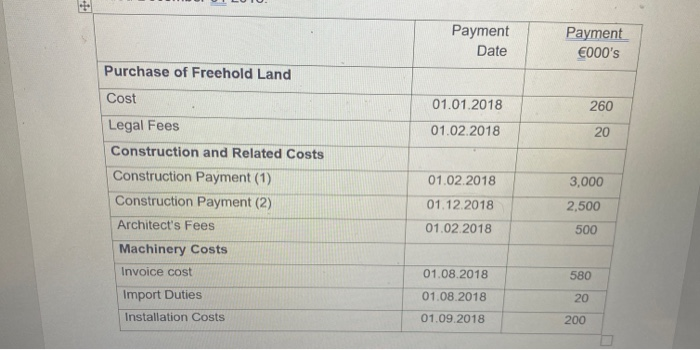

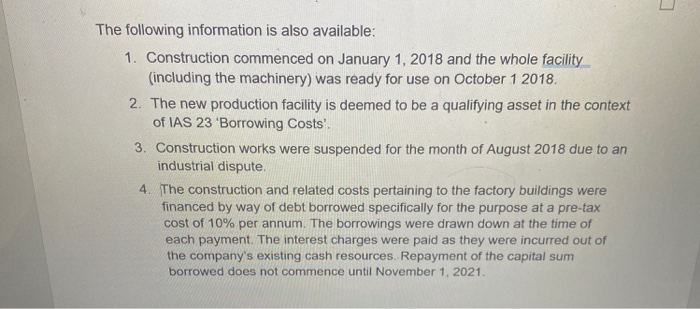

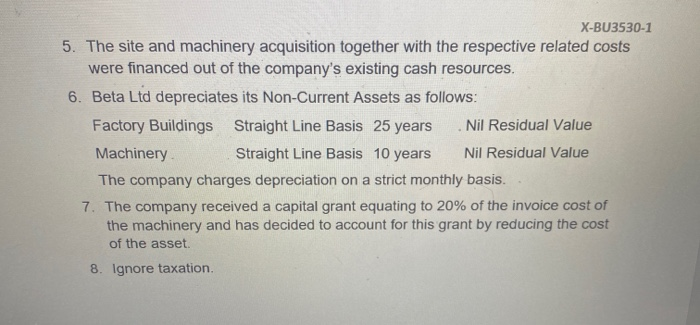

X-BU3530-1 Question 5 Beta Ltd which prepares its financial statements to December 31 each year is an Irish company involved in manufacturing. The company has decided to expand its operations by the addition of a new production facility. This expansion involves the purchase of a site, the construction of a factory premises and the installation of machinery The following information is available from the records of the company in the year ended December 31 2018: Payment Date Payment 000's Purchase of Freehold Land Cost 01.01.2018 01.02.2018 260 20 Legal Fees Construction and Related Costs Construction Payment (1) Construction Payment (2) Architect's Fees Machinery Costs Invoice cost Import Duties Installation Costs 01.02.2018 01.12.2018 01.02.2018 3,000 2,500 500 580 01.08.2018 01.08.2018 01.09.2018 200 The following information is also available: 1. Construction commenced on January 1, 2018 and the whole facility (including the machinery) was ready for use on October 1 2018. 2. The new production facility is deemed to be a qualifying asset in the context of IAS 23 'Borrowing Costs'. 3. Construction works were suspended for the month of August 2018 due to an industrial dispute 4. The construction and related costs pertaining to the factory buildings were financed by way of debt borrowed specifically for the purpose at a pre-tax cost of 10% per annum. The borrowings were drawn down at the time of each payment. The interest charges were paid as they were incurred out of the company's existing cash resources Repayment of the capital sum borrowed does not commence until November 1, 2021 X-BU3530-1 5. The site and machinery acquisition together with the respective related costs were financed out of the company's existing cash resources. 6. Beta Ltd depreciates its Non-Current Assets as follows: Factory Buildings Straight Line Basis 25 years Nil Residual Value Machinery Straight Line Basis 10 years Nil Residual Value The company charges depreciation on a strict monthly basis. 7. The company received a capital grant equating to 20% of the invoice cost of the machinery and has decided to account for this grant by reducing the cost of the asset. 8. Ignore taxation. Required: For the purposes of financial reporting in accordance with International Accounting Standards: a) Calculate the separate cost of the Land, Factory Building and Machinery at December 31, 2018 and justify your calculations by reference to the relevant accounting standards. 16 marks b) Calculate the total depreciation charge and interest costs which will be included in the Statement of profit or loss and other comprehensive income for the year ended December 31, 2018. 6 marks C) IAS 20 permits a second method for the accounting of capital-based grants i.e. the deferred credit method. Explain the deferred credit method and discuss why it might be considered preferable to the reduction of cost method in the context of the Conceptual Framework and relevant Accounting standards. 3 marks X-BU3530-1 Question 5 Beta Ltd which prepares its financial statements to December 31 each year is an Irish company involved in manufacturing. The company has decided to expand its operations by the addition of a new production facility. This expansion involves the purchase of a site, the construction of a factory premises and the installation of machinery The following information is available from the records of the company in the year ended December 31 2018: Payment Date Payment 000's Purchase of Freehold Land Cost 01.01.2018 01.02.2018 260 20 Legal Fees Construction and Related Costs Construction Payment (1) Construction Payment (2) Architect's Fees Machinery Costs Invoice cost Import Duties Installation Costs 01.02.2018 01.12.2018 01.02.2018 3,000 2,500 500 580 01.08.2018 01.08.2018 01.09.2018 200 The following information is also available: 1. Construction commenced on January 1, 2018 and the whole facility (including the machinery) was ready for use on October 1 2018. 2. The new production facility is deemed to be a qualifying asset in the context of IAS 23 'Borrowing Costs'. 3. Construction works were suspended for the month of August 2018 due to an industrial dispute 4. The construction and related costs pertaining to the factory buildings were financed by way of debt borrowed specifically for the purpose at a pre-tax cost of 10% per annum. The borrowings were drawn down at the time of each payment. The interest charges were paid as they were incurred out of the company's existing cash resources Repayment of the capital sum borrowed does not commence until November 1, 2021 X-BU3530-1 5. The site and machinery acquisition together with the respective related costs were financed out of the company's existing cash resources. 6. Beta Ltd depreciates its Non-Current Assets as follows: Factory Buildings Straight Line Basis 25 years Nil Residual Value Machinery Straight Line Basis 10 years Nil Residual Value The company charges depreciation on a strict monthly basis. 7. The company received a capital grant equating to 20% of the invoice cost of the machinery and has decided to account for this grant by reducing the cost of the asset. 8. Ignore taxation. Required: For the purposes of financial reporting in accordance with International Accounting Standards: a) Calculate the separate cost of the Land, Factory Building and Machinery at December 31, 2018 and justify your calculations by reference to the relevant accounting standards. 16 marks b) Calculate the total depreciation charge and interest costs which will be included in the Statement of profit or loss and other comprehensive income for the year ended December 31, 2018. 6 marks C) IAS 20 permits a second method for the accounting of capital-based grants i.e. the deferred credit method. Explain the deferred credit method and discuss why it might be considered preferable to the reduction of cost method in the context of the Conceptual Framework and relevant Accounting standards. 3 marks