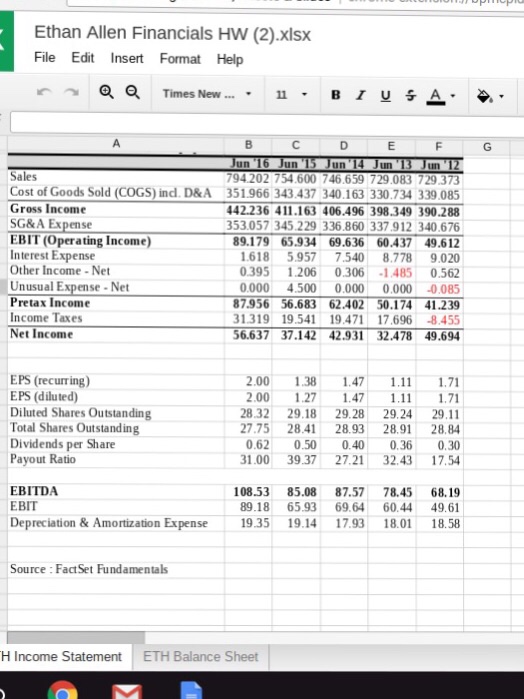

x y w ch.17 Home? X chapter 5 w x Y G 1. Using the Ye Forecast The Y G Financial An ? Ye 1. Using The s, Sheets & Slides chrome-extension://bpmcpldpdmajfigpchkicefoigmkfalc/views/app.html CX elp Normal Calibri Ch. 17 Homework (Due3/26/18 by 10:30 a.m.) 1. Using the data in the student spreadsheet file Ethan Allen Financials.xlsx forecast the June 30, 2017 income statement and balance sheet for Ethan Allen. Use the percent of sales method and the following assumptions: (1) sales in FY 2017 will be $797.3359 (2) the tax rate will be 35%; (3) each item that changes with sales will be the five-year average percentage of sales; (4) net fixed assets will increase to $300; and (5) the common dividend will be $0.75 per share. Use your judgment on all other items a. What is the discretionary financing needed in 2017? Is this a surplus or deficit? b. Assume that the DFN will be absorbed by long-term debt and that the interest rate is 4% of LTD. Set up an iterative worksheet to eliminate it. x y w ch.17 Home? X chapter 5 w x Y G 1. Using the Ye Forecast The Y G Financial An ? Ye 1. Using The s, Sheets & Slides chrome-extension://bpmcpldpdmajfigpchkicefoigmkfalc/views/app.html CX elp Normal Calibri Ch. 17 Homework (Due3/26/18 by 10:30 a.m.) 1. Using the data in the student spreadsheet file Ethan Allen Financials.xlsx forecast the June 30, 2017 income statement and balance sheet for Ethan Allen. Use the percent of sales method and the following assumptions: (1) sales in FY 2017 will be $797.3359 (2) the tax rate will be 35%; (3) each item that changes with sales will be the five-year average percentage of sales; (4) net fixed assets will increase to $300; and (5) the common dividend will be $0.75 per share. Use your judgment on all other items a. What is the discretionary financing needed in 2017? Is this a surplus or deficit? b. Assume that the DFN will be absorbed by long-term debt and that the interest rate is 4% of LTD. Set up an iterative worksheet to eliminate it