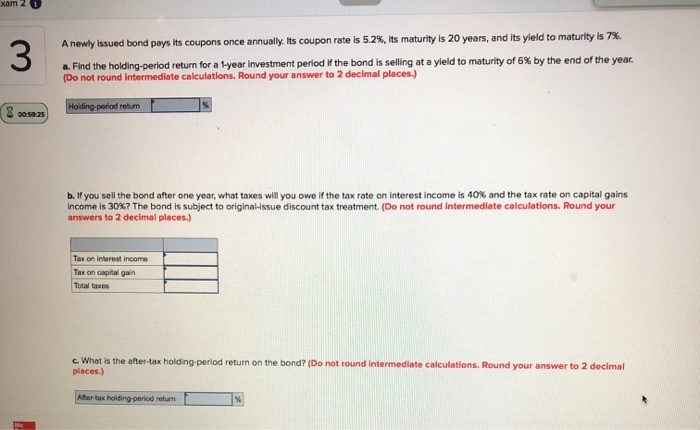

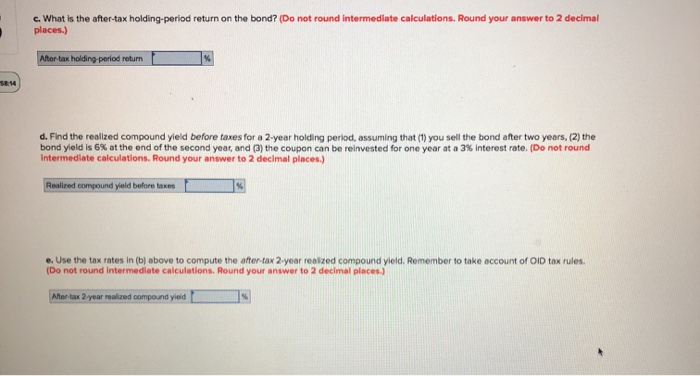

xam 20 A newly issued bond pays its coupons once annually. Its coupon rate is 5.2%. Its maturity is 20 years, and its yield to maturity is 7% 3. a. Find the holding-period return for a 1-year Investment period If the bond is selling at a yield to maturity of 6% by the end of the year. (Do not round Intermediate calculations. Round your answer to 2 decimal places.) 8 00:52:25 Holding period retum b. If you sell the bond after one year, what taxes will you owe if the tax rate on interest income is 40% and the tax rate on capital gains Income is 30%? The bond is subject to original-issue discount tax treatment. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Tax on interest income Tax on capital gain Total taxes c. What is the after-tax holding period return on the bond? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Atar-tax holding period return c. What is the after-tax holding-period return on the bond? (Do not round intermediate calculations. Round your answer to 2 decimal places.) After-tax holding period return d. Find the realized compound yield before taxes for a 2-year holding period, assuming that (1) you sell the bond after two years, (2) the bond yield is 6% at the end of the second year, and (3) the coupon can be reinvested for one year at a 3% interest rate. (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Realized compound yield before taxes e. Use the tax rates in (b) above to compute the after fax 2-year realized compound yield. Remember to take account of OID tax rules. (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Alertax 2-year realized compound yield xam 20 A newly issued bond pays its coupons once annually. Its coupon rate is 5.2%. Its maturity is 20 years, and its yield to maturity is 7% 3. a. Find the holding-period return for a 1-year Investment period If the bond is selling at a yield to maturity of 6% by the end of the year. (Do not round Intermediate calculations. Round your answer to 2 decimal places.) 8 00:52:25 Holding period retum b. If you sell the bond after one year, what taxes will you owe if the tax rate on interest income is 40% and the tax rate on capital gains Income is 30%? The bond is subject to original-issue discount tax treatment. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Tax on interest income Tax on capital gain Total taxes c. What is the after-tax holding period return on the bond? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Atar-tax holding period return c. What is the after-tax holding-period return on the bond? (Do not round intermediate calculations. Round your answer to 2 decimal places.) After-tax holding period return d. Find the realized compound yield before taxes for a 2-year holding period, assuming that (1) you sell the bond after two years, (2) the bond yield is 6% at the end of the second year, and (3) the coupon can be reinvested for one year at a 3% interest rate. (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Realized compound yield before taxes e. Use the tax rates in (b) above to compute the after fax 2-year realized compound yield. Remember to take account of OID tax rules. (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Alertax 2-year realized compound yield