Answered step by step

Verified Expert Solution

Question

1 Approved Answer

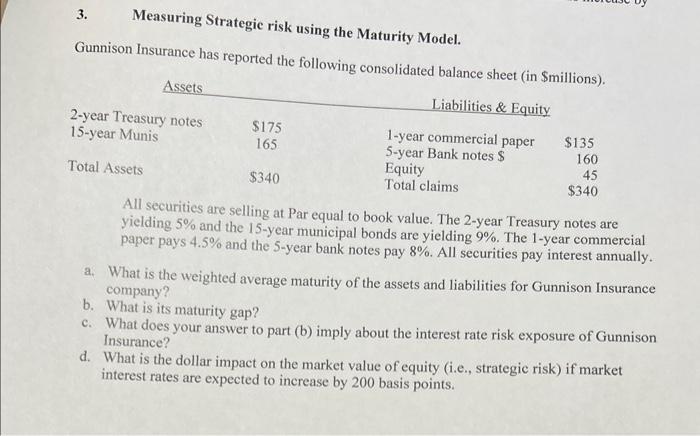

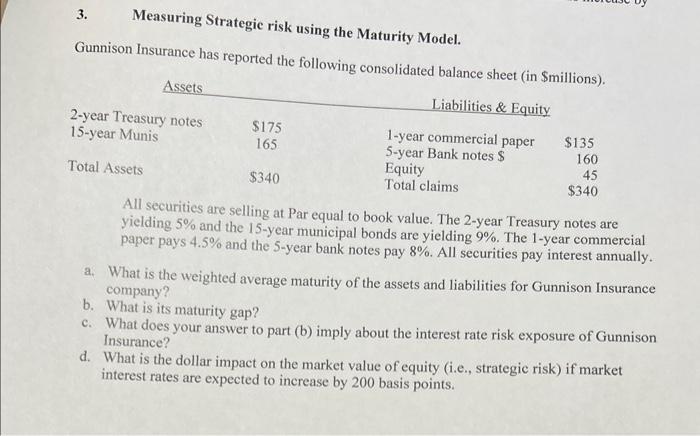

xcel 3. Measuring Strategic risk using the Maturity Model. Gunnison Insurance has reported the following conenlidnt.. i.. AII securities are selling at Par equal to

xcel

3. Measuring Strategic risk using the Maturity Model. Gunnison Insurance has reported the following conenlidnt.. i.. AII securities are selling at Par equal to book value. The 2-year Treasury notes are yielding 5% and the 15-year municipal bonds are yielding 9%. The 1-year commercial paper pays 4.5% and the 5 -year bank notes pay 8%. All securities pay interest annually. a. What is the weighted average maturity of the assets and liabilities for Gunnison Insurance company? b. What is its maturity gap? c. What does your answer to part (b) imply about the interest rate risk exposure of Gunnison Insurance? d. What is the dollar impact on the market value of equity (i.e., strategic risk) if market interest rates are expected to increase by 200 basis points

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started