Answered step by step

Verified Expert Solution

Question

1 Approved Answer

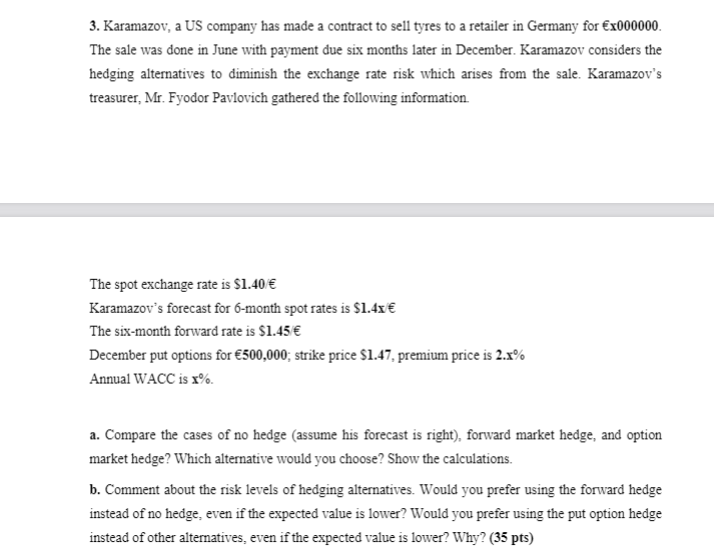

X=9 (write 9 in x place) 3. Karamazov, a US company has made a contract to sell tyres to a retailer in Germany for x000000.

X=9 (write 9 in x place)

3. Karamazov, a US company has made a contract to sell tyres to a retailer in Germany for x000000. The sale was done in June with payment due six months later in December. Karamazov considers the hedging alternatives to diminish the exchange rate risk which arises from the sale. Karamazov's treasurer, Mr. Fyodor Pavlovich gathered the following information. The spot exchange rate is $1.40 Karamazov's forecast for 6-month spot rates is $1.42 The six-month forward rate is $1.45 December put options for 500,000; strike price $1.47, premium price is 2.x% Annual WACC is r%. a. Compare the cases of no hedge (assume his forecast is right), forward market hedge, and option market hedge? Which alternative would you choose? Show the calculations. b. Comment about the risk levels of hedging alternatives. Would you prefer using the forward hedge instead of no hedge, even if the expected value is lower? Would you prefer using the put option hedge instead of other alternatives, even if the expected value is lower? Why? (35 pts)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started