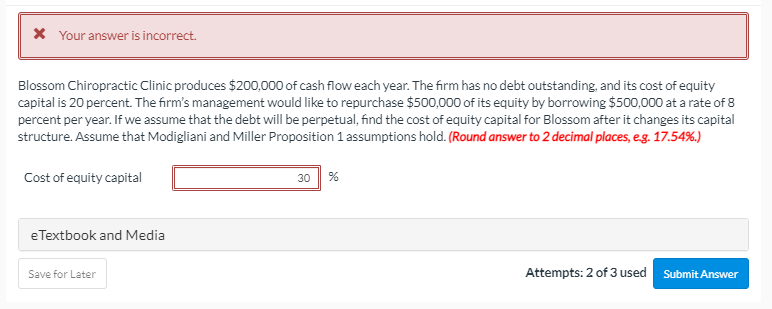

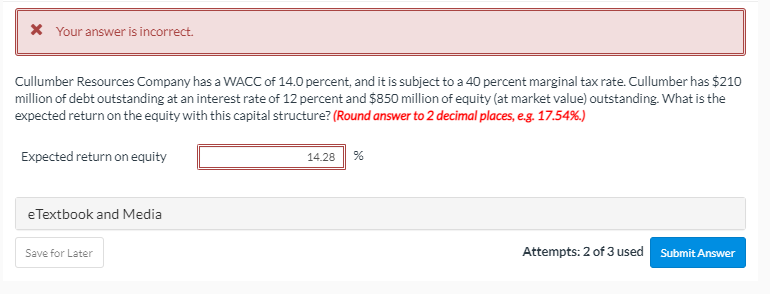

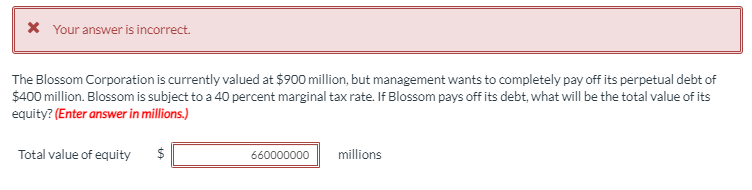

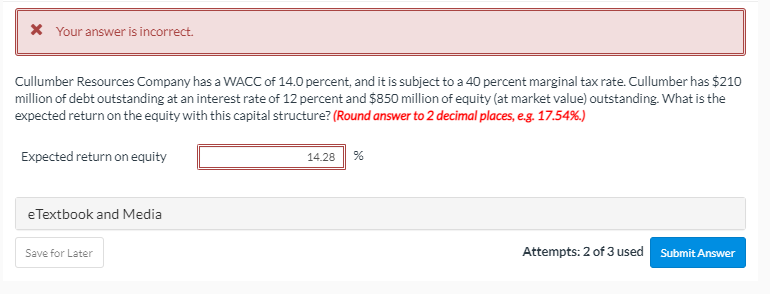

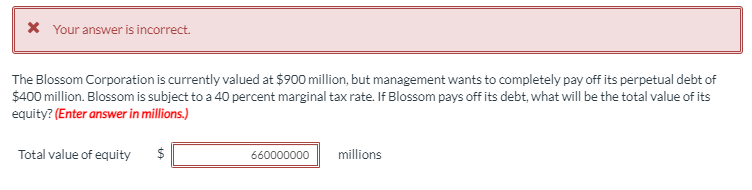

X Your answer is incorrect. Blossom Chiropractic Clinic produces $200,000 of cash flow each year. The firm has no debt outstanding, and its cost of equity capital is 20 percent. The firm's management would like to repurchase $500,000 of its equity by borrowing $500,000 at a rate of 8 percent per year. If we assume that the debt will be perpetual, find the cost of equity capital for Blossom after it changes its capital structure. Assume that Modigliani and Miller Proposition 1 assumptions hold. (Round answer to 2 decimal places, eg. 17.54%.) Cost of equity capital 30 % e Textbook and Media Save for Later Attempts: 2 of 3 used Submit Answer * Your answer is incorrect. Cullumber Resources Company has a WACC of 14.0 percent, and it is subject to a 40 percent marginal tax rate. Cullumber has $210 million of debt outstanding at an interest rate of 12 percent and $850 million of equity (at market value) outstanding. What is the expected return on the equity with this capital structure? (Round answer to 2 decimal places, e.g. 17.54%.) Expected return on equity 14.28 % e Textbook and Media Save for Later Attempts: 2 of 3 used Submit Answer X Your answer is incorrect. The Blossom Corporation is currently valued at $900 million, but management wants to completely pay off its perpetual debt of $400 million. Blossom is subject to a 40 percent marginal tax rate. If Blossom pays off its debt, what will be the total value of its equity? (Enter answer in millions.) Total value of equity $ 660000000 millions X Your answer is incorrect. Blossom Chiropractic Clinic produces $200,000 of cash flow each year. The firm has no debt outstanding, and its cost of equity capital is 20 percent. The firm's management would like to repurchase $500,000 of its equity by borrowing $500,000 at a rate of 8 percent per year. If we assume that the debt will be perpetual, find the cost of equity capital for Blossom after it changes its capital structure. Assume that Modigliani and Miller Proposition 1 assumptions hold. (Round answer to 2 decimal places, eg. 17.54%.) Cost of equity capital 30 % e Textbook and Media Save for Later Attempts: 2 of 3 used Submit Answer * Your answer is incorrect. Cullumber Resources Company has a WACC of 14.0 percent, and it is subject to a 40 percent marginal tax rate. Cullumber has $210 million of debt outstanding at an interest rate of 12 percent and $850 million of equity (at market value) outstanding. What is the expected return on the equity with this capital structure? (Round answer to 2 decimal places, e.g. 17.54%.) Expected return on equity 14.28 % e Textbook and Media Save for Later Attempts: 2 of 3 used Submit Answer X Your answer is incorrect. The Blossom Corporation is currently valued at $900 million, but management wants to completely pay off its perpetual debt of $400 million. Blossom is subject to a 40 percent marginal tax rate. If Blossom pays off its debt, what will be the total value of its equity? (Enter answer in millions.) Total value of equity $ 660000000 millions