Answered step by step

Verified Expert Solution

Question

1 Approved Answer

X=0 Y=6 Z=8 please state what more infomation is needed. x y & z numbers have been stated. thanks! Question 1 (25 points): Refinancing a

X=0 Y=6 Z=8

please state what more infomation is needed. x y & z numbers have been stated. thanks!

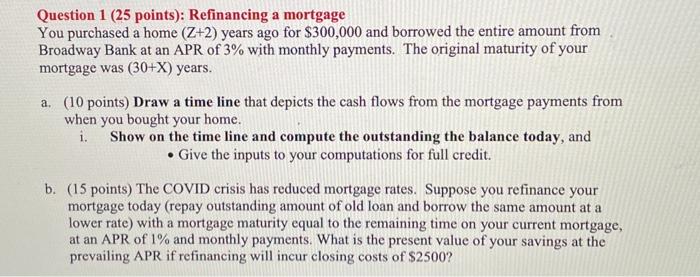

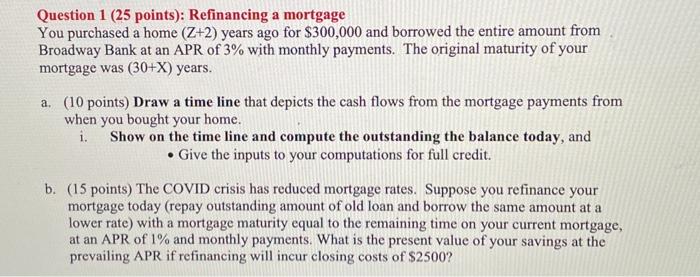

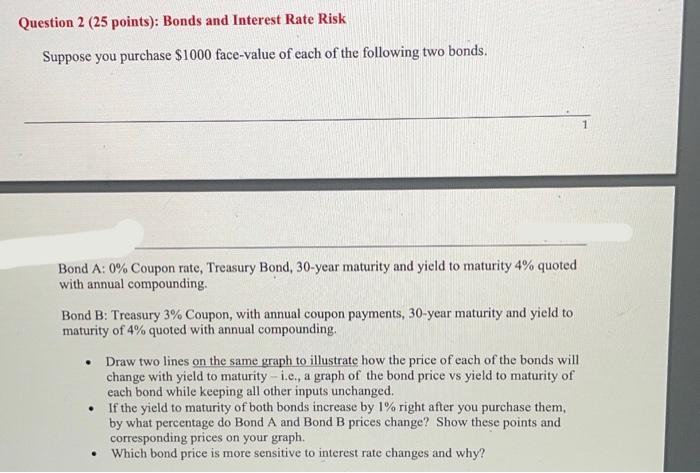

Question 1 (25 points): Refinancing a mortgage You purchased a home (Z+2) years ago for $300,000 and borrowed the entire amount from Broadway Bank at an APR of 3% with monthly payments. The original maturity of your mortgage was (30+X) years. a. (10 points) Draw a time line that depicts the cash flows from the mortgage payments from when you bought your home. i. Show on the time line and compute the outstanding the balance today, and Give the inputs to your computations for full credit. b. (15 points) The COVID crisis has reduced mortgage rates. Suppose you refinance your mortgage today (repay outstanding amount of old loan and borrow the same amount at a lower rate) with a mortgage maturity equal to the remaining time on your current mortgage, at an APR of 1% and monthly payments. What is the present value of your savings at the prevailing APR if refinancing will incur closing costs of $2500? Question 2 (25 points): Bonds and Interest Rate Risk Suppose you purchase $1000 face-value of each of the following two bonds. 1 Bond A: 0% Coupon rate, Treasury Bond, 30-year maturity and yield to maturity 4% quoted with annual compounding, Bond B: Treasury 3% Coupon, with annual coupon payments, 30-year maturity and yield to maturity of 4% quoted with annual compounding, Draw two lines on the same graph to illustrate how the price of each of the bonds will change with yield to maturity - i.e., a graph of the bond price vs yield to maturity of each bond while keeping all other inputs unchanged. If the yield to maturity of both bonds increase by 1% right after you purchase them, by what percentage do Bond A and Bond B prices change? Show these points and corresponding prices on your graph. Which bond price is more sensitive to interest rate changes and why Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started