Answered step by step

Verified Expert Solution

Question

1 Approved Answer

x18 Working Notes: (1) Calculation of new profit-sharing ratio after D's admission D was admitted for 1/5 share. The balance 4/5 share will be enjoyed

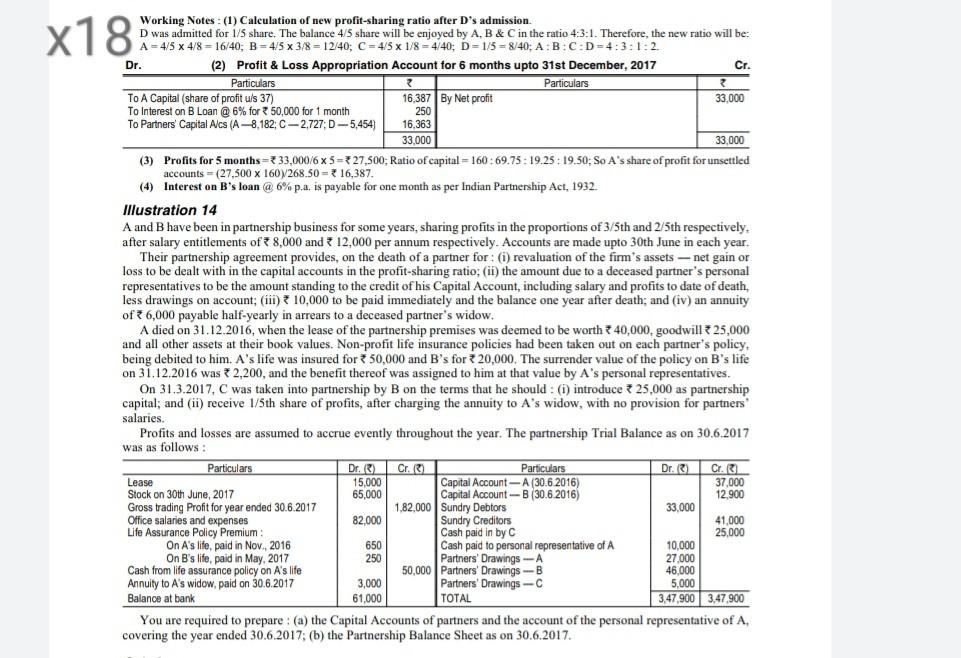

x18 Working Notes: (1) Calculation of new profit-sharing ratio after D's admission D was admitted for 1/5 share. The balance 4/5 share will be enjoyed by A, B & C in the ratio 4:3:1. Therefore, the new ratio will be: A = 4/5 x 4/8 = 16/40; B = 4/5 x 3/8 = 12/40; C = 4/5 x 1/8 = 4/40; D=1/5 = 8/40; A:B:C:D=4:3:1:2 Dr. (2) Profit & Loss Appropriation Account for 6 months upto 31st December, 2017 Cr. Particulars Particulars To A Capital (share of profit uls 37) 16,387 By Net profit 33,000 To Interest on B Loan @ 6% for 50,000 for 1 month 250 To Partners Capital Alcs (A-8,182, C-2,727D-5,454) 16.363 33.000 33.000 (3) Profits for 5 months=733,000/6 x 5=327,500; Ratio of capital = 160:69.75: 19.25: 19.50: So A's share of profit for unsettled accounts (27,500 x 160/268.50-16,387. (4) Interest on B's loan @ 6% p.a. is payable for one month as per Indian Partnership Act, 1932. Illustration 14 A and B have been in partnership business for some years, sharing profits in the proportions of 3/5th and 2/5th respectively. after salary entitlements of 8,000 and 12,000 per annum respectively. Accounts are made upto 30th June in each year. Their partnership agreement provides, on the death of a partner for: (i) revaluation of the firm's assets - net gain or loss to be dealt with in the capital accounts in the profit-sharing ratio; (ii) the amount due to a deceased partner's personal representatives to be the amount standing to the credit of his Capital Account, including salary and profits to date of death, less drawings on account; (ii) 10,000 to be paid immediately and the balance one year after death; and (iv) an annuity of 36,000 payable half-yearly in arrears to a deceased partner's widow. A died on 31.12.2016, when the lease of the partnership premises was deemed to be worth 340,000. goodwill

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started