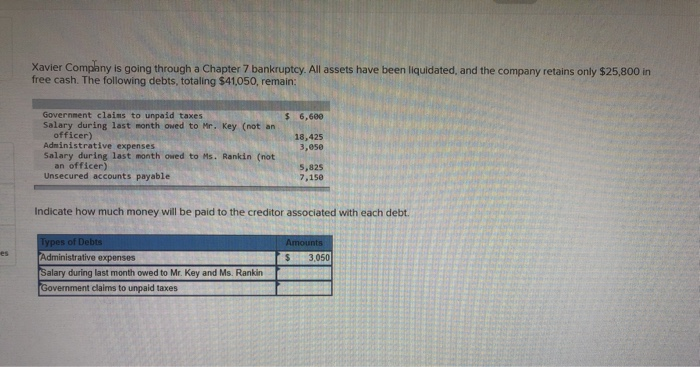

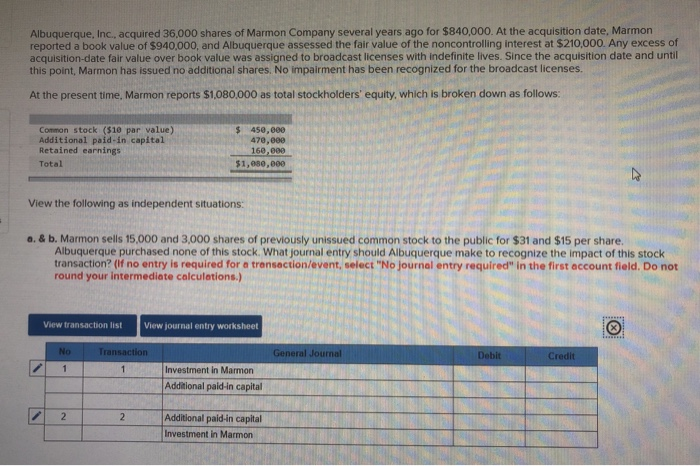

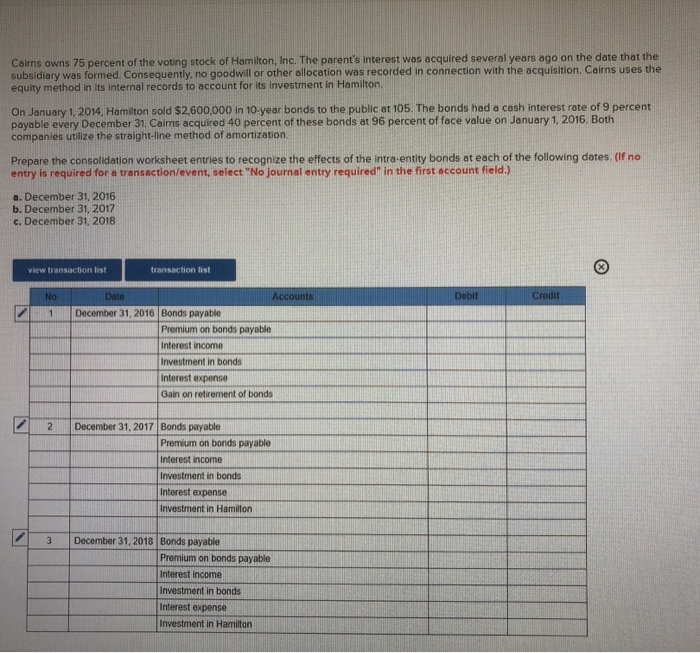

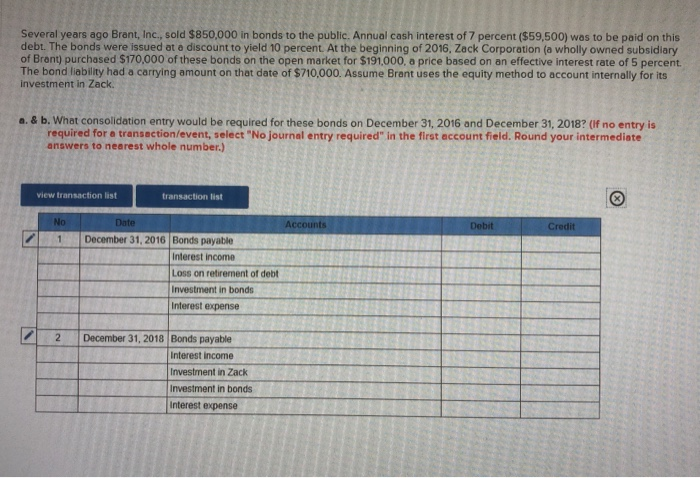

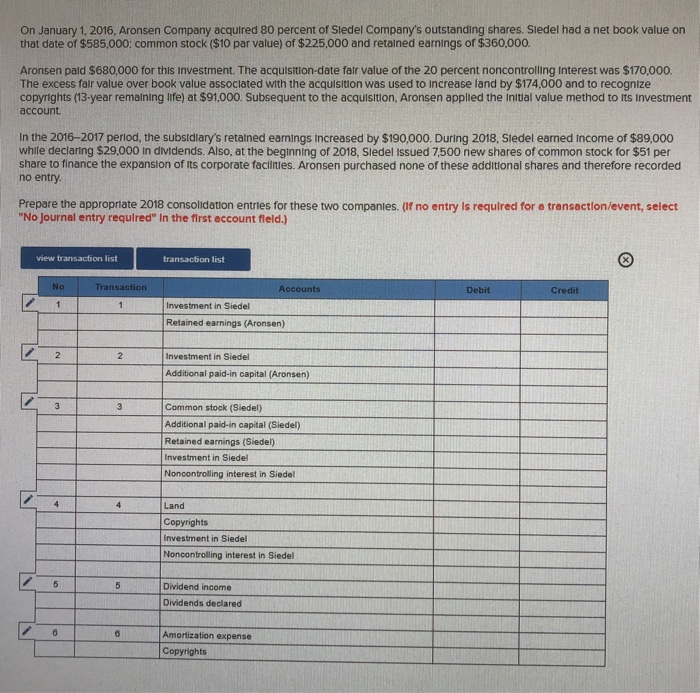

Xavier Company is going through a Chapter 7 bankruptcy. All assets have been liquidated, and the company retains only $25,800 in free cash. The following debts, totaling $41,050, remain: $ 6,600 Government claims to unpaid taxes Salary during last month owed to Mr. Key (not an officer) Administrative expenses Salary during last month owed to Ms. Rankin (not an officer) Unsecured accounts payable 18,425 3,050 5,825 7,150 Indicate how much money will be paid to the creditor associated with each debt. es Amounts $ 3,050 Types of Debts Administrative expenses Salary during last month owed to Mr. Key and Ms. Rankin Government claims to unpaid taxes Albuquerque, Inc., acquired 36,000 shares of Marmon Company several years ago for $840,000. At the acquisition date, Marmon reported a book value of $940,000, and Albuquerque assessed the fair value of the noncontrolling interest at $210,000. Any excess of acquisition-date fair value over book value was assigned to broadcast licenses with indefinite lives. Since the acquisition date and until this point, Marmon has issued no additional shares. No impairment has been recognized for the broadcast licenses. At the present time, Marmon reports $1,080,000 as total stockholders' equity, which is broken down as follows: Common stock (510 par value) Additional paid in capital Retained earnings Total $ 450,000 470,000 160,000 $1,680,000 View the following as independent situations: a. & b. Marmon sells 15,000 and 3,000 shares of previously unissued common stock to the public for $31 and $15 per share. Albuquerque purchased none of this stock. What journal entry should Albuquerque make to recognize the impact of this stock transaction? (if no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round your intermediate calculations.) View transaction list View journal entry worksheet No Transaction General Journal Debit Credit 1 1 Investment in Marmon Additional paid-in capital 2 2 Additional paid in capital Investment in Marmon Cairns owns 75 percent of the voting stock of Hamilton, Inc. The parent's interest was acquired several years ago on the date that the subsidiary was formed. Consequently, no goodwill or other allocation was recorded in connection with the acquisition. Cairns uses the equity method in its internal records to account for its investment in Hamilton, On January 1, 2014. Hamilton sold $2,600,000 in 10-year bonds to the public at 105. The bonds had a cash interest rate of 9 percent payable every December 31. Caims acquired 40 percent of these bonds at 96 percent of face value on January 1, 2016. Both companies utilize the straight-line method of amortization Prepare the consolidation worksheet entries to recognize the effects of the intra-entity bonds at each of the following dates. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) a. December 31, 2016 b. December 31, 2017 c. December 31, 2018 view transaction list transaction list No Debit Credit 1 Date Accounts December 31, 2016 Bonds payable Premium on bonds payable Interest income Investment in bonds Interest expense Gain on retirement of bonds 2 December 31, 2017 Bonds payable Premium on bonds payable Interest income Investment in bonds Interest expense Investment in Hamilton 3 December 31, 2018 Bonds payable Premium on bonds payable Interest income Investment in bonds Interest expense Investment in Hamilton Several years ago Brant, Inc., sold $850,000 in bonds to the public. Annual cash interest of 7 percent ($59,500) was to be paid on this debt. The bonds were issued at a discount to yield 10 percent. At the beginning of 2016, Zack Corporation (a wholly owned subsidiary of Brant) purchased $170,000 of these bonds on the open market for $191,000, a price based on an effective interest rate of 5 percent The bond liability had a carrying amount on that date of $710,000. Assume Brant uses the equity method to account internally for its investment in Zack a. & b. What consolidation entry would be required for these bonds on December 31, 2016 and December 31, 2018? (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your intermediate answers to nearest whole number.) view transaction list transaction list No Accounts Debit Credit 1 Date December 31, 2016 Bonds payable Interest income Loss on retirement of debt Investment in bonds Interest expense 21 2 December 31, 2018 Bonds payable Interest income Investment in Zack Investment in bonds Interest expense On January 1, 2016. Aronsen Company acquired 80 percent of Sledel Company's outstanding shares. Siedel had a net book value on that date of $585.000: common stock ($10 par value) of $225,000 and retained earnings of $360,000. Aronsen pald $680,000 for this investment. The acquisition-date fair value of the 20 percent noncontrolling Interest was $170,000. The excess fair value over book value associated with the acquisition was used to increase land by $174,000 and to recognize copyrights (13-year remaining life) at $91.000. Subsequent to the acquisition, Aronsen applied the initial value method to its Investment account. In the 2016-2017 period, the subsidiary's retained eamings Increased by $190,000. During 2018, Sledel earned Income of $89,000 while declaring $29,000 in dividends. Also, at the beginning of 2018, Sledel issued 7,500 new shares of common stock for $51 per Share to finance the expansion of its corporate facilities. Aronsen purchased none of these additional shares and therefore recorded no entry Prepare the appropriate 2018 consolidation entries for these two companies. (If no entry is required for a transaction/event, select "No Journal entry required in the first account field.) view transaction list transaction list NO Transaction Accounts Debit Credit 1 1 Investment in Siedel Retained earnings (Aronsen) 2 2 Investment in Siedel Additional paid-in capital (Aronsen) 3 Common stock (Siedel) Additional paid-in capital (Sledel) Retained earnings (Sledel) Investment in Siedel Noncontrolling interest in Siedel 4 Land Copyrights Investment in Siedel Noncontrolling interest in Siedel 5 5 Dividend income Dividends declared 6 Amortization expense Copyrights