Answered step by step

Verified Expert Solution

Question

1 Approved Answer

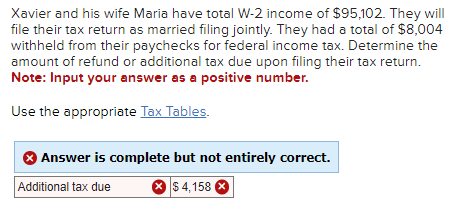

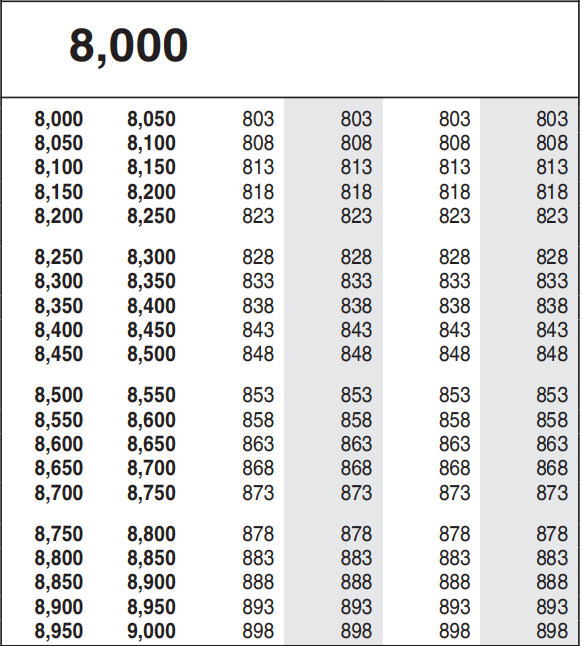

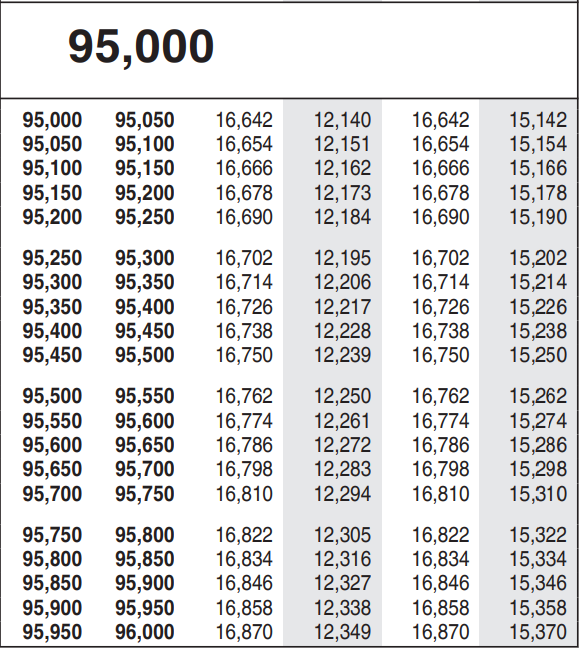

Xavier and his wife Maria have total W-2 income of ( $ 95,102 ). They will file their tax return as married filing jointly. They

Xavier and his wife Maria have total W-2 income of \\( \\$ 95,102 \\). They will file their tax return as married filing jointly. They had a total of \\( \\$ 8,004 \\) withheld from their paychecks for federal income tax. Determine the amount of refund or additional tax due upon filing their tax return. Note: Input your answer as a positive number. Use the appropriate Tax Tables. Answer is complete but not entirely correct. Xavier and his wife Maria have total W-2 income of \\( \\$ 95,102 \\). They will file their tax return as married filing jointly. They had a total of \\( \\$ 8,004 \\) withheld from their paychecks for federal income tax. Determine the amount of refund or additional tax due upon filing their tax return. Note: Input your answer as a positive number. Use the appropriate Tax Tables. Answer is complete but not entirely correct.

Xavier and his wife Maria have total W-2 income of \\( \\$ 95,102 \\). They will file their tax return as married filing jointly. They had a total of \\( \\$ 8,004 \\) withheld from their paychecks for federal income tax. Determine the amount of refund or additional tax due upon filing their tax return. Note: Input your answer as a positive number. Use the appropriate Tax Tables. Answer is complete but not entirely correct. Xavier and his wife Maria have total W-2 income of \\( \\$ 95,102 \\). They will file their tax return as married filing jointly. They had a total of \\( \\$ 8,004 \\) withheld from their paychecks for federal income tax. Determine the amount of refund or additional tax due upon filing their tax return. Note: Input your answer as a positive number. Use the appropriate Tax Tables. Answer is complete but not entirely correct.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started