Answered step by step

Verified Expert Solution

Question

1 Approved Answer

x1=110,000$, x2= 20% Please DO NOT use excel or tables, I need written steps thanks. Question (3): The IPS company has installed a system to

x1=110,000$, x2= 20%

Please DO NOT use excel or tables, I need written steps thanks.

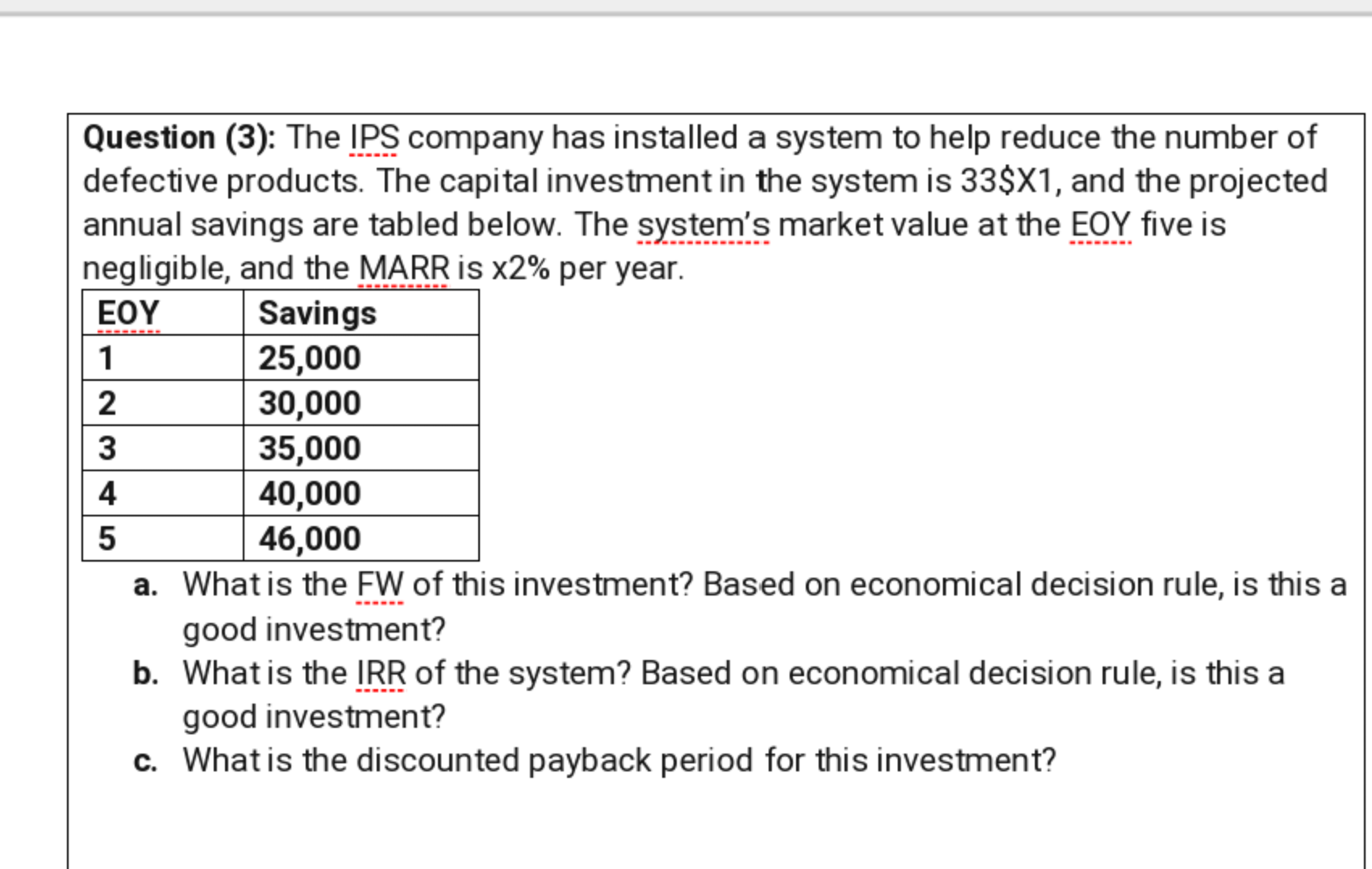

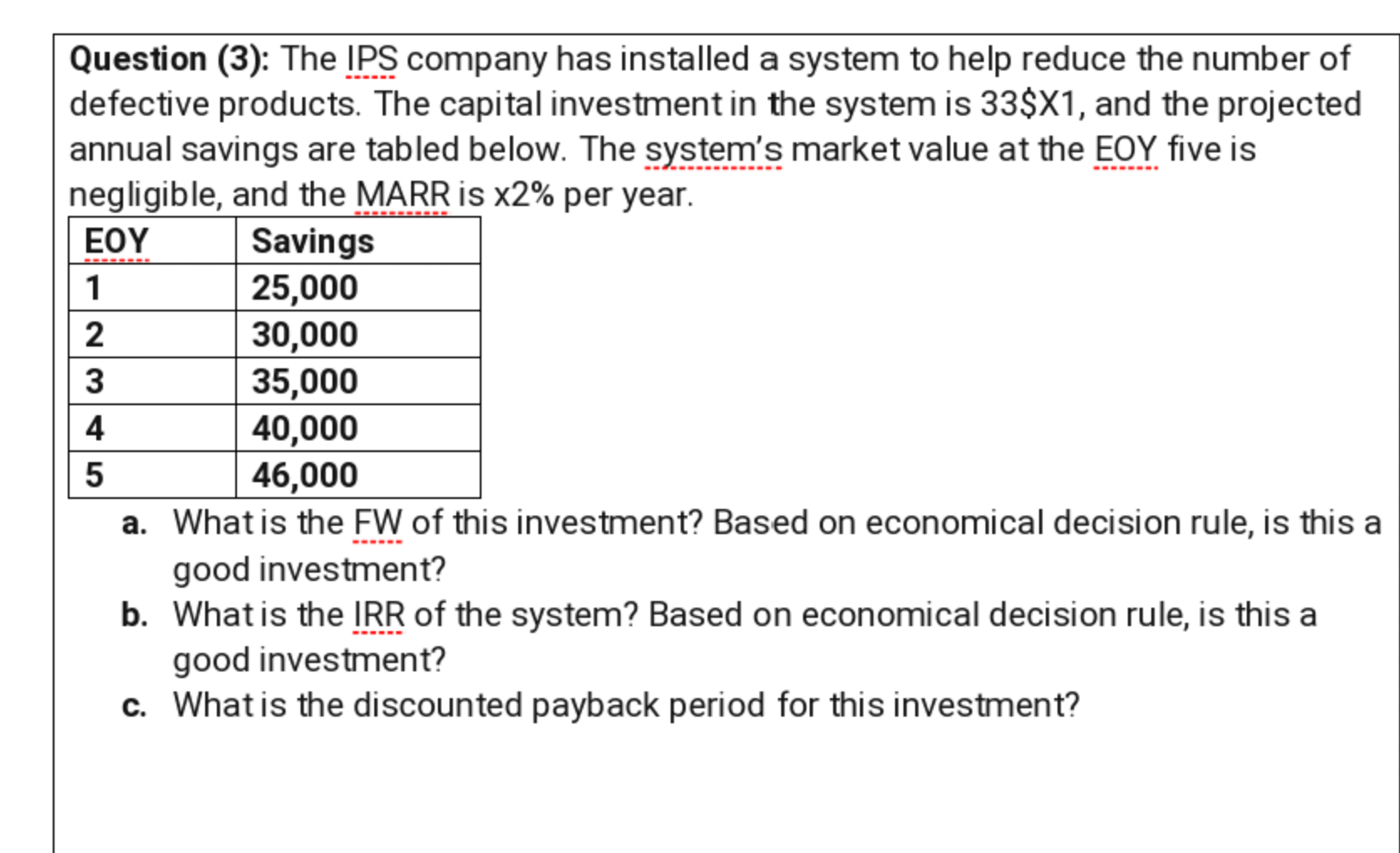

Question (3): The IPS company has installed a system to help reduce the number of defective products. The capital investment in the system is 33$X1, and the projected annual savings are tabled below. The system's market value at the EOY five is negligible, and the MARR is x2% per year. EOY Savings 1 25,000 2 30,000 3 35,000 4 40,000 5 46,000 a. What is the FW of this investment? Based on economical decision rule, is this a good investment? b. What is the IRR of the system? Based on economical decision rule, is this a good investment? c. What is the discounted payback period for this investment? WN LO Question (3): The IPS company has installed a system to help reduce the number of defective products. The capital investment in the system is 33$X1, and the projected annual savings are tabled below. The system's market value at the EOY five is negligible, and the MARR is x2% per year. EOY Savings 1 25,000 2 30,000 3 35,000 4 40,000 5 46,000 a. What is the FW of this investment? Based on economical decision rule, is this a good investment? b. What is the IRR of the system? Based on economical decision rule, is this a good investment? c. What is the discounted payback period for this investment? 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started