Question

X, Yand C formed a partnership on January 1, 2023. The fair value of the net assets invested by each partner as follow: X:

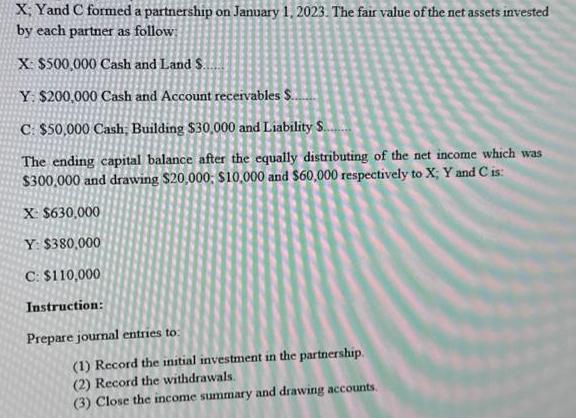

X, Yand C formed a partnership on January 1, 2023. The fair value of the net assets invested by each partner as follow: X: $500,000 Cash and Land S. Y: $200,000 Cash and Account receivables S.. C: $50,000 Cash; Building $30,000 and Liability S..... The ending capital balance after the equally distributing of the net income which was $300,000 and drawing $20,000 $10,000 and $60,000 respectively to X; Y and C is: X: $630,000 Y: $380,000 C: $110,000 Instruction: Prepare journal entries to: (1) Record the initial investment in the partnership. (2) Record the withdrawals. (3) Close the income summary and drawing accounts.

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Record the initial investment in the partnership X Debit Cash 500000 Debit Land assuming fair valu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Debra C. Jeter, Paul K. Chaney

8th Edition

111979465X, 9781119794653

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App