Answered step by step

Verified Expert Solution

Question

1 Approved Answer

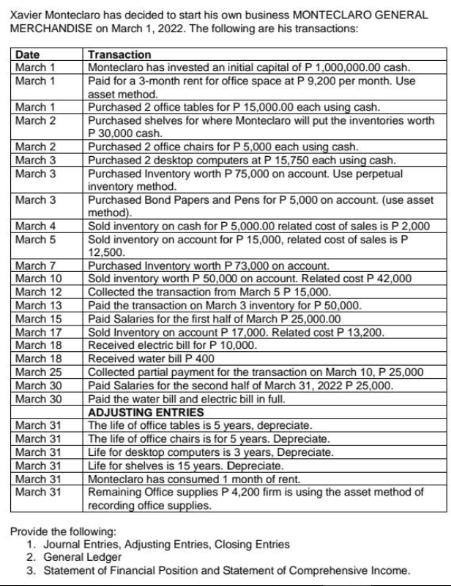

Xavier Monteclaro has decided to start his own business MONTECLARO GENERAL MERCHANDISE on March 1, 2022. The following are his transactions: Date March 1

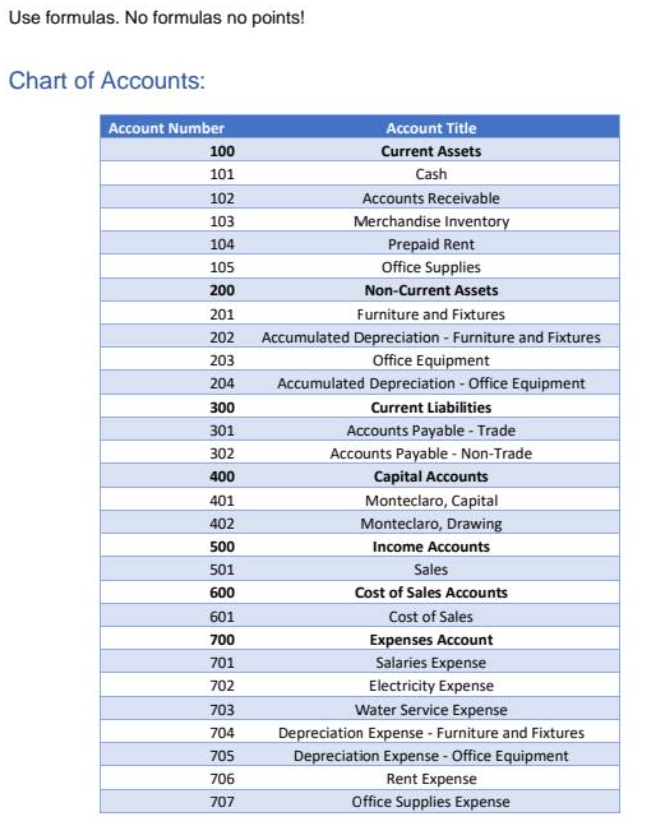

Xavier Monteclaro has decided to start his own business MONTECLARO GENERAL MERCHANDISE on March 1, 2022. The following are his transactions: Date March 1 March 1 March 1 March 2 March 2 March 3 March 3 March 3 March 4 March 5 March 7 March 10 March 12 March 13 March 15 March 17 March 18 March 18 March 25 March 30 March 30 March 31 March 31 March 31 March 31 March 31 March 31 Transaction Monteclaro has invested an initial capital of P 1,000,000.00 cash. Paid for a 3-month rent for office space at P 9,200 per month. Use asset method. Purchased 2 office tables for P 15,000.00 each using cash. Purchased shelves for where Monteclaro will put the inventories worth P 30,000 cash. Purchased 2 office chairs for P 5,000 each using cash. Purchased 2 desktop computers at P 15,750 each using cash. Purchased Inventory worth P 75,000 on account. Use perpetual inventory method. Purchased Bond Papers and Pens for P 5,000 on account. (use asset method). Sold inventory on cash for P 5,000.00 related cost of sales is P 2,000 Sold inventory on account for P 15,000, related cost of sales is P 12,500. Purchased Inventory worth P 73,000 on account. Sold inventory worth P 50,000 on account. Related cost P 42,000 Collected the transaction from March 5 P 15,000. Paid the transaction on March 3 inventory for P 50,000. Paid Salaries for the first half of March P 25,000.00 Sold Inventory on account P 17,000. Related cost P 13,200. Received electric bill for P 10,000. Received water bill P 400 Collected partial payment for the transaction on March 10, P 25,000 Paid Salaries for the second half of March 31, 2022 P 25,000. Paid the water bill and electric bill in full. ADJUSTING ENTRIES The life of office tables is 5 years, depreciate. The life of office chairs is for 5 years. Depreciate. Life for desktop computers is 3 years, Depreciate. Life for shelves is 15 years. Depreciate. Monteclaro has consumed 1 month of rent. Remaining Office supplies P 4,200 firm is using the asset method of recording office supplies. Provide the following: 1. Journal Entries, Adjusting Entries, Closing Entries 2. General Ledger 3. Statement of Financial Position and Statement of Comprehensive Income. Use formulas. No formulas no points! Chart of Accounts: Account Number 100 101 102 103 104 105 200 201 202 203 204 300 301 302 400 401 402 500 501 600 601 700 701 702 703 704 705 706 707 Account Title Current Assets Cash Accounts Receivable Merchandise Inventory Prepaid Rent Office Supplies Non-Current Assets Furniture and Fixtures Accumulated Depreciation - Furniture and Fixtures Office Equipment Accumulated Depreciation - Office Equipment Current Liabilities Accounts Payable - Trade Accounts Payable - Non-Trade Capital Accounts Monteclaro, Capital Monteclaro, Drawing Income Accounts Sales Cost of Sales Accounts Cost of Sales Expenses Account Salaries Expense Electricity Expense Water Service Expense Depreciation Expense - Furniture and Fixtures Depreciation Expense - Office Equipment Rent Expense Office Supplies Expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started